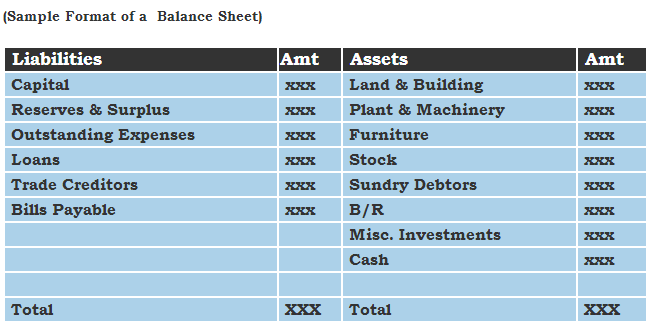

Balance Sheet

Balance sheet is a financial statement which shows the net worth of a company at the end of a financial period. A Balance sheet portrays the financial position of a company, disclosing what it owes and owns. It is an important document that needs to be prepared and submitted regularly like when submitting taxes, applying for grants or loans, while looking for investments etc. A company’s balance sheet comprises of three parts: assets, liabilities and capital or equity.

Following is the formula used for calculation: Assets = Liabilities + Capital

(Also known as the accounting equation or balance sheet equation)

Assets

Assets are tangible or intangible resources owned by the company that has an economic value which can be expressed and measured. From a business point of view assets include cash, inventory, investment, equipment, building, etc.

Some items that may be seen in the Assets section of a company’s Balance Sheet are:

- Cash

- Accounts receivable

- Patents

- Equipment

- Inventory

- Reimbursable expenses

Liabilities

Liability is a legal obligation to be paid by the company. Liability could be incurred due to business transactions happening in the company. In a business, liabilities could be – pending taxes, credit card bills, loans etc.

Some items that may appear in the Liabilities section of a company’s Balance Sheet are:

- Taxes

- Accounts payable

- Credit cards payable

- Long term loans

- Current loans

Capital or Shareholder’s Equity

Capital is the owner’s share on the company’s assets. This share is nothing but the assets that are left after the deduction of the liabilities. In a business, equity is what you infuse in the business.

Some items that could appear in the Capital section of a company’s Balance Sheet are:

- Owners Capital – An investment from the owner in the company and the net income earned that has been earned by the company subtracted by any withdrawals if made by the owner. An owner’s personal bank account and business bank account are two different entities.

- Retained Earnings – Part of the net income which is retained by the corporation instead of distributing it among its owners as dividends.

A balance sheet is perfect only when the Total Assets are exactly equal to the Sum of Liabilities and the Owner’s Equity. If there is a difference in the amounts, it needs to be rechecked for missing items.

Short Quiz for Self-Evaluation