-This question was submitted by a user and answered by a volunteer of our choice.

Another name of Balance Sheet

There are several names given to the balance sheet such as Statement of financial position, Statement of financial affairs, Net worth statement etc., In American history balance sheet was referred by various other names such as- Treasurer Reports, Financial Statements, Statement of Assets and Liabilities, Consolidated Balance Sheet and Condensed Financial Statements.

Apart from all the above-mentioned names, the two most popular names of the Balance Sheet are- Statement of financial position and Statement of Assets and Liabilities.

To make the concept clear, I would like to add logic behind the different names of the balance sheet followed by a snippet of a practical example.

Statement of Financial Position

The balance sheet is called a statement of financial position because it shows financial stability, liquidity and performance of the business. This statement helps the business to define its future financial goals.

Analyzing the statement of financial position would help the users of financial data (both internal and external users) to forecast the period, value and volatility of the organization’s future earnings.

Statement of Assets and Liabilities

The balance sheet is also known as the statement of assets and liabilities because it portraits what entity owns (Assets) and owes (Liabilities) along with the amount invested by the owner (or) shareholders in the form of capital for a specified period.

The logic behind this name states that there should be a balance between total assets and total liabilities along with the owner’s equity. Hence a sound organization’s financial statements must always be balanced.

Assets = Liabilities + Owner’s Equity

Practical Example

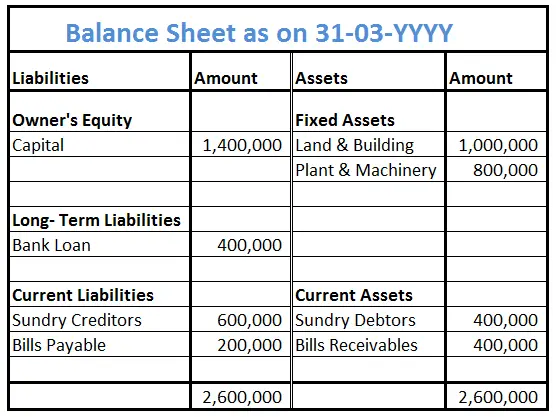

The following are the balances of ABC Enterprises. Prepare Balance Sheet.

| Particulars | Amount | Particulars | Amount |

| Capital | 14,00,000 | Sundry Debtors | 4,00,000 |

| Plant & Machinery | 8,00,000 | Bills Payable | 2,00,000 |

| Sundry Creditors | 6,00,000 | Bills Receivable | 4,00,000 |

| Land & Building | 10,00,000 | Bank Loan | 4,00,000 |

Balance Sheet of ABC Enterprises

The Balance Sheet has 3 main components– Liabilities, Assets and Net Worth

Liabilities- It refers to the debts owed by the organization which are needed to the paid before the entity is legally wound up. They are classified into two types- Current and Non- Current Liabilities. Bank Loans, Sundry Creditors, Bills Payables are a few examples.

Assets- It refers to the economic resources owned and controlled by the organization for deriving long-term future benefits. They are classified into two types- Fixed and Current Assets. Land & Building, Sundry Debtors, Bills Receivables are a few examples.

Owner’s Equity- It refers to the amount introduced (or) invested by the owner at the time of starting the business. This amount remains in the business until the entity is legally wounded by the law. Owner’s Equity is also known as capital (or) net worth.

Owner’s Equity = Assets – Liabilities