Revenue From Operations

Revenue from operations or operating revenue can be defined as the income generated by an entity from its daily core business operations. If the entity is able to generate a steady flow of income from its operations, it is said to have been running successfully. It is also called operating revenue.

Example – ABC Automobile Co. makes and sells automobiles as their daily core business, so their revenue from operations is said to be generated by the selling of automobiles only.

Point to be noted – let’s say in a financial year ABC Automobile Co. earns a significant amount of money by selling one of its manufacturing plant (building), this will NOT be considered as revenue from operations instead this will be termed as a capital receipt.

Calculation of Operating Revenue

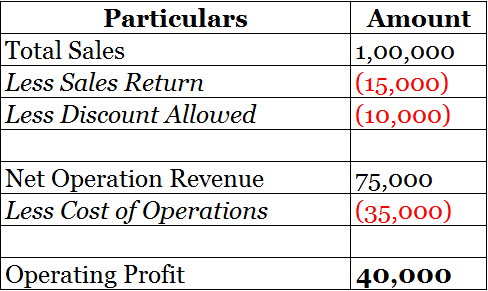

Revenue from operations is calculated by taking into account the figure of “sales” after factoring in any sales return or discounts allowed.

After calculating the net operating revenue from the above step deduct the “cost of operations” to derive the operating profits of a company. The same can be explained with the help of a simple illustration.

The operating profit of ABC Ltd for the period ending 31st March XXXX is calculated as follows:

Revenue from Operations is the starting point for Profit and Loss or Income and Expenditure Account. Following are some of the incomes/expenditures which are not considered while calculating revenue from operations.

- Income from Non-operating activities like profit on the sale of an asset, Income from investments, etc.

- Administrative expenses like salaries, lighting and electricity, etc.

- Selling expenses like advertising and promotions, etc.

Short Quiz for Self-Evaluation

>Read Revenue Receipts