Depreciation Vs Depletion Vs Amortization

All assets with an estimated useful life eventually end up being exhausted. Different types of assets such as fixed, intangible & mineral assets are systematically reduced within their useful life. The difference between depreciation, depletion and amortization depends on the type of asset in question.

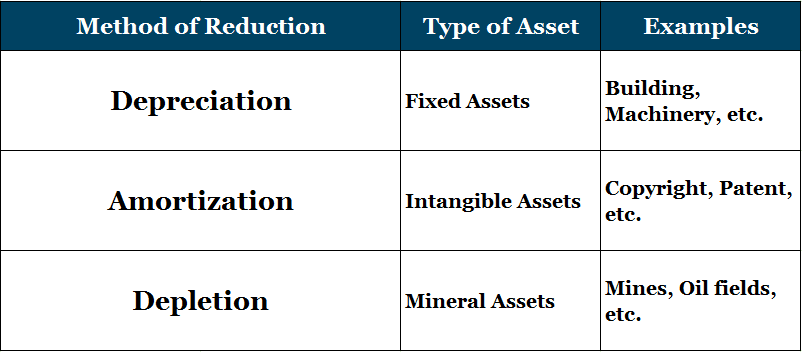

Depreciation, Depletion and Amortization are three primary ways to apply such reductions in assets. To begin with, here is a quick reference table;

Depreciation

It is to spread or allocate the cost of a tangible fixed asset over its estimated economic useful life. In other words, it may be seen as a reduction in the cost of a fixed asset due to normal usage, wear and tear, new technology, and other related reasons.

Example – A company charging 10% depreciation on all their buildings, 25% depreciation on laptops, etc.

Related Topic – Why is Depreciation not charged on land?

Amortization

Prorating cost of an “Intangible Asset” over the period during which benefits of this asset are estimated to last is called Amortization. The concept of amortization is also used with leases & debt repayment.

Amortization is for Intangible assets whereas depreciation is for tangible fixed assets. Examples of intangible assets are copyrights, patents, software, goodwill, etc.

Depletion

When dealing with a natural resource also referred as a mineral asset the concept of depreciation or amortization cannot be applied. “Depletion” is a form of a systematic reduction in the value of a natural resource based on the rate at which it is being used.

For example – A coal mine has 10 Million tonnes of coal and the coal extraction is happening at the rate of 1 Million tonnes per year. In this case, depletion rate would be 10% p.a. since at this rate of extraction the coal mine is being depleted at 10% per year.

>Related Long Quiz for Practice Quiz 39 – Depreciation

>Read Explain Obsolescence and Depletion