- Amortization Journal Entry for Intangible Assets

- Entry using Accumulated Amortization A/c

- Treatment in the Financial Statements

- Journal Entry for Amortization of Patent

- Journal Entry for Amortization of Goodwill

- Is Amortization an Expense?

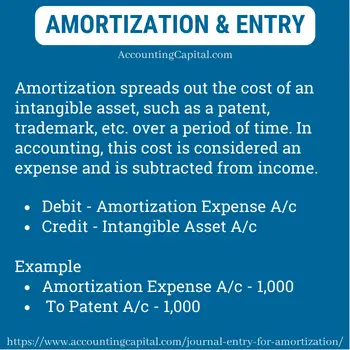

Amortization means spreading out the cost of an intangible asset, like a patent or trademark, over the time it is useful. This cost is considered an expense in accounting and is subtracted from the income periodically.

Depreciation is a similar concept, but it’s used for tangible fixed assets, like equipment or buildings.

Intangible assets are things that do not have a physical existence, and they’re usually hard to evaluate. Examples include patents, copyrights, franchises, goodwill, trademarks, customer data, etc.

Amortization Journal Entry for Intangible Assets

When amortization is charged, it is shown on the debit side of the income statement as an expense. This means some value of the intangible asset was used in the current accounting period, and the value was therefore reduced.

The net cost of the asset (or current value) = Cost of acquisition – amortization.

The journal entry for the Amortization of intangible assets is as follows:

| Amortization Expense A/c | Debit | Debit the increase in expense |

| To Intangible Asset A/c | Credit | Credit the decrease in assets |

(Being intangible asset amortized)

Two accounts are involved in the journal entry for amortization of intangible assets: the amortization expense account & the intangible asset account.

Related Topic – Amortization Vs Depreciation

Example

Unreal Co. registers a new trademark in the year 20YY for 20,000 for a period of 10 years. Show the journal entry to be passed in the books of XYZ Ltd every year for the amortization charged on this trademark.

In the books of XYZ Ltd.

| Amortization Expense A/c | 2,000 |

| To Trademark A/c | 2,000 |

(Being trademark amortized for the year 1)

The firm will debit the Amortization expense with the amount of 2,000, crediting the Trademark A/c for the same amount for the next 10 years.

This entry reduces the value of the intangible asset on the balance sheet by 2,000 and recognizes the expense on the profit & loss account. You would repeat this entry each year until the asset is fully amortized.

Related Topic – What is Goodwill in Accounting?

Entry Using Accumulated Amortization Account

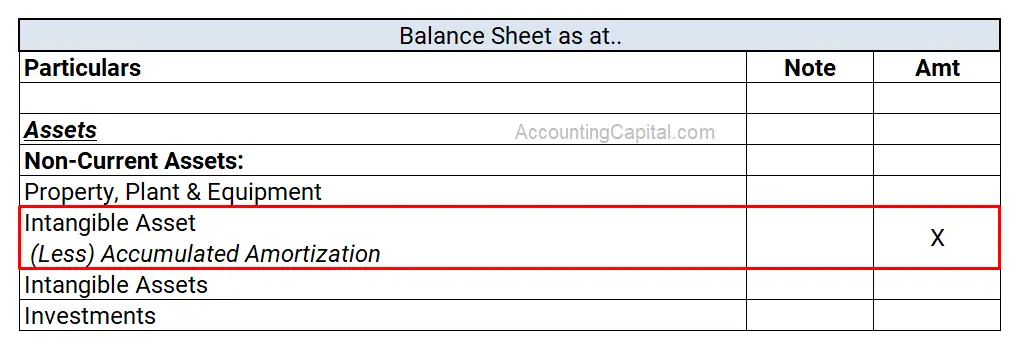

Similar to the accumulated depreciation account, the accumulated amortization account can also be used to record the journal entry for amortization.

| Amortization Expense A/c | Debit |

| To Accumulated Amortization A/c | Credit |

An accumulated amortization account is a contra-asset account, which is a type of contra account. This means that it offsets the value of the intangible asset account on the balance sheet.

- Amortization expense is collected in the Accumulated Amortization account instead of being charged directly to the asset every year.

- It helps track the amount of amortization charged to an asset and shows its net value.

- Each year, the amortization expense is recorded as a debit to the amortization expense account and a credit to the Accumulated Amortization account.

- The Accumulated Amortization account appears as a deduction from the intangible asset account on the balance sheet.

- The difference between these two accounts shows the net value of the intangible asset after accounting for the amount of its cost that has been written off as amortization.

The Accumulated Amortization account acts as a running total of the amount of the asset’s cost written off over time.

Related Topic – Is Accumulated Depreciation an Asset or Liability?

Example with Accumulated Amortization Account

ABC Ltd. has a trademark of 50,000 for a period of 5 years. The company maintains a related accumulated amortization account to charge the amortization expense.

Show the journal entries for 5 years. In addition, pass the journal entry at the end of those 5 years when the trademark has been fully amortized. (no scrap value)

Here’s a table to illustrate the amortization process over five years:

| Year | Cost of Trademark | Amortization Expense | Accumulated Amortization |

| Year 1 | 50,000 | 10,000 | 10,000 |

| Year 2 | 50,000 | 10,000 | 20,000 |

| Year 3 | 50,000 | 10,000 | 30,000 |

| Year 4 | 50,000 | 10,000 | 40,000 |

| Year 5 | 50,000 | 10,000 | 50,000 |

In the books of QPR Ltd for year 1

| Amortization Expense A/c | 10,000 |

| To Accumulated Amortization A/c | 10,000 |

(Being amortization expense charged on the trademark for year 1)

- The amortization expense account is debited to recognize the expense for the year.

- The accumulated amortization account is credited to record the reduction in the value of the trademark.

The same entry will be repeated in the books of QPR Ltd. for the next 5 years until it is balanced out at the end of the period to nullify the asset balance.

Ensure that amortization expense is accurately recorded by reviewing the intangible asset’s useful life and estimated salvage value.

At the end of 5 years

The accumulated amortization account will have a total balance of 50,000 after 5 years of amortization. This balance represents the total amount of the intangible asset that has been expensed. Eventually, the intangible asset will have zero remaining cost, meaning it’s fully amortized.

Journal entry at the end of 5 years

| Accumulated Amortization A/c | 50,000 |

| To Trademark A/c | 50,000 |

In the end, we credit the intangible asset account with the remaining balance of 50,000 to bring the account balance to zero while debiting the accumulated amortization account with the same amount to clear out the balance in the account.

This reflects that the asset has been fully expensed and is no longer on the balance sheet.

Related Topic – What are Fixed Assets?

Treatment in the Financial Statements

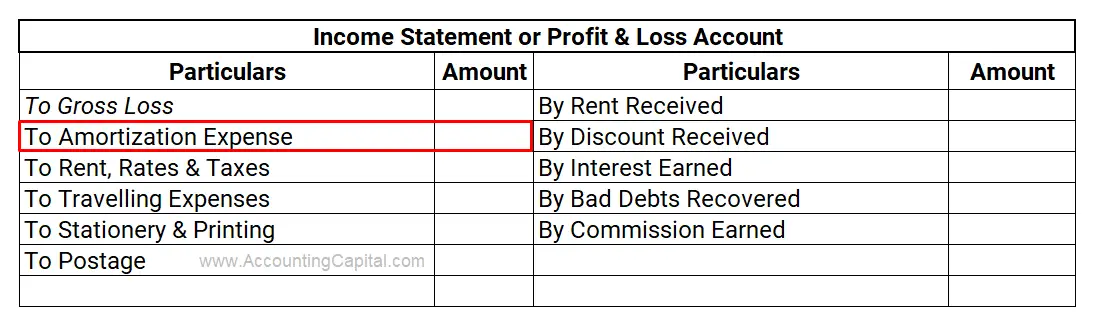

There are mainly two effects of amortization in the financial statements.

- It is shown as an expense in the income statement (profit & loss account)

- It is shown as a reduction from the intangible asset’s value in the balance sheet.

Amortization Expense Shown in the Income Statement

Amortization Reduced from the Respective Intangible Asset in the Balance Sheet Related Topic – Adjustments in Final Accounts (financial statements)

Related Topic – Adjustments in Final Accounts (financial statements)

Journal Entry for Amortization of Patent

A patent is a legal right provided by the government to the inventor or the owner of an invention (if a patent is sold). This gives the owner the exclusive right to make, use, and sell their invention. No one can copy or use the invention without the patent owner’s permission.

It is recorded as an intangible asset on the balance sheet. However, like other assets, patents also lose their value over time as they can be obsolete, expire, etc. To reflect this decrease in value, firms amortize their patents.

Let us understand the journal entry to amortize a patent with an example.

XYZ Ltd purchased a patent for 50,000 which is expected to expire after five years. Show the entry for amortization expense charged each year on the patent.

| Amortization Expense A/c | 10,000 |

| To Patent A/c | 10,000 |

This journal entry will be passed in the books of XYZ Ltd. every year until the asset’s value becomes zero. (5 x 10,000)

- The price of a patent includes the cost of registration, legal charges, documentation, etc.

- Initially, these patents are recorded at the original purchase price or estimated cost, and then annual amortization entries are passed until the account reaches zero.

Related Topic – Depletion Vs Depreciation Vs Amortization

Journal Entry for Amortization of Goodwill

Goodwill in accounting refers to the intangible value of a business that is above and beyond its tangible assets, such as equipment or inventory. It represents the reputation, customer base, and other non-physical assets contributing to the business’s value.

Goodwill is typically created when one business acquires another business, and in the process, the acquiring business pays more than the book value of the acquired business. It is recorded on the acquiring company’s balance sheet.

Goodwill = Amount Paid to Acquire a Business – Book Value of the Acquired Business

Let us understand the journal entry to amortize goodwill with an example.

ABC Ltd. purchased the business of XYZ Ltd. for a total of 50,000, while the actual book value of the business was 30,000. Show the journal entry for amortization of goodwill in the books of ABC LTD. in year 1 after the acquisition assuming it will be amortized over 10 years.

The annual journal entry in the books of ABC ltd. will be as follows,

| Amortization Expense A/c | 2,000 |

| To Goodwill A/c | 2,000 |

Working Note – The difference of 20,000 will be treated as Goodwill of the business and written off annually for the next 10 years.

- Annual amortization entries are passed until the goodwill reaches zero.

- Valuation of Goodwill can be changed over time due to changes in the business environment, market conditions, or other factors.

Related Topic – Capex and Opex

Is Amortization an Expense?

The short answer is yes. Amortization is considered an expense. This is because the cost of an intangible asset is spread over the years, and such periodic charges reduce its value over time.

Let’s consider a hypothetical example. Suppose a company purchases a patent for 50,000 with a useful life of 5 years. The company should not show it as a one-time charge; instead, it should spread the cost over its life and expense off by 10,000 per year.

Short Quiz for Self-Evaluation

>Related Long Quiz for Practice Quiz 15 – Amortization

>Read Journal Entry for Depreciation