Net Profit VS Operating Profit

The term “profit” is divided into different types according to the source of benefit and the stage at which it is calculated during the life cycle of a business. This article illustrates the difference between net profit and operating profit.

Some of the most common forms of profit that can be found in financial statements are gross profit, net profit, operating profit, etc. All of them are calculated for different reasons, and each plays a diverse role in their journey through the accounting cycle.

Net Profit

The word Net means “after all deductions”. Accordingly, the profit earned after all deductions is called Net Profit. It is also called Net Income or Net Earnings. It is the difference between “total revenue earned” and “total cost incurred”.

Deductions include adjustments related to the cost of doing business, such as taxes, depreciation and other miscellaneous expenses.

Net Profit = Total Revenue – Total Cost

Net Profit = Gross Profit – (Total expenses from operations, interests and taxes)

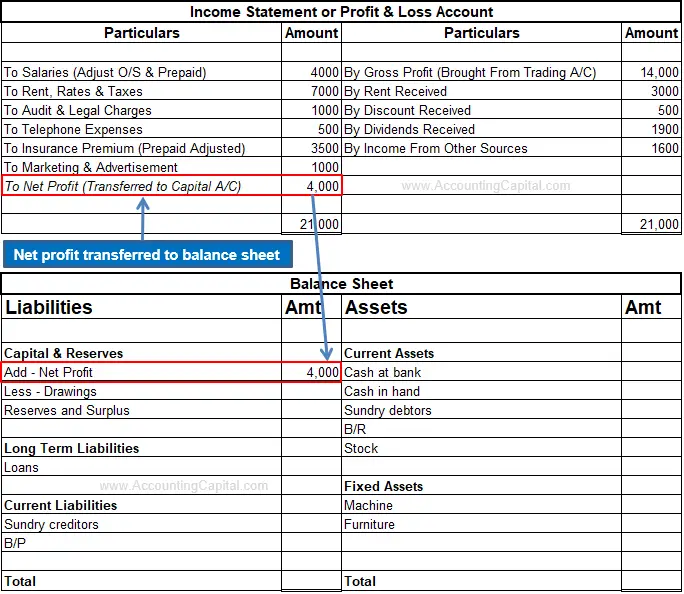

Net profit can be found on a company’s income statement & it is further transferred to the organization’s balance sheet. (Add to capital)

Related Topic – Difference Between Revenue and Profit

Operating Profit

Profit earned from a firm’s core business operations is called Operating Profit. So a shoe company’s operating profit will be the profit earned only from selling shoes. Operating profit doesn’t include any profits earned from investments and interests. It is also known as Operating Income, PBIT and EBIT (Earnings before Interest and Taxes).

It is the excess of Gross Profit over Operating Expenses.

Operating Profit = Gross Profit – Operating Expenses

Operating Profit = Net Profit – Non-Operating Expenses – Non-Operating Income

Example of Net Profit vs Operating Profit

Calculate both operating and net profit from the below information.

| Particulars | Amt | Particulars | Amt |

|---|---|---|---|

| Gross Profit | 2,00,000 | Interest on Loans | 35,000 |

| Carriage Outwards | 15,000 | Interest on Investments | 10,000 |

| Advertising | 17,000 | Printing and Stationery | 3,000 |

| Salaries | 40,000 | Loss on Sale of Furniture | 9,000 |

| Rent | 37,000 | General Expenses | 10,000 |

| Lighting | 11,000 | Donation | 4,000 |

Solution:

| Add Gross Profit | 2,00,000 |

| Operating Profit = Gross Profit – Operating Expenses | |

| Less Carriage Outwards | (15,000) |

| Less Advertising | (17,000) |

| Less Salaries | (40,000) |

| Less Rent | (37,000) |

| Less Lighting | (11,000) |

| Less Printing and Stationery | (3,000) |

| Less General Expenses | (10,000) |

| Operating Expenses | (1,33,000) |

| 2,00,000 – 1,33,000 | |

| Operating Profit | 67,000 |

Related Topic – Journal Entry for Profit on Sale of Fixed Assets

| Total Revenue (Operating + Non-Operating Income) | |

| Add Gross Profit | 2,00,000 |

| Add Interest on Investments | 10,000 |

| Total Revenue | 2,10,000 |

| Net Profit = Total Revenue – Total Cost | |

| Total Cost (Operating + Non-Operating Expenses) | |

| Less Operating Expenses | (1,33,000) |

| Less Non-Operating Expenses | |

| Interest on Loans | (35,000) |

| Loss on Sale of Furniture | (9,000) |

| Donation | (4,000) |

| Total Cost | (1,81,000) |

| 2,10,000 – 1,81,000 | |

| Net Profit | 29,000 |

One of the main points of difference between net profit and operating profit is that net profit takes into account earnings from all sources & all sorts of deductions. In contrast, operating profit only considers profits earned from operations.

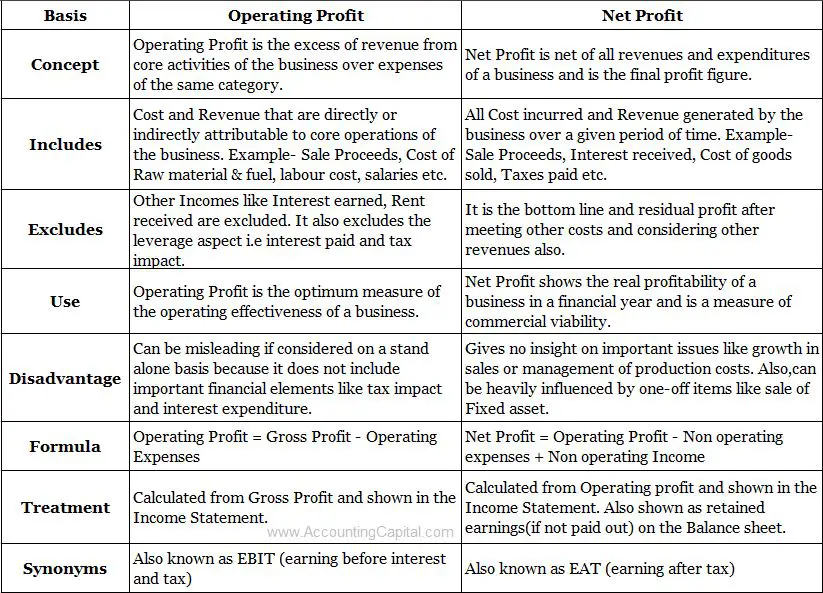

The difference in Table Format

A few more differences are;

- Net profit is often used by investors and analysts to evaluate a company’s overall financial performance.

- Operating profit is often used by managers to identify areas for improvement in a company’s operations.

- Net profit is affected by a company’s financial decisions, such as borrowing money or paying dividends.

- Operating profit is not affected by these financial decisions.

Short Quiz for Self-Evaluation

>Read Difference between Gross Profit and Operating Profit