Unexpired Cost

Every asset in a company is expected to fetch at least 100% returns on its cost, however, the returns obtained may not be in a single accounting period and may spread to multiple future accounting years. This is why unexpired cost exists in a business.

At the time of preparing financial statements, an asset may have costs that are yet to be utilized. Such a cost that is expected to reap benefits in multiple future accounting periods and has not been written off yet is called an unexpired cost. (The benefits are yet to be derived for this portion of the cost)

Example – Deferred Revenue Expenditure, the Net Book Value of an asset on the balance sheet is its unexpired cost.

It is shown as an asset in the company’s final accounts. All assets are capitalized, however, the cost is eventually matched with its future revenue till then it is only a deferred expense waiting to be expensed.

Unexpired Cost = Cost of Asset – Revenue Generated from Asset to date

Technically, it is the balance of an expense item that has not been written off to the income statement because it still has some remaining value. It is applicable to all costs including the cost of inventory, deferred costs, and prepaid costs.

Example – Unexpired Cost

Suppose there is a fixed asset for 1,000,000 which depreciates at 10% straight-line method.

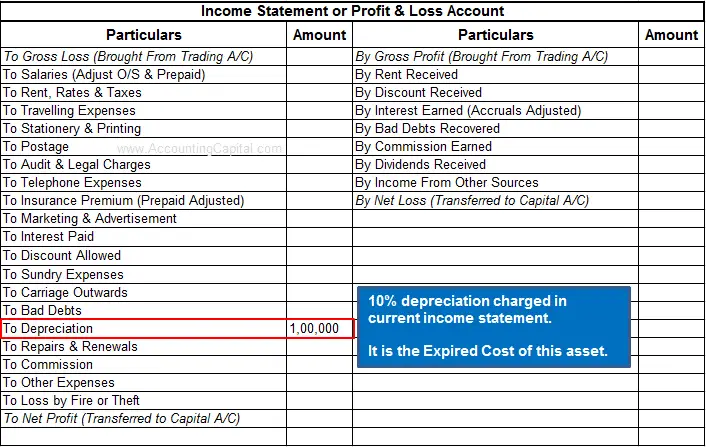

Depreciation charged in current year = 10% x 1,000,000 = 1,00,000

This 1,00,000 is said to be utilized, written off, or expired cost of the asset and is shown in the profit and loss account.

*Assumption – Depreciation shown is only related to the machine.

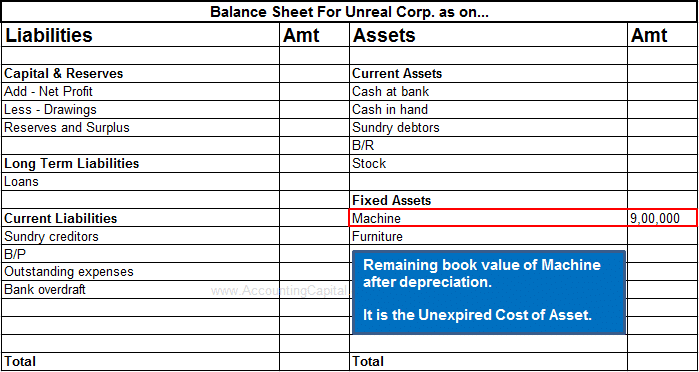

The remaining balance of the asset (book value) is termed as its unexpired cost as the benefits are yet to be derived in future accounting periods.

After the completion of an asset’s useful life, it may still fetch some money which can be determined using the method to calculate the scrap value of an asset.

Related Topic – Difference Between Loss and Expense

Example – II

Suppose a company, Unreal Corp. introduces a new product into the market and decides to spend 6,00,000 (50,000 x 12 months) on advertising in the current accounting period.

It decides to pay the entire cost in the first month of the accounting year itself. After 6 months the balance cost (not used yet) can be seen as the unexpired cost of advertisement as the related work has not happened yet.

Short Quiz for Self-Evaluation

>Read Accounting Treatment of Prepaid Expenses in Financial Statements