Loss Vs Expense

Loss – is the excess of expenditure incurred over revenue earned by a business for a given accounting period. It reduces the total capital invested in the business.

Such monetary damage may arise due to;

- Business operations – Relating to business activities.

- Non-recurring events – Relating to unforeseen events e.g. fire, theft, loss on sale of fixed assets, etc.

- Accounting loss – Relating to accounting policy or accounting standard changes, etc.

Loss Shown in Financial Statements

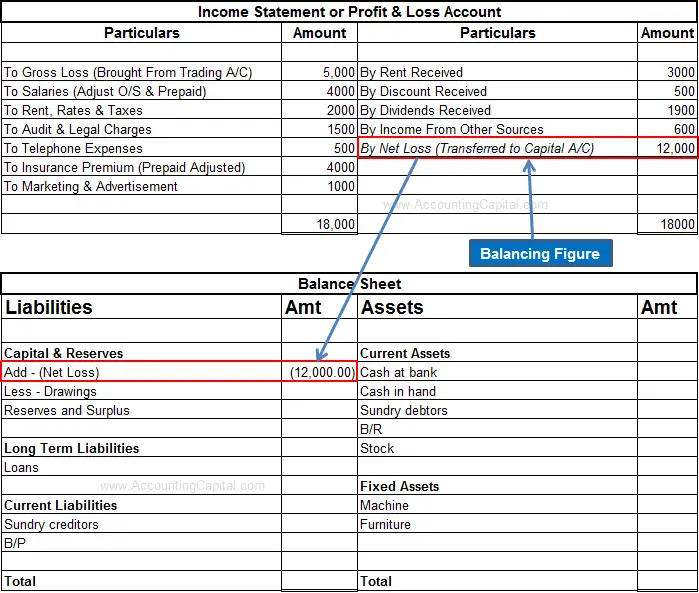

Net Loss incurred by a business is shown on the credit side of an income statement as a balancing figure. At the time of preparation of final accounts, the loss is transferred to the balance sheet.

Expense – Money spent by a firm for generating revenue is termed as expenditure or expenses. The cost incurred as expense usually expires during the same accounting period, i.e. it is not carried forward to a future period.

Expenses may occur in the following forms;

- Cash payment of currency, for e.g. paying bills such as rent, salaries, etc.

- A decline in the value of assets (e.g revaluation loss or investment loss), etc.

- Accepting a liability, for example – accrual of rent, etc.

- The total cost of goods sold.

- Depreciation & Amortization.

- Bad debts, etc.

Expenses are classified in various different ways;

- Direct or Indirect Expense – Based on the relationship with the core business.

- Capital or Operating Expense – Based on the type of expenditure.

- Petty or Sundry Expenses – Based on the size, quantity & relevance.

Expense Shown in Financial Statements

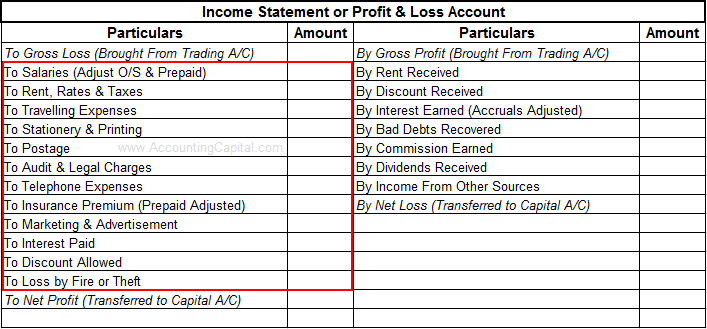

Expenses incurred by a business are shown on the debit side of an income statement and are further used to compute the net gain or net loss of the company.

One of the main differences between loss and expense is that total loss is computed with the help of total expenses and affects the total capital invested in the business. On the other hand, expenses do not directly affect the capital invested in a business.

Difference Between Loss and Expense (Table)

| Basis | Loss | Expense |

| Meaning | A loss is an unfavourable movement in monetary terms. Specifically, it can be excess of expenses over revenue. | In a very broad sense, expense represents all consumed up costs that should be deducted from the revenue of a business. |

| Types | In accounting terms, a loss can be operating, gross, or net. | Expenses can be either direct or indirect for a business. |

| Origin | Loss is the opposite outcome of gain. For a non-operating activity of a business, the result will be either a loss or gain. | Expenses are comparable to revenues but not the exact opposite financial outcome of the same economic activity. |

| Gross/Net | Loss is generally shown in net terms in financial statements because it usually originates from incidental transactions. | Expense is usually shown in gross terms as it originates from the major revenue earning activities of a business. |

| Capital/Revenue | There is no concept of capital and revenue in losses. These terms are defined for tax purposes. | There is a clear distinction between revenue expenses and capitalized expenses, in accountancy. |

| Interrelation | A loss results from an excess of expenses over operating revenue, in a financial year. | Expenses do not get affected by losses generally. |

| Importance | A loss can critically affect the financial performance of a company, even if it results from secondary activities. | Without the correct assessment of the expenses used up in earning the revenue, true profit or loss can not be determined. |

| Example | A loss arising from the sale of a fixed asset at a price less than its book value. | Electricity expense, rent paid, utility bills, salary expense, etc. |

Cost Vs Expense Vs Loss

Meaning of cost: Cost is the monetary measure of the resources that a business has used or spent in the primary process of producing its sources of revenue i.e. goods or services.

- Cost may also represent the resources utilized in acquiring assets for the business, as that will result in future benefits.

- Cost does not include the profit margin. It can be divided into categories like direct-indirect, implicit-explicit, etc.

Loss vs Cost – Loss can not be used interchangeably with cost, in any accounting sense. Loss necessarily means an outflow of funds, an unfavourable monetary condition that results from some incidental transaction and not the primary activities of a business. Loss does not give rise to any economic benefit. On the other hand, the cost incurred will represent resources used in order to earn revenue from it.

Expense vs Cost – Expense and cost are closely related terms but there are few points of distinction between the two.

- The similarity between them is that both the expense and cost represent the use of resources owned by a business in relation to some revenue. Both of them relate to the primary money-earning operations of a business.

- But, the expense necessarily inhibits resources that have already been used and the economic benefits have been realized. If not, that particular expense shall not be a part of the income statement.

- Costs can be both utilized and deferred. Cost is more of a sacrifice to let go of one thing in order to own something else.

- If the economic benefit deriving from the cost has been realized in the financial year, it will be expensed and shown on the income statement. Else, it will be a deferred cost and shown on the balance sheet.

Read Difference Between Income and Revenue