Prepaid Expenses

At times, during business operations, a payment made for an expense may belong fully or partially to the upcoming accounting period. Such a payment (partly or fully) is treated as a prepaid expense (unexpired expense) for the current period. It is treated as an adjustment in the financial statements and this article will describe the treatment of prepaid expenses in final accounts.

Some common examples of prepaid expenses are prepaid rent, prepaid insurance premium, etc.

Journal Entry for Prepaid Expense

| Prepaid Expense A/C | Debit | Debit the increase in asset |

| To Expense A/C | Credit | Credit the decrease in expense |

Payment for “insurance premium” is commonly issued in advance hence it will be used to explain the treatment of prepaid expenses in final accounts (or) financial statements.

Treatment of Prepaid Expenses in Final Accounts

Explanation with Example

Company – Unreal Corporation

Insurance prem. paid on 30th Jun YYYY – 1200 for a year (50% prepaid for next year)

Premium prepaid – 600

Accounting Cycle Ends – 31 Dec YYYY

Journal Entry on 30th June YYYY

| Insurance Premium A/C | 1200 |

| To Bank A/C | 1200 |

(Payment made for insurance premium from the bank)

Adjustment entry

| Prepaid Insurance Premium A/C | 600 |

| To Insurance Premium A/C | 600 |

(Transferring insurance premium prepaid to its respective “Prepaid Insurance A/C”)

Related Topic – How to Post a Journal Entry to a Ledger?

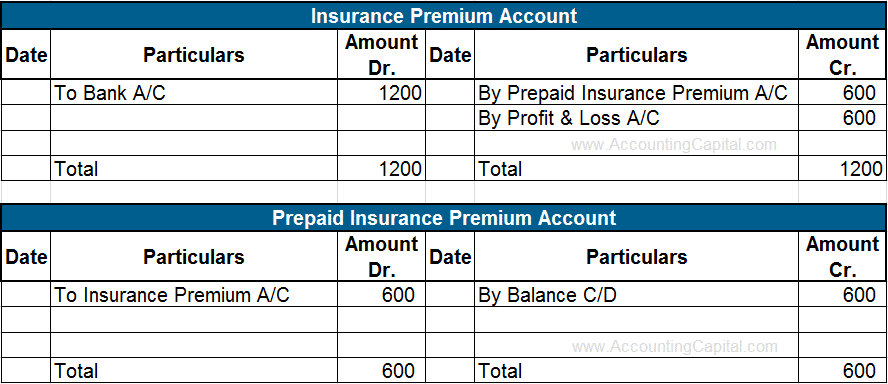

In the above example, both the respective journal entries are posted to the ledger accounts and the balances are transferred and carried forward wherever necessary.

Related Topic – More Accounting Questions Related to Revenue & Income

Treatment of Prepaid Expenses in Final Accounts (or) Financial Statements

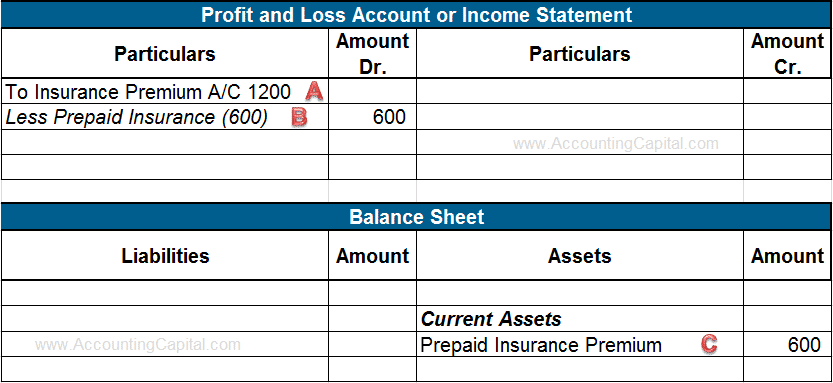

1. The prepaid portion of the expense (unexpired) is reduced from the total expense in the profit & loss account.

2. The prepaid expense is shown on the assets side of the balance sheet under the head “Current Assets”.

| A | Payment of 1200 made for the insurance premium is shown in the P&L A/C |

| B | 600 adjusted as “prepaid insurance premium” since it belongs to the following year |

| C | The prepaid insurance premium is shown as a “Current Asset” on the balance sheet |

Related Topic – What is Unexpired Cost?

Additional points related to the treatment of prepaid expenses in final accounts;

1. If the prepaid expense is shown inside the adjusted trial balance it indicates that the related adjustment entry has already been posted i.e. In this case, prepaid expenses are shown only on the balance sheet.

2. In the next accounting year prepaid expense account is transferred to the expense account i.e. at the beginning of the next period, a reversal entry is passed.

| Insurance Premium A/C | 600 |

| To Prepaid Insurance Premium A/C | 600 |

Short Quiz for Self-Evaluation

>Related Long Quiz for Practice Quiz 36 – Prepaid Expenses

>Read Journal Entry for Outstanding Expenses