Journal Entry for Accrued Income

It is income earned during a particular accounting period but not received until the end of that period. It is treated as an asset for the business. Journal entry for accrued income recognizes the accounting rule of “Debit the increase in assets” (modern rules of accounting).

Examples of accrued income – Interest on investment earned but not received, rent earned but not collected, commission due but not received, etc.

Journal entry for accrued income is;

| Accrued Income A/C | Debit | Debit the increase in asset |

| To Income A/C | Credit | Credit the increase in income |

As per accrual-based accounting income must be recognized during the period it is earned irrespective of when the money is received.

Accrued income is also known as income receivable, income accrued but not due, outstanding income and income earned but not received.

Related Topic – Journal Entry for Income Received in Advance

Simplifying with an Example

Question – On December 31st 2019 Company-A calculated 50,000 as rent earned but not received for 12 months from Jan’19 to Dec’19.

The same is received in cash next year on January 10th 2020. Show all related rent entries including the journal entry for accrued income on these dates;

- December 31st 2019 (Same day)

- January 10th 2020 (When the payment is received)

1. December 31st 2019 – (Rent earned but not received)

| Accrued Rent Account | 50,000 |

| To Rent Account | 50,000 |

2. January 10th 2020 – (Received cash in lieu of accrued rent from 2019)

| Cash Account | 50,000 |

| To Accrued Rent Account | 50,000 |

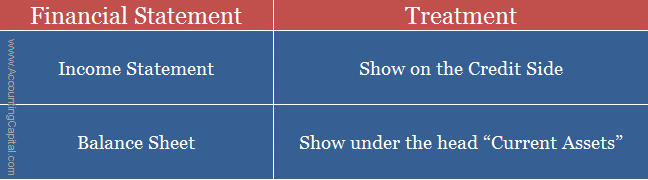

Treatment of Accrued Income in Financial Statements

After posting the journal entry for accrued income a business records it in the final accounts as follows;

- Shows it on the credit side of the income statement as it is an income for the current accounting period (just not received yet).

- Shows it on the asset side of the balance sheet under the head “Current Assets”.

Example – Journal Entry for Accrued Commission

Let’s assume that in March there was 30,000 as commission earned but not received due to business reasons.

At the end of the month, the company will record the situation into their books with the below journal entry.

| Accrued Commission A/C | 30,000 |

| To Commission Received A/C | 30,000 |

(Commission earned but not received)

Example – Journal Entry for Accrued Interest

Total of 2000 was not received as interest earned on debentures in the current accounting year. Post the journal entry for accrued income (interest earned) to include the impact of this activity.

| Accrued Interest A/C | 2,000 |

| To Interest Received A/C | 2,000 |

(Interest receivable on debentures)

Short Quiz for Self-Evaluation

>Related Long Quiz for Practice Quiz 14 – Accrued Income

> Read How to Prepare a Journal Entry (With Steps)