- Bad Debts Journal Entry

- Bad Debts Adjustment in Final Accounts

- Bad Debt Recovery Journal Entry

- Provision for Bad Debts Journal Entry

- Practice

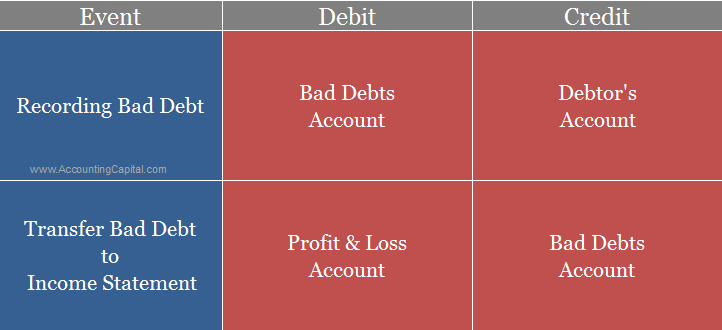

Insolvency may cause some debtors to fail to pay their dues on time. Such partially or fully irrecoverable debts are called bad debts. Accounting and journal entry for bad debt expense involves two accounts, “Bad Debts Account” & “Debtor’s Account (Name)”.

When you write off bad debt, you simply acknowledge that you have suffered a loss. It differs from a bad debt expense, which anticipates future losses.

Bad debt is a loss for the business, and it is transferred to the income statement to adjust against the current period’s income.

Bad Debts Journal Entry

Journal entry for bad debts expense is as follows;

| Bad Debts A/c | Debit | Nominal | Debit all Losses |

| To Debtor’s A/c | Credit | Personal | Credit the giver |

(Amount written off from the respective debtor’s account)

Rules applied as per modern or US style of accounting

| Bad Debts A/C | Debit the increase in expense |

| Debtor’s A/C | Credit the decrease in asset |

The closing journal entry for bad debts would be as follows;

| Profit and Loss A/c | Debit |

| To Bad Debts A/c | Credit |

(Transferring bad debts to the profit and loss account)

Related Topic – Difference Between Debtors and Creditors

When only a part of the debt is not recovered

| Bank A/c | Debit |

| Bad Debts A/c | Debit |

| To Debtor’s A/c | Credit |

(Amount received against a bad debt loss which was previously written off)

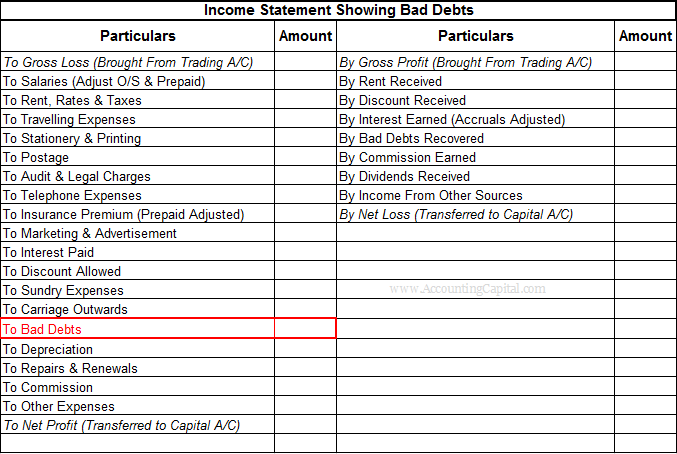

Bad Debts Shown Inside a Financial Statement

Related Topic – Provision for Doubtful Debts

Example

Unreal corp was declared insolvent this year, and an amount of 70,000 is to be shown as bad debts in the books of ABC Corp. Show accounting for bad debts in this case.

In the books of ABC Corp.

| Bad Debts A/c | 70,000 |

| To Unreal Corp’s A/c | 70,000 |

(70,000 written-off as a bad debt being transferred to bad debts account)

| Profit and Loss A/c | 70,000 |

| To Bad Debts A/c | 70,000 |

(Transferring 70,000 bad debts to the current income statement)

Related Topic – Provision for Doubtful Debts in Trial Balance

Bad Debts Adjustment in Final Accounts

Any information about bad debts that is present outside the trial balance is incorporated before the adjustments in final accounts are concluded.

Without such adjustments being made during the preparation of financial statements, the numbers shown in the firm’s final accounts will not be accurate.

Incorporating bad debts into financial statements

Situation 1 – No adjustment is made when bad debts are included in the trial balance. Only the P&L is affected.

Situation 2 – The final accounts are adjusted when bad debts are given outside the trial balance as supplement information. They are called further bad debts.

| Account | Impact |

| Profit & Loss A/c | Show on the debit side (add to bad debts already written off) |

| Balance Sheet | Show on the “Asset” side (subtract from sundry debtors) |

Related Topic – Are Non-current Liabilities Debt?

Bad Debt Recovery Journal Entry

Accepting payment from sundry debtors who have already had their accounts written off as bad debt is called “recovery of bad debts”.

Journal entry for bad debts recovered should reflect that it is treated as a gain for the business as opposed to bad debts written off, which are losses. While recording the money received, the debtor should not be credited as in the case of sales.

Journal entry for bad debts recovered is as follows;

| Bank A/c | Debit | Asset | Dr. the increase |

| To Bad Debts Recovered A/c | Credit | Income | Cr. the increase |

Debit (Bank A/c) assuming the recovery was done as a deposit in the firm’s bank account.

Rules applied in the journal entry as per the three golden rules of accounting,

| Account | Type | Rule |

| Bank A/c | Personal Account | Debit the receiver |

| Bad Debts Recovered A/c | Nominal Account | Credit incomes & gains |

Related Topic – Treatment of Discount on Debtors in Final Accounts

Provision for Bad Debts Journal Entry

Out of the total debtors of a business, there is always a small percentage that is unable to make a payment. To allow for such doubtful and bad debts, it is important to create a reserve (as an estimate). Such a provision is called a provision for bad debts.

The journal entry of provision for bad debts would be as follows;

| Profit and Loss A/c | Debit |

| To Provision for Bad Debts A/c | Credit |

(Creating a provision for b/debts by debiting the profit & loss a/c)

Related Topic – Difference Between Bad Debts and Doubtful Debts

Practice

Record the journal entries for the following transactions in the books of Unreal Co.

- It is determined that the 50,000 due from ABC Co. is irrecoverable after they declared bankruptcy.

- John, declared insolvent last year, has paid 9,000 this year with a cheque.

- Kumar was also declared insolvent last year. The balance of his accounts payable is 30,000, but it is fully closed after he repaid 50% in cash.

Journal – 1

There has been a loss for Unreal Co. due to the bad debt incurred. ABC co. has declared bankruptcy and is therefore unable to make any payments.

| Bad Debts A/c | 50,000 |

| To ABC Co. A/c | 50,000 |

(Amount is written off as bad debts)

Journal – 2

Bad debt recovery occurs when you receive payment for a debt previously written off as uncollectible. The recovery of bad debt usually results in income, whereas a bad debt typically means a loss.

In this case, the money received is treated as income. Since the recovery is a gain for the business, it is credited to the “Bad Debts Recovered A/c”.

| Bank A/c | 9,000 |

| To Bad Debts Recovered A/c | 9,000 |

(Recovering a previously written-off bad debt via a cheque from John)

Journal – 3

A partial recovery may require tweaking the journal entry for bad debts. This is because a certain portion of the money received is considered actual payment by the debtor, whereas the remaining is written off as a loss.

The journal entry below shows this as a compound entry.

| Cash A/c | 15,000 |

| Bad Debts A/c | 15,000 |

| To Kumar’s A/c | 30,000 |

(Out of 30,000 in debt, 50% was received from Kumar as a final settlement)

Related Topic – How to Calculate Provision for Doubtful Debts?

Short Quiz for Self-Evaluation

>Read Journal Entry for Loan Payment