-This question was submitted by a user and answered by a volunteer of our choice.

Introduction

In simple words, provision for doubtful debts refers to the amount set aside as a provision from the profits of the business for the amount that is doubtful to be received in the future.

The provision for doubtful debts is usually provided for credit sales. This is because it is doubtful whether the customer might not be able to make the payment completely or partially.

Why is it necessary to maintain provision for doubtful debts?

It is necessary to maintain provision for doubtful debts due to the prudence principle. According to this principle, the company needs to be cautious and conservative when recording financial statements and reports. The company needs to identify potential losses from the events and transactions of the company.

It is a proactive step taken to safeguard the accurate financial position of the firm & to ensure the year-end reporting is done accurately. The accountant views the past trends of a business and then determines the approximate amount of doubtful debts every year and creates a provision for the same.

This shows how a company can manage risk related to credit sales when the company is on the receivable end. This will also increase the confidence of investors and stakeholders as this principle ensures transparency by showing how the potential risks are treated.

Example

A customer has purchased goods on credit for 50,000 from Kumar company. Provide provision for doubtful debts of 10%.

The Journal entry for the above example for the provision of doubtful debts will be

| Particulars | Debit | Credit |

| Profit/Loss A/c | 5,000 | |

| To provision for doubtful debts | 5,000 |

The journal entry is recorded in the books for the provision for doubtful debts of 50,000.

As per the modern rules, since there is a decrease in profit, the profit and loss account will be debited. The provision for doubtful debts will be credited since there is an increase in liability.

The company’s (receivables) debtors is 50,000.

| Particulars | Amount |

| Debtors | 50,000 |

| Provision for doubtful debts (50,000 x 10%) | (5,000) |

| Total Debtors | 45,000 |

As per the prudence principle, after the potential losses, the amount receivable from debtors will be 45,000.

Treatment of provision for doubtful debts

The provision for doubtful debts can either appear in the trial balance or as an adjustment entry.

When provision for bad debts is shown in the trial balance:

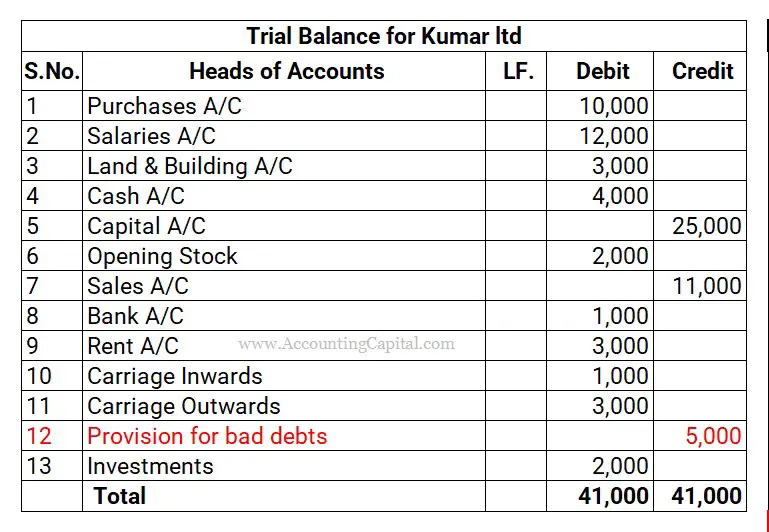

Provision of doubtful debts appears on the credit side of the trial balance. The provision for bad debts is created out of profits. This is done to not overestimate the profits.

In the trial balance, the Provision for doubtful debts has a credit balance as it is an accounts receivables contra account. A Contra account is an account that acts against the asset account.

According to the example, we can see that debtors is an asset, and the provision for doubtful debts has been deducted from the total debtors.

The trial balance of Kumar Ltd. is as follows:

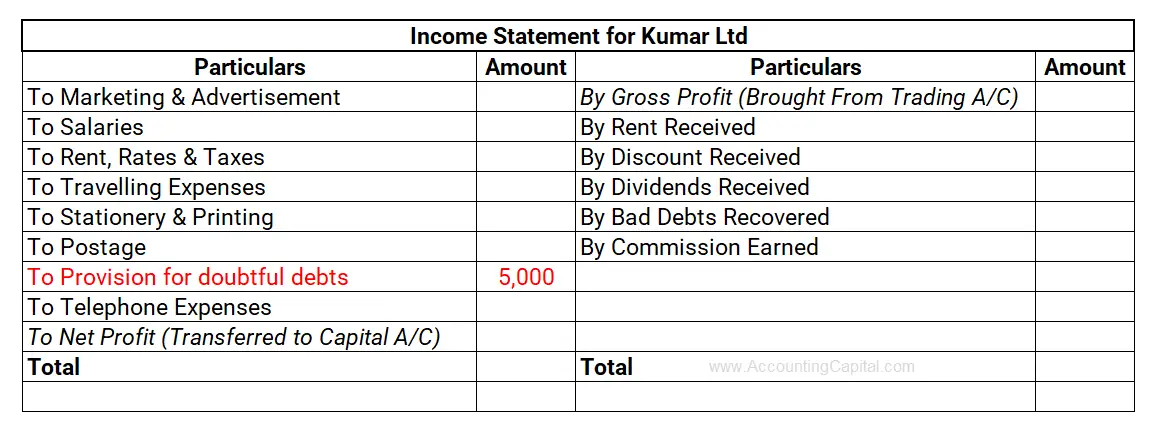

In the Profit and loss a/c

In the profit and loss account, the provision for doubtful debts will be debited as this will lead to a decrease in net profit.

Conclusion

- Provision for doubtful debts is an account made based on the amount that might not be receivable from the debtors

- This account follows the prudence principle.

- It appears on the credit side of the trial balance as it is a contra account as it is reduced from debtors (asset).

- It appears on the debit side of the profit and loss account since it is an expense for the company.