As a general accounting term, “Sales” refers to the revenue generated by a business by selling products or services. This is the income generated by the business’s core business operations.

he amount of sales recorded is based on the selling price of the goods or services sold and any applicable taxes or discounts.

Sales can be of two types,

Cash Sales: When the payment for the goods sold is received immediately, it is considered cash sales. The buyer makes payment at the time of purchase of goods.

Credit Sales: When the payment for goods sold is received later, it is considered credit sales.

Journal Entry for Sold Goods in Cash

| Cash A/C | Debit |

| To Sales A/C | Credit |

Modern Rules Applied

- Dr. the increase in Assets as cash comes into the business.

- Cr. the increase in Income as sales increase income.

Traditional Rules

- ‘Cash’ is a Real A/c; therefore, Dr. what comes in.

- ‘Sales’ is a Nominal A/c; therefore, Cr. all incomes and gains.

Related Topic – Journal Entry for Amortization

Example

Mr. Y has a business of trading furniture and fittings. He sold fittings to Mr. Z for 10,000 on a cash basis. The journal entry for the above transaction will be:

| Cash A/C | 10,000 |

| To Sales A/C | 10,000 |

(Being fittings sold for 10,000 to Mr. Z)

- Depending on your specific business and chart of accounts, the specific amounts and account names may differ.

- Based on your company’s accounting system, enter the correct date, amounts, and account names.

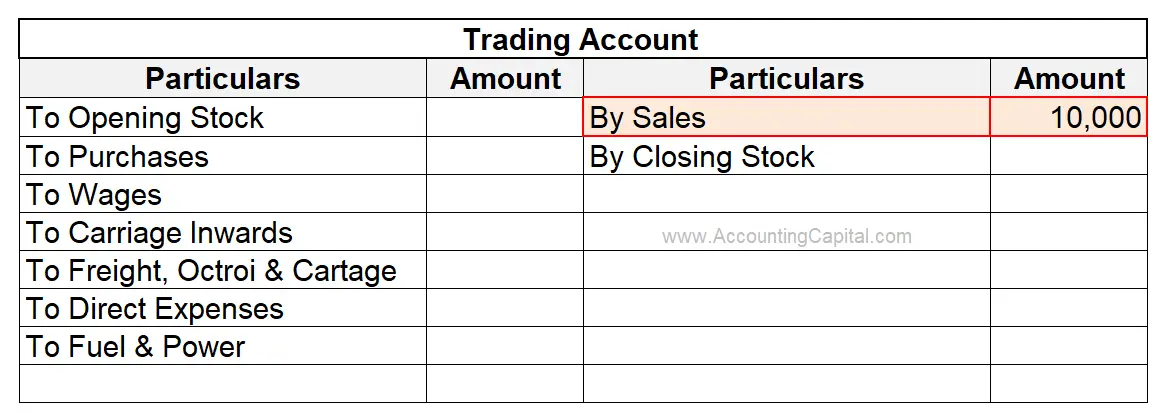

The sales of 10,000 made in cash shall be recorded on the credit side of a Trading A/c of the entity. Below is the extract of the Trading A/c, showing the same.

Related Topic – Difference Between Revenue and Profit

Effect on the Accounting Equation

ASSETS = CAPITAL + LIABILITIES

As per the accounting rules, this equation must always be balanced. The transaction, goods sold for cash, has an effect on both sides of the accounting equation.

To understand it more clearly, let us take an example.

Company XYZ Ltd. has 50,000 cash as its capital. It sold goods worth 20,000 at 25,000 for cash. (Profit margin 25,000 – 20,000 = 5,000). Show the effect on the accounting equation.

| Assets = | Liabilities | + Capital | |

|---|---|---|---|

| Balance | 50,000 | 0 | 50,000 |

| Cash A/c | 25,000 | 0 | 5,000 |

| Stock A/c | (20,000) | 0 | 0 |

| Total | 55,000 | 0 | 55,000 |

>Read Bought Goods for Cash Journal Entry