As a general accounting term, “Goods” refer to tangible products or merchandise that a business buys or manufactures for the purpose of selling to customers. These goods can include various items such as electronics, clothing, furniture, groceries, etc.

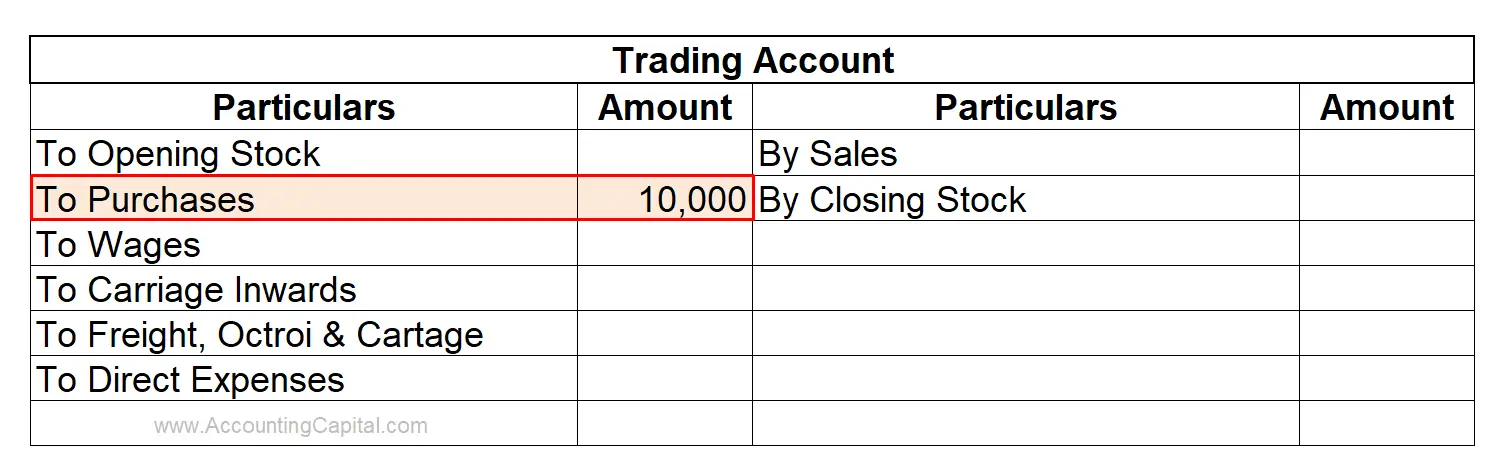

The acquisition of goods by an entity for resale to its customers is recorded as a purchase. It is shown on the debit side of a Trading A/c.

Purchase can be of two types,

Cash Purchase: The purchase of goods is considered a cash purchase if the payment is made immediately after the purchase.

Credit Purchase: When payment is made at a later date, the purchase is considered a credit purchase.

Journal Entry for Purchased Goods in Cash

| Purchase A/c | Debit |

| To Cash A/c | Credit |

Modern Rules Applied

- Dr. the increase in ‘Expense’ as expenditure is increased for the firm.

- Cr. the decrease in ‘Assets’ as cash goes out of the business.

Traditional Rules

- ‘Purchase’ is a Nominal A/c; therefore, Dr. all expenses & losses.

- ‘Cash’ is a Real A/c; therefore, Cr. what goes out.

Related Topic – Quiz on Rules for Debit and Credit

EXAMPLE

ABC ltd. purchased goods worth 10,000 from ZY Motors. The company paid the total amount in cash on the date of purchase. Show the journal entry for the transaction.

| Purchase A/c | 10,000 |

| To Cash A/c | 10,000 |

In the Trading Account, 10,000 purchases made in cash will be recorded as a debit.

Related Topic – Simple petty cash book

Related Topic – Simple petty cash book

Effect on the Accounting Equation

ASSETS = CAPITAL + LIABILITIES

As per the accounting rules, this equation must always be balanced. The transaction, ‘bought goods for cash,’ affects both sides of the accounting equation.

To understand it more clearly, let us take an example.

Company XYZ Ltd. has 50,000 cash as its capital. It purchases goods from AP Ltd. worth 20,000 and pays immediately with cash. Show its effect on the accounting equation.

The company has,

- A combination of 50,000 ‘Cash’ & 30,000 as ‘Capital’.

- It has purchased goods worth 20,000 in cash.

| Assets = | Liabilities | + Capital | |

|---|---|---|---|

| Balance | 50,000 | 0 | 50,000 |

| Cash A/c | (20,000) | 0 | 0 |

| Stock A/c | 20,000 | 0 | 0 |

| Total | 50,000 | 0 | 50,000 |

>Read Sold Goods for Cash Journal Entry