Revenue Receipt

Revenue receipts are funds received by a business as a result of its core business activities. It leads to an overall increase in the total revenue of the company. These funds are generated from a firm’s operating activities hence they are shown inside trading and profit and loss account and not in a balance sheet.

They are recurring in nature which means that they can be seen quite often and can also be used for distribution of profits. Unlike capital receipts which can not be used to create reserves, revenue receipts are used to create reserve funds.

They have no effect on liabilities or assets of a company. Receipts of this kind affect the overall profit and loss of an organization & are booked on accrual basis which means as soon as the right of receipt is established.

Examples of Revenue Receipts

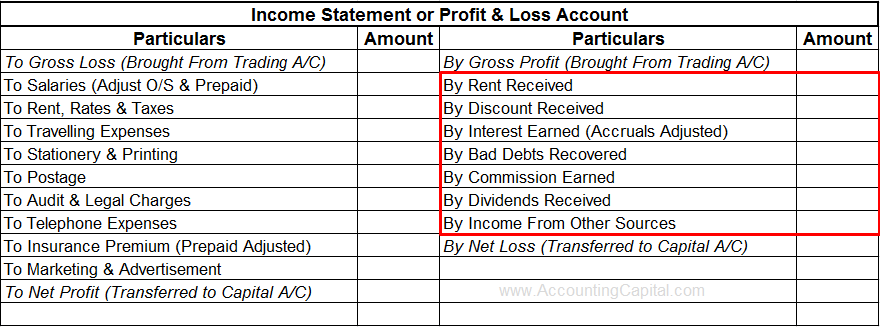

Few common examples are receipts from sale of good and services, discount received from creditors or suppliers, interests earned, dividends received, rent received, commission received, bad-debts recovered, income from other sources, etc.

An elaborated example of revenue receipts is interest earned – money received via earned interest is classified as revenue receipts as it is generated from regular business activities, doesn’t reduce assets or increase liabilities and & is a result of recurring business activity.

Sample view in a company

Short Quiz for Self-Evaluation

>Read Capital Receipts