Journal Entry for Recovery of Bad Debts

At times a debtor whose account had earlier been written off by a creditor as a bad debt may decide to make a payment. This is called “recovery of bad debts”. While posting the journal entry for bad debts recovered it is important to note that it is treated as a gain for the business & that the debtor should not be credited as in the case of sales.

While journalizing for bad debts debtor’s personal account is credited and the bad debts account is debited because bad debts written off are treated as a loss to the business and now when they are recovered it is seen as a fresh gain.

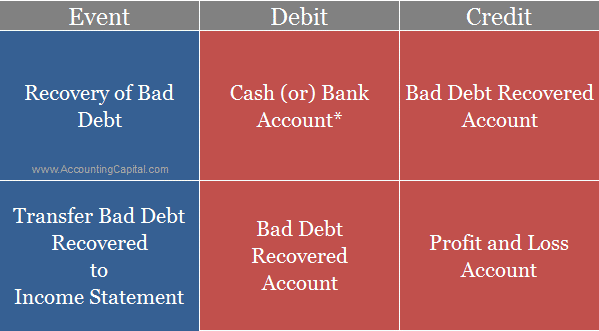

Journal entry for recovery of bad debts is as follows;

| Cash A/c | Debit | Real A/C | Dr. What comes in |

| To Bad Debts Recovered A/C | Credit | Nominal A/C | Cr. income & gains |

Debit (Cash A/c) assuming the recovery was done in cash

Rules applied as per modern or US style of accounting

| Cash or Bank A/C | Debit the increase in assets |

| Bad Debts Recovered A/C | Credit the increase in income |

The closing journal entry for bad debts recovered would be as follows;

| Bad Debts Recovered A/C | Debit |

| To Profit and Loss A/C | Credit |

(Transferring bad debts recovered to the income statement)

Related Topic – Journal Entry for Credit Sales and Cash Sales

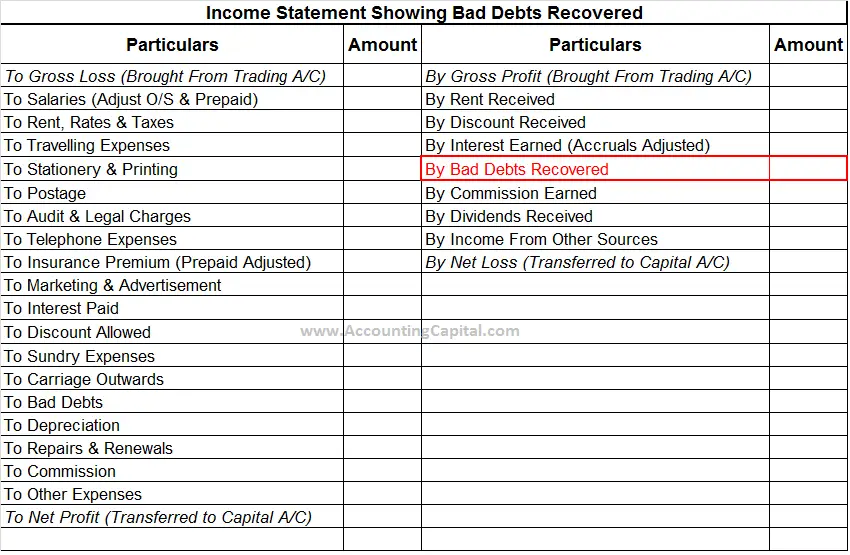

Bad Debts Recovered Shown Inside a Financial Statement

Related Topic – What is Provision for Discount on Debtors?

Example – Journal Entry for Recovery of Bad Debts

Unreal corp was declared insolvent last year and an amount of 70,000 was shown as bad debts in the books of ABC corp, this year Unreal corp decided to pay cash 70,000 against the same debt.

In the books of ABC Corp.

| Cash A/C | 70,000 |

| To Bad Debts Recovered A/C | 70,000 |

(Cash received from Unreal corp previously written off as bad debt)

| Bad Debts Recovered A/C | 70,000 |

| To Profit & Loss A/C | 70,000 |

(Transferring bad debts recovered to the income statement)

Short Quiz for Self-Evaluation

>Read Grouping and Marshalling