Journal Entry for Credit Card Sales

Digitization and modernization have made credit cards a very common mode of payment. Credit cards allow customers to shop without cash and make swift hassle-free payments. Frequent credit card payments mean businesses have to deal with the aspect of accounting and posting journal entry for credit card sales.

There are majorly four credit card issuers in the world Visa, Master, Discover & American Express. For accounting and journal entry for credit card sales there are 2 scenarios;

Scenario 1 – When cash is received at a later date.

Scenario 2 – When cash is received immediately.

1. Accounting for Credit Card Sale when Money is Received at a Later Date

In case if the company’s bank account is not linked to the payer bank (issuer of swipe machine) then the business receives cash at a later date. The seller needs to submit all receipts of credit card sales as prescribed by the payer bank. Money is credited to the company’s account after deducting the commission on credit card sale.

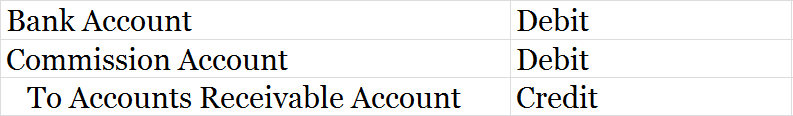

- Journal entry when the amount is due

When the amount is due it is shown as accounts receivable in the books of the business.

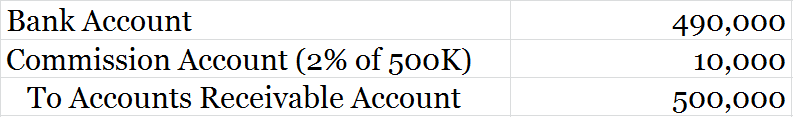

- Journal entry when dues are settled at a later date

Following journal entry is posted in the ledger accounts when the amount is settled and the company’s bank account is credited with the net amount; i.e. after adjusting commission.

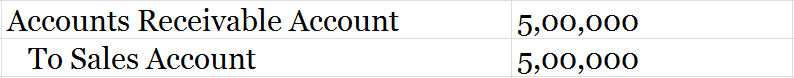

Example

Unreal Corp. has 5,00,000 as credit card sales on 10th of January which is due to be settled on the 30th of January. Commission rate charged by the issuer bank is 2% on total sales.

Journal entry on the date of transaction (10th January)

(Accounts Receivable account is used to show the amount due)

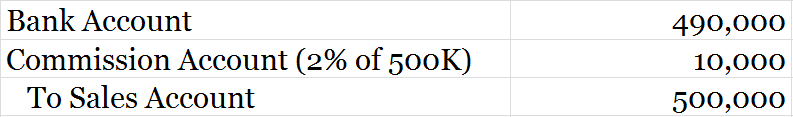

Journal entry on the date of settlement (30th January)

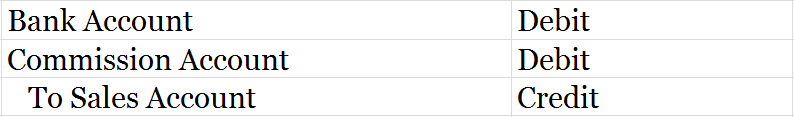

2. Accounting for Credit Card Sale when Money is Received Immediately

Nowadays payer banks issuing credit card machines (also known as Point of Sale terminals) automate the entire process. This means that the cash is credited automatically to the firm’s current account and no manual settlement is required. In this case, it is treated as an ordinary cash sale.

Example – When cash is received immediately

Unreal Corp. has a total of 5,00,000 as credit card sales on 10th January which is directly credited to the company’s account. Commission rate charged by the issuer bank is 2% on total sales.

(Sales account is credited as there is no requirement of accounts receivable account in this case)

Short Quiz for Self-Evaluation

>Read Accounting and Journal Entry for Provident Fund