-This question was submitted by a user and answered by a volunteer of our choice.

Meaning of Outstanding Subscriptions

In the context of non-profit organizations, a subscription is an amount paid by every member of the organization as membership fees. It is the main source of income of a non-profit entity. It is usually collected monthly from all the ordinary members.

Outstanding subscription is the amount of subscription which was to be paid by the members during the course of an accounting period but is due for payment i.e. the payment for it has not been made.

Understanding Outstanding Subscriptions is important for investors, financial analysts and company management as they assess the financial health and potential future growth of a company.

High level of Outstanding Subscriptions indicate strong investor interest in the company’s offerings, which can be a positive signal for its future prospects.

Example

For example, XYZ Club has 1200 members, each paying a monthly subscription of 100. As of 31st March, the Subscription due (or) outstanding subscription amounted to 25,000. Journalize the following transactions for subscriptions due and received in the books of XYZ Club.

In the books of XYZ Club

| Date | Particulars | Amount | Nature of Account | Accounting Rule |

| 31st March | Outstanding Subscription a/c Dr | 25,000 | Representative Personal | Debit– The Receiver |

| To Subscription a/c | 25,000 | Nominal | Credit– All Incomes and Gains |

(Being Subscription due as of 31st March)

At the time of receipt

| Date | Particulars | Amount | Nature of Account | Accounting Rule |

| 1st April | Cash/Bank a/c Dr | 25,000 | Real | Debit– What comes into the business |

| To Outstanding Subscription a/c | 25,000 | Representative Personal | Credit– The Giver |

(Being Subscription received)

Modern Accounting Approach

We will record the same transaction by following the modern rules of accounting.

In the books of XYZ Club

| Date | Particulars | Amount | Nature of Account | Accounting Rule |

| 31st March | Outstanding Subscription a/c Dr | 25,000 | Asset | Debit– The Increase in Asset |

| To Subscription a/c | 25,000 | Income | Credit– The Increase in Income |

(Being Subscription due as of 31st March)

At the time of receipt

| Date | Particulars | Amount | Nature of Account | Accounting Rule |

| 1st April | Cash/Bank a/c Dr | 25,000 | Asset | Debit– The Increase in Asset |

| To Outstanding Subscription a/c | 25,000 | Asset | Credit– The Decrease in Asset |

(Being Subscription received)

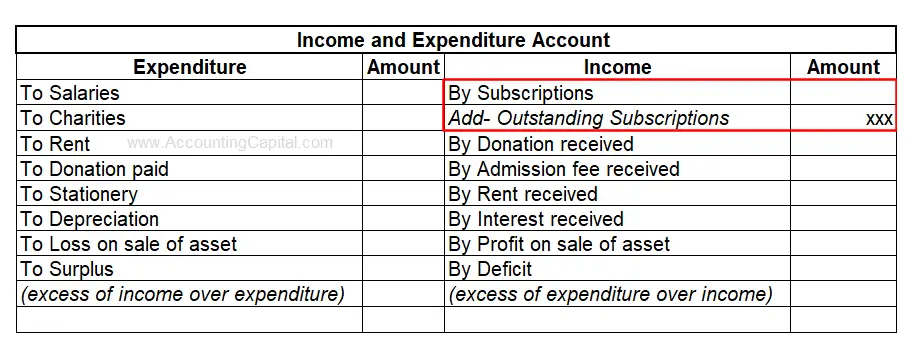

Outstanding Subscriptions in Financial Statements

Accounting Treatment

- It is added to the subscription and recorded on the income side of the Income and Expenditure account. It is also termed as Subscription in areas (or) Subscription due.

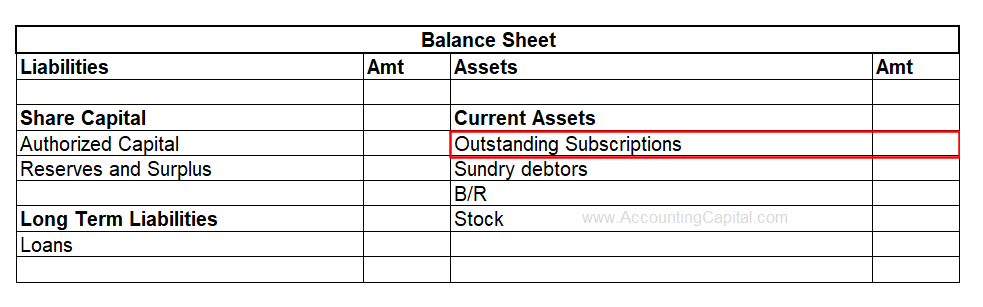

- An outstanding subscription is treated as an asset to the organization and shown on the asset side of the balance sheet.

O/s Subscription at the end of the Accounting Year Represents

An outstanding subscription at the close of the financial year is considered an asset and, therefore, appears on the Assets side of the closing balance sheet as a result (being the closing balance of the subscription).