-This question was submitted by a user and answered by a volunteer of our choice.

Meaning of Days Payable Outstanding

Days Payable Outstanding (DPO) refers to the average number of days taken by an organization (or) company to pay to its outstanding suppliers/vendors. It is calculated on the credit purchases made by an organization. It is computed on a monthly, quarterly (or) annual basis. This portraits how well can a company manage its cash outflows.

If the company takes less time to make payment to its outstanding suppliers then it states that an organization has a strong financial position. but if the company takes a more (or) longer time to pay its outstanding supplier then it could either be an action plan or else the company’s financial position is weak.

Formula

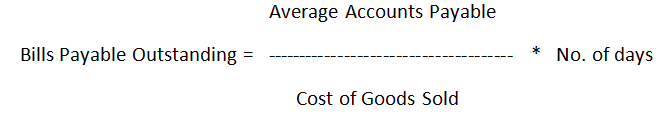

The following formula is used for calculating the Days Payable Outstanding (DPO) of an organization.

Where Cost of Goods Sold (COGS) = Opening Inventory + Purchases – Closing Inventory.

Example

ABC Ltd has furnished you with the following information. Compute Days Payable Outstanding.

| S.No. | Particulars | Amount |

| 1. | Average Accounts Payable | 45,000 |

| 2. | Cost of Goods Sold | 2,25,000 |

| 3. | Number of Days | 30 |

Calculation

Days Payable Outstanding = Average Accounts Payable * No. of days/Cost of Goods Sold

= 45,000 * 30/2,25,000

= 6 Days

In my perspective, 6 days is a low average period for an organization for making the payments to all the outstanding suppliers. Therefore it represents a fairly good DPO. Although it depends on the organization about their understandability of high or low DPO.