Drawings

In accounting, assets such as Cash or Goods which are withdrawn from a business by the owner(s) for their personal use are termed as drawings. It is also called a withdrawal account. It reduces the total capital invested by the proprietor(s).

In the case of goods withdrawn by owners for personal use, purchases are reduced and ultimately the owner’s capital is adjusted. The adjustment is done at cost price.

For small firms withdrawals are ordinarily seen in the form of cash or business assets, however, if a business is incorporated they are often observed in the form of dividends or scrip dividends. It is a natural personal account out of the three types of personal accounts.

Journal Entry for Drawings of Goods or Cash

- In case of cash withdrawn for personal use from in-hand-cash or the official bank account.

| Drawings A/C | Debit | Debit the increase in drawings |

| To Cash (or) Bank A/C | Credit | Credit the decrease in assets |

- In case of goods withdrawn for personal use from the business.

| Drawings A/C | Debit | Debit the increase in drawings |

| To Stock A/C | Credit | Credit the decrease in assets |

*Purchases account can also be used instead of stock account as the firm’s stock/purchases are being reduced.

It is a temporary account which is cleared during the accounting process at the end of each accounting year & is not shown as a business expense.

A debit balance in drawing account is closed by transferring it to the capital account. It does not directly affect the profit and loss account in any way.

Adjustment entry to show the decrease in capital

| Capital A/C | Debit |

| To Drawings A/C | Credit |

(Same for both cash & goods)

Related Topic – Journal Entry for Goods Given as Charity/ or Free Samples

Example & Placement in Financial Statements

A leather manufacturer withdrew cash worth 5,000 from an official bank account for personal use. Post an appropriate journal entry for this scenario and also show journal entry for adjustment in the capital account.

Journal entry for cash withdrawn for personal use

| Drawings A/C | 5,000 |

| To Bank A/C | 5,000 |

(Bank balance reduced by 5,000)

Adjustment entry to show the decrease in capital

| Capital A/C | 5,000 |

| To Drawings A/C | 5,000 |

(Owner’s capital reduced by 5,000)

Type of Account and Where is it Shown in the Financial Statements

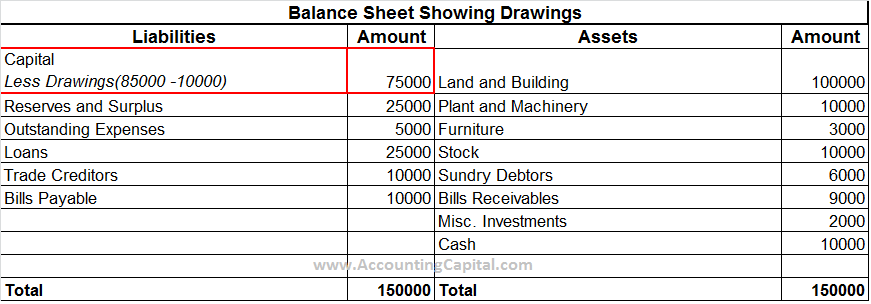

It is a Personal A/C and is adjusted from the capital. It is shown in the balance sheet on the liability side as a reduction in capital.

Related Topic – Compound Journal Entry

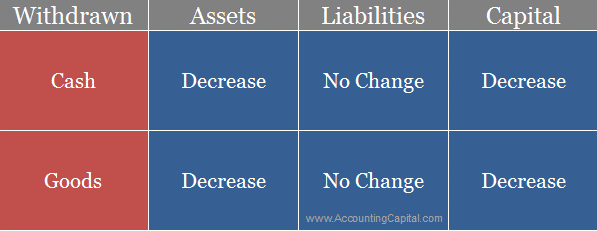

Change in the Accounting Equation

The accounting equation changes with every transaction that happens in a business. Similarly with withdrawals for personal use the accounting equation changes as follows;

Short Quiz for Self-Evaluation

>Related Long Quiz for Practice Quiz 24 – Drawings

>Read Offset Account