- Overview and Meaning

- Real, Personal, and Nominal Accounts

- List of Examples – 3 Types of Accounts

- PDF Download

- Quiz

- Revision Video

- Practice

- Conclusion

Overview and Meaning

In accounting, an account is a specific header created for grouping similar transactions. It is maintained in a T-shaped tabular format with multiple columns containing matching transactions that are recorded together. Following the traditional approach, there are three types of accounts in accounting: Real, Personal, and Nominal.

They are journalized as per the golden rules of accounting. After that, the balance is transferred in a T-shaped table that contains all debit transactions on the lef, and the right-hand side includes all credit transactions.

Different types of financial statements are created using transactional information from accounts. A company’s financial position, operational performance, etc., are all represented using the same data.

As per the two accounting approaches i.e. the traditional (aka English approach) and the modern (aka American or the Accounting Equation approach) the accounts are classified into 2 major groups as shown below:

| Personal Accounts | Impersonal Accounts |

| Natural Personal | Real |

| Artificial Personal | Nominal |

| Representative Personal |

Related Topic – Debit Balance and Credit Balance

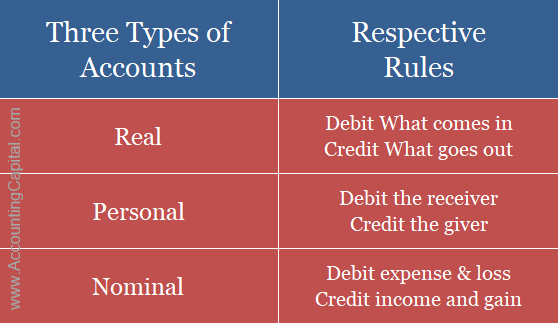

Real, Personal and Nominal Accounts

It is important to know what type of account are you dealing with because if you fail to identify an account correctly as either a real, personal or nominal account, in most cases, you will get end up recording incorrect journal entries.

A company’s financial data becomes unreliable when debit and credit rules are incorrectly applied. The golden rules are dependent on the accurate classification of the account.

1. Real Accounts

All assets of a firm, which are tangible or intangible, fall under the category of ‘Real Accounts’. (Except debtors)

Tangible real accounts are related to things that can be touched and felt physically. A few examples of tangible real accounts are building, furniture, equipment, cash in hand, land, machinery, stock, investments, etc.

Intangible real accounts are related to things that can’t be touched and felt physically. A few examples of such real accounts are copyrights, intellectual property, customer data, goodwill, patents, trademarks, broadcasting rights, logos, etc.

The golden rule for real accounts

| Debit What Comes in |

| Credit What Goes Out |

Example of Real Accounts

The transaction below shows the interaction of two different accounts: one is ‘Furniture’ and the other is ‘Cash’.

Furniture – Real Account (tangible) & Cash in Hand – Real Account (tangible)

- Purchased furniture for 10,000 in cash

| Accounts Involved | Debit/Credit | Rule Applied |

| Furniture A/C | 10,000 | Real A/C – Dr. what comes in |

| To Cash A/C | 10,00 | Real A/C – Cr. what goes out |

Important to know about Real Accounts – In spite of the fact that “debtors” are assets for the company, they continue to be classified as personal accounts. This is because ‘debtors’ belong to individuals or entities and personal accounts specifically serve the purpose of calculating balances due to or due from such 3rd parties.

Related Topic – Step by Step Process to Create a Journal Entry

2. Personal Accounts

Second among three types of accounts are personal accounts which are related to individuals, firms, companies, etc. A few examples are debtors, creditors, banks, outstanding accounts, prepaid accounts, accounts of customers, accounts of goods suppliers, capital, drawings, etc.

Natural personal accounts: All of God’s creations are included in these types of personal accounts. Accounts that belong to individuals fall into this category e.g. Kumar’s A/c, Adam’s A/c, Unreal Co. A/c, etc.

Artificial personal accounts: Personal accounts which are created artificially by law, such as corporate bodies and institutions, are called artificial personal accounts. E.g. private companies, LLCs, LLPs, clubs, schools, sole proprietors, public limited companies, one-person companies, cooperative societies, etc.

Representative personal accounts: These are accounts that directly or indirectly represent a particular person or a group of people.

Consider the example of an employee whose wages are paid in advance to him/her, a prepaid wages account will be opened in the books of accounts. This wages prepaid account is a representative personal account indirectly linked to the person.

A few other examples that are related are as follows: prepaid insurance account, unearned interest account, rent received account, accrued commission account, prepaid rent account, outstanding rent, etc.

The golden rule for personal accounts

| Debit the receiver |

| Credit the giver |

Example of Personal Accounts

The transaction below demonstrates the interaction between two accounts: one is a ‘Private Limited Company’ and the other is a ‘Bank’.

Private Ltd Co. – Personal Account (artificial) & Bank – Personal Account (artificial)

- Paid Unreal Company 24,000 by check

| Accounts Involved | Debit/Credit | Rule Applied |

| Unreal Company A/C | 24,000 | Personal – Dr. the receiver |

| To Bank A/C | 24,000 | Personal – Cr. the giver |

Related Topic – Difference between Journal and Ledger

3. Nominal Accounts

Accounts which are related to expenses, losses, incomes or gains are called Nominal accounts.

The dictionary meaning of the word ‘nominal’ is “existing in name only“ and the meaning is absolutely true in the accounting terms as well. There is no physical existence of nominal accounts, but money is involved behind every such account even though they have no physical form.

Example – Purchases, Sales, Salaries, Commission Received, Bad Debts, Telephone Bills, etc. The final result of all nominal accounts is either profit or loss which is then transferred to the capital account.

The golden rule for nominal accounts

| Debit all expenses and losses |

| Credit all incomes and gains |

Example of Nominal Accounts

The transaction below shows the interaction between two accounts: one is a ‘Purchase’ and the other is ‘Cash’.

Purchase – Nominal Account (expense) & Cash – Real Account (tangible)

- Purchased good for 15,000 in cash

| Accounts Involved | Debit/Credit | Rule Applied |

| Purchase A/C | 15,000 | Nominal A/C – Dr. all expenses |

| To Cash A/C | 15,000 | Real A/C – Cr. what goes out |

To Summarize,

Related Topic – What are Trading Expenses in Final Accounts?

Types Of Accounts And Rules

The following section provides a brief overview and explanation of the most commonly used accounts and their types.

| Account | Type | Comments |

|---|---|---|

| Plant & Machinery A/c | Real | Tangible asset |

| Investments A/c | Real | Intangible asset |

| Purchases A/c | Nominal | Expense for business |

| Creditor’s A/c | Personal | Related to persons* |

| Accrued Income A/c | Personal | Related to persons* |

| Equipment A/c | Real | Tangible asset |

| Loan Taken A/c | Personal | Related to persons* |

| Outstanding Expense A/c | Personal | Related to persons* |

| Bank A/c | Personal | Related to persons* |

| Capital A/c | Personal | Related to persons* |

| Loose Tools A/c | Real | Tangible asset |

| Sales A/c | Nominal | Income for business |

| Goodwill A/c | Real | Intangible asset |

| Drawings A/c | Personal | Related to the owner |

| Payment of Expense A/c | Nominal | Reduction of expense |

| Prepaid Expense A/c | Personal | Related to persons* |

| Debtor’s A/c | Personal | Related to persons* |

| Bad Debts Written Off A/c | Nominal | Loss for business |

| Bad Debts Recovered A/c | Nominal | Gain for business |

| Income Received in Advance A/c | Personal | Related to persons* |

| Cash A/c | Real | Tangible asset |

| Discount Received A/c | Nominal | Gain for business |

| Discount Allowed A/c | Nominal | Loss for business |

| Petty Cash A/c | Real | Tangible asset |

| Carriage Inwards A/c | Nominal | Expense for business |

| Depreciation A/c | Nominal | Non-cash Expense |

| Leasehold Property A/c | Real | Asset for the business |

| Interest on Drawings A/c | Nominal | Income for business |

| Interest on Capital A/c | Nominal | Expense for business |

| Trademark A/c | Real | Intangible asset |

| Bank Overdraft A/c | Personal | Related to persons* |

| Furniture A/c | Real | Tangible asset |

| Interest Paid A/c | Nominal | Expense for business |

| Bills Payable A/c | Personal | Related to persons* |

| Bills Receivable A/c | Personal | Related to persons* |

*Persons – Our use of the word “persons” mirrors the usage found in the financial world. In this context, it can refer to individuals, firms, companies, etc.

It is nearly impossible to provide a complete list of accounts therefore we tried to provide you with the most often used accounts along with a general understanding of how similar types of accounts may look like.

Related Topic – Petty Cash Book

PDF Download

We have created a printer-friendly PDF version of the above table that can be instantly downloaded, for free. Those who use the three types of accounts in accounting and apply the legacy rules of debit and credit regularly should print or save this on their desktop.

Download – List of commonly used accounts in business & their types

Short Quiz for Self-Evaluation

Related Topic – Why are Subsidiary Books Prepared?

Revision & Highlights Short Video

Highly Recommended!!

Do not miss our 1-minute revision video. This will help you quickly revise and memorize the topic forever. Try it :)

Practice

This section is dedicated to the practice of the three types of accounts in accounting. Practising this will help you gain a better understanding of the subject.

Question – Identify the accounts involved and their types. Also, state whether they should be debited or credited.

1. Paid rent for 30,000 in cash.

Accounts Involved – Rent Expense A/c & Cash A/c

Type – Rent Expense is a Nominal account & Cash is a Real account

Debit & Credit – Rent Expense A/c will be debited by 30,000 (Dr. all expenses & losses) whereas Cash A/c will be credited by 30,000 (Cr. what goes out)

2. Mary started the business with 95,000 in cash.

Accounts Involved – Cash A/c & Capital A/c

Type – Cash is a Real account & Capital A/c is a Personal account

Debit & Credit – Cash A/c will be debited by 95,000 (Dr. what comes in) whereas Capital A/c will be credited by 95,000 (Cr. the giver)

Capital A/C and Mary’s Capital A/C both can be used in the above question.

3. Sold goods on credit to Unreal Company for 25,000

Accounts Involved – Unreal Company’s A/c (Debtor) & Sales A/c

Type – Unreal Company’s A/c is a Personal account & Sales is a Nominal account

Debit & Credit – Unreal Company’s A/c will be debited by 25,000 (Dr. the receiver) whereas Sales A/c will be credited by 25,000 (Cr. all incomes & gains)

4. Purchased goods on credit from Kumar for 50,000

Accounts Involved – Purchases A/c & Kumar’s A/c (Creditor)

Type – Purchases A/c is a Nominal account & Kumar’s A/c is a Personal account

Debit & Credit – Purchases A/c will be debited by 50,000 (Dr. all expenses & losses) whereas Kumar’s A/c will be credited by 50,000 (Cr. the giver)

5. 40,000 cash withdrawn by the proprietor for personal use

Accounts Involved – Drawings A/c & Cash A/c

Type – Drawings A/c is a Personal account & Cash A/c is a Real account

Debit & Credit – Drawings A/c will be debited by 40,000 (Dr. the receiver) whereas Cash A/c will be credited by 40,000 (Cr. what goes out)

6. Paid 2,000 as carriage inwards by cheque (inventory purchase)

Accounts Involved – Carriage Inwards A/c & Bank A/c

Type – Carriage Inwards A/c is a Nominal account & Bank A/c is a Personal account

Debit & Credit – Carriage Inwards A/c will be debited by 2,000 (Dr. all expenses & losses) whereas Bank A/c will be credited by 2,000 (Cr. the giver)

“Purchases account” is also debited (equal to the amount of purchase), however, it is not necessary to show that in the above practice example. Carriage inwards is treated as a direct operating expense since the product is intended for operational use.

7. Commission received 80,000 in cash

Accounts Involved – Cash A/c & Commission Received A/c

Type – Cash A/c is a Real account & Commission Received A/c is a Nominal account

Debit & Credit – Cash A/c will be debited by 80,000 (Dr. what comes in) whereas Commission Received A/c will be credited by 80,000 (Cr. all incomes & gains)

8. Paid 15,000 by the bank for trademark registration

Accounts Involved – Trademark A/c & Bank A/c

Type – Trademark A/c is a Real account & Bank A/c is a Personal account

Debit & Credit – Trademark A/c will be debited by 15,000 (Dr. what comes in) whereas Bank A/c will be credited by 15,000 (Cr. the giver)

Although a trademark may seem like an expense, it is an intangible asset and should not be viewed as a nominal account.

Related Topic – Why is Debit written as Dr. and Credit as Cr.?

9. Deposited 20,000 in the bank to open a new account

Accounts Involved – Bank A/c & Cash A/c

Type – Bank A/c is a Personal account & Cash A/c is a Real account

Debit & Credit – Bank A/c will be debited by 20,000 (Dr. the receiver) whereas Cash A/c will be credited by 20,000 (Cr. what goes out)

This entry is also called a Contra Entry. The entry acts as a counterweight and is made to reverse or offset an entry on the other side of an account.

10. From the total receivables of Star Co. (Debtor), bad debts were recognized as 11,000

Accounts Involved – Bad Debts A/c & Star Co. A/c (Debtor)

Type – Bad Debts A/c is a Nominal account & Star Co. A/c (Debtor) is a Personal account

Debit & Credit – Bad Debts A/c will be debited by 11,000 (Dr. all expenses & losses) whereas Star Co. A/c will be credited by 11,000 (Cr. the giver)

During the preparation of final accounts, debts written off after the trial balance is finalized are transferred to the profit and loss account.

11. Paid John (Creditor) 10,000 by Cheque

Accounts Involved – John’s A/c & Bank A/c

Type – John’s A/c is a Personal account & Bank A/c is a Personal account

Debit & Credit – John’s A/c will be debited by 10,000 (Dr. the receiver) whereas Bank A/c will be credited by 10,000 (Cr. the giver)

12. Purchased Furniture for 75,000 (paid by Cheque)

Accounts Involved – Furniture A/c & Bank A/c

Type – Furniture A/c is a Real account & Bank A/c is a Personal account

Debit & Credit – Furniture A/c will be debited by 75,000 (Dr. what comes in) whereas Bank A/c will be credited by 15,000 (Cr. the giver)

13. Charged depreciation at 20% on furniture valued at 75,000

Accounts Involved – Depreciation A/c & Furniture A/c

Type – Depreciation A/c is a Nominal account & Furniture A/c is a Real account

Debit & Credit – Depreciation A/c will be debited by 15,000 (Dr. all expenses & losses) whereas Furniture A/c will be credited by 15,000 (Cr. what goes out)

Depreciation is a non-cash expense and should be viewed as a nominal account. The amount debited & credited should be equal to the depreciation expense.

14. Received 7,000 as interest on drawings from Neel (Proprietor)

Accounts Involved – Drawings A/c & Interest on Drawings A/c

Type – Drawings A/c is a Personal account & Interest on Drawings A/c is a Nominal account

Debit & Credit – Drawings A/c will be debited by 7,000 (Dr. the receiver) whereas Interest on Drawings A/c will be credited by 7,000 (Cr. all incomes & gains)

Due to the fact that interest on drawings is an income for the company, it is added to the company’s interest account, thereby increasing its income. Actual cash is not received, instead, adjustments are made within relevant accounts.

15. 9,500 received in cash from Unreal Co. as the full and final settlement of their account worth 10,000.

Accounts Involved – Cash A/c, Discount Allowed A/c, and Unreal Co. A/c

Cash is a Real account so Dr. what comes in (9,500), Discount Allowed A/c is a Nominal account so Dr. all expenses/losses (500), and Unreal Co. A/c (Debtor) is a Personal account so Cr. the giver (10,000).

Type – Cash A/c is a Real account, Discount Allowed A/c is a Nominal account, and Unreal Co. A/c (Debtor) is a Personal account.

Debit & Credit – Cash A/c will be debited by 9,500 (Dr. what comes in), Discount Allowed A/c will be debited by 500 (Dr. all expenses & losses) whereas Unreal Co. A/c will be credited by 10,000 (Cr. the giver)

Related Topic – Is Debit Balance Positive and Credit Balance Negative?

Conclusion

Accounts are broken down into 2 major categories based on their type, according to the traditional approach: Personal, and Impersonal. Personal accounts come in three types. Impersonal accounts are further broken down into two: Real & Nominal.

Due to its more holistic approach, the modern classification of accounts (assets, liabilities, revenue, expenses & capital) has gained more followers than the traditional classification (real, personal & nominal).

As far as we are concerned, using modern rules and classifications is easier and more convenient than using traditional rules.

There are some tricky cases where a person might incorrectly identify an account and we would like to identify them explicitly.

- Accrued Income – is a personal account whereas the related income account is a nominal account. Any income or expense with a prefix such as prepaid, outstanding, accrued, received in advance, etc. shall be classified as a personal account.

- Bank – It is easy to get confused because a bank account may seem like an asset therefore it should be a real account, No! Due to the fact that the bank account belongs to a legal entity, it is considered a personal account & treated accordingly.

- Capital or Equity – It is a personal account as equity/capital is provided to the company by a person i.e. individual, firm, company, etc.

- Goodwill – At the time of comparing tangible and intangible assets, it is easy to forget that assets are both physical and non-physical therefore, all intangible assets like goodwill, copyright, patents, investments, etc. are categorized as real accounts.

- Drawings – Drawings refer to withdrawals of cash or goods for personal use by the owners of a business. Since the owner is a separate entity from the business, it is seen as a personal account.

- Debtors – It’s easy to get confused because debtors are receivables, which are assets, so it should be treated as a real account, No! Due to the fact that debtors are an external third party (a separate entity), they are treated as personal.

The debit and credit rules are applied correctly when the type of account is accurately identified. By doing this, all financial events of a business are accurately recorded and accounted for. As a result, in the light of the accounting equation, debits are always equal to credits and the balance sheet is always a match.

Due to the fact that both internal and external users of accounting information rely on financial data, the accounts identified and the resulting rules applied should be accurate at all times.

>Read 5 Principles of Accounting with Examples