Trade Receivables

It is the total amount receivable to a business for sale of goods or services provided as a part of their business operations. Trade receivables consist of Debtors and Bills Receivables. Trade receivables arise due to credit sales.

They are treated as an asset to the company and can be found on the balance sheet.

Trade Receivables = Debtors + Bills Receivables

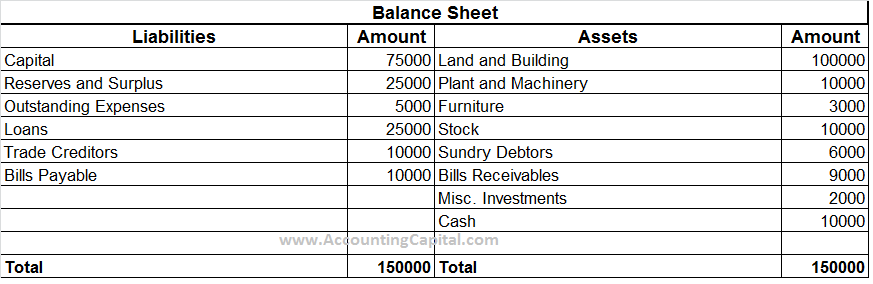

Example – Trade Receivables

Calculate trade receivables from the below balance sheet

Trade Receivables = 6000 (sundry debtors) + 9000 (bills receivable)

= 15,000

Debtors are people or entities to whom goods have been sold or services have been provided on credit and payment is yet to be received for that. In addition, debtors are treated as current assets in a business.

Bills Receivable (B/R) is a bill of exchange accepted by a debtor or is received in way of an endorsement from them. The amount which is due to be received on a specific date is mentioned in the bill.

Related Topic – What is Provision for Doubtful Debts?

Trade Payables

It is the total amount payable by a business for goods purchased or services availed as a part of their business operations. Trade payables comprise of Creditors and Bills Payables. Trade payables arise due to credit purchases.

They are treated as a liability for the company and can be found on the balance sheet.

Trade Payables = Creditors + Bills Payables

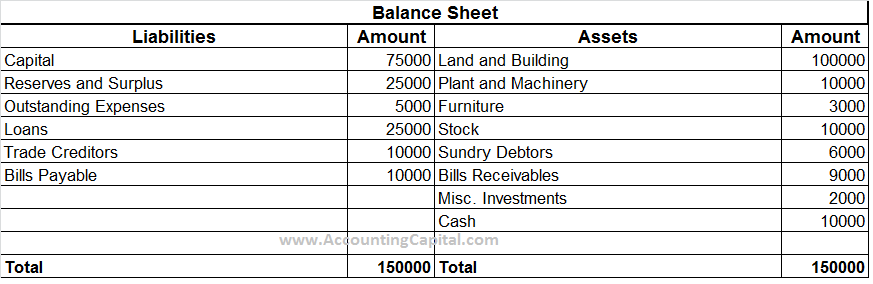

Example – Trade Payables

Calculate trade payables from the below balance sheet

Trade Payables = 10,000 (sundry creditors) + 10,000 (bills payable)

= 20,000

Creditors are people or entities from whom goods have been purchased or services have been availed on credit and payment is yet to be made against that. In addition, creditors are treated as current liabilities in a business.

Bills Payable (B/P) is a bill of exchange accepted by a business the amount for which will be payable on the specific date mentioned in the bill.

Short Quiz for Self-Evaluation

>Read Working Capital