Bills Payable Book

Also known as a B/P book, bills payable book is a subsidiary or secondary book of accounting where all bills of exchange, which are payable by the business, are recorded. The total value of all the bills payable for an accounting period is transferred to the books of accounts.

In a mid to large sized business where the number of bills exchanging hands is large in number, it is tough to journalize all bills drawn. All such bills are entered in an accounting ERP or a register depending on the business, furthermore, all these entries are transferred to the respective ledger accounts at a regular interval, often monthly.

A bill receivable for a “drawer” is a bill payable for a “drawee”. Bills payable account will usually have a credit balance, as it is supposed to be paid at maturity, it acts as a liability for the business. Generally, every bill has a 3-day grace period.

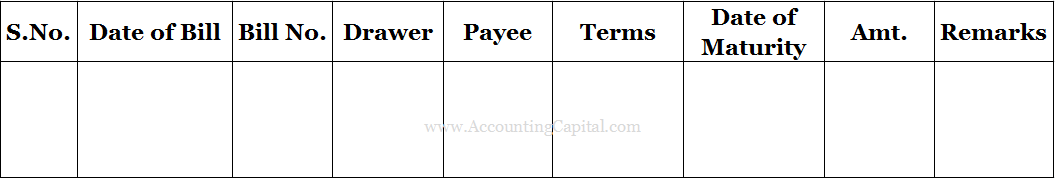

Sample Format of a B/P Book

The person, who draws the bill of exchange, is called a “drawer” and the customer, on whom it is drawn, is called a “drawee” or an “acceptor”.

Short Quiz for Self-Evaluation

>Read What is Days Payable Outstanding or DPO?