Subsidiary Books of Account

Also known as books of original entry, special purpose books, special purpose subsidiary books, and subsidiary books of accounts are various books recording financial transactions of a similar nature. They are the sub-division of the journal.

During the lifecycle of a business, the volume of transactions in a business may rise to the extent that a single journal may no longer be adequate to keep the books. This is when special purpose books or subsidiary books may be required for more efficient bookkeeping.

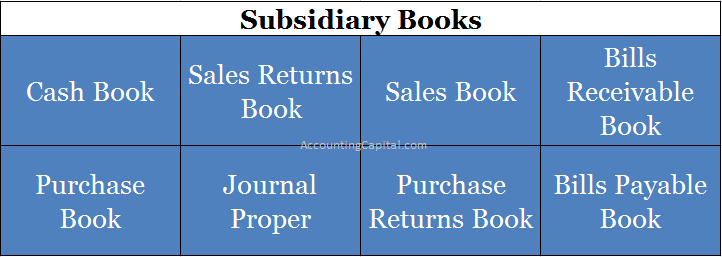

List of supporting books

Related Topic – How to treat return inwards in trial balance?

Types of Subsidiary Books

1. Cash Book – A cash book is a book of prime entry that records all transactions made by a business in both cash and a bank instrument.

2. Purchase Book – A purchase book is one of the special purpose books where all the credit purchases are recorded by a business.

3. Sales Book – A sales book is one of the subsidiary books where all the credit sales are recorded by a business.

4. Purchase Returns Book – Also known as returns outward book, a purchase returns book is prepared to record goods returned by a business to its suppliers.

5. Sales Return Book – Also known as a returns inward book, a sales return book is prepared to record goods returned to a business by the customers.

6. Journal Proper – It is a book in which all miscellaneous transactions which are not recorded in any other subsidiary book are called a journal proper.

7. Bills Receivable Book – is a book that records all bills receivable to a business, the total of bills receivable book is posted on the debit side of the B/R account.

8. Bills Payable Book – is one of the subsidiary books that records all bills payable by a business, the total of bills payable book is posted on the credit side of the B/P account.

Related Topic – Is sales return a debit or credit?

Purpose of Subsidiary Books

For any business that grows large enough and the amount of transactions increases, it is no longer possible to record all transactions in one journal book, but rather in a number of journals. This is where subsidiary books play a crucial role and they can be seen as an extension of the journal book itself.

As a result, subsidiary books may be defined as books in which transactions are entered first, followed by ledger account preparation. They are also called day books or special journals.

In addition to overcoming the limitations of a journal book or journal entries, they have other benefits such as better organization of similar types of transactions.

Related Topic – Is cash book both a journal and ledger?

Short Quiz for Self-Evaluation

Revision & Highlights Short Video

Highly Recommended!!

Do not miss our 1-minute revision video. This will help you quickly revise and memorize the topic forever. Try it :)

>Read Why are subsidiary books maintained in accounting?