Capex and Opex

Expenses are costs incurred for a consideration. An expense may be capital or revenue in nature and usually incurred by disbursal of money. Capex and Opex refer to capital expenditure and operating expenditure respectively.

They can also be recognized by agreeing to pay off an obligation e.g. paying rent, buying machinery, paying taxes, etc.

Capital Expenditure (Capex)

Also known as Capex it is an expenditure incurred by a business to acquire fixed assets or add value to them in view of creating future benefits. The benefits derived from capital expenditure extend beyond the accounting period of the actual spend. The assets acquired in question might be tangible or intangible.

This will include everything from costs incurred for installation of a fixed asset, legal costs to acquire it, extension or improvement of fixed assets.

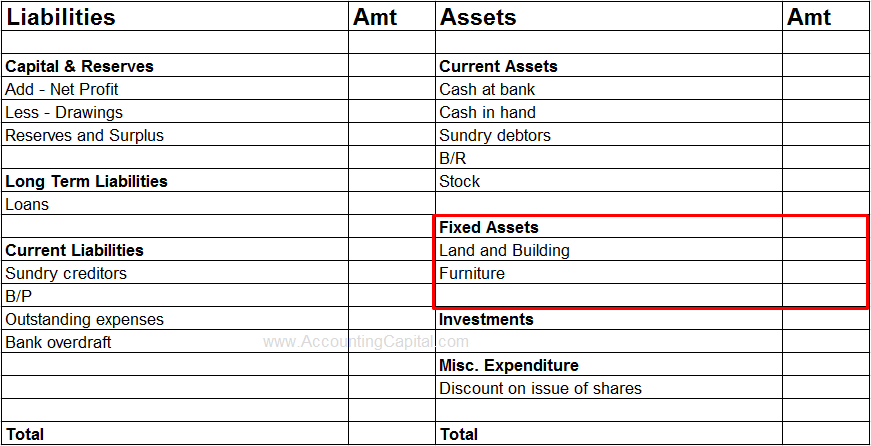

This type of expenditure is shown in the balance sheet on the asset side.

Examples of Capital Expenditure (Capex)

Furniture – 50,000, Machine – 10,00,000

Installation (Furniture) – 1000, Upgrading (Machine) – 40,000

All these are examples of Capex (Capital Expenses) incurred by a business. Even the upgrading and installation cost will qualify as a capital expenditure.

Related Topic – Difference between Capital Receipts and Revenue Receipts

Operating Expenditure (Opex)

Also known as operational expenditure and operating expense, it is an ongoing cost that a business has to spend to run its day-to-day operations. The benefits derived from such expenses are exhausted within the same accounting period and don’t carry forward. It is the opposite of capital expenditure.

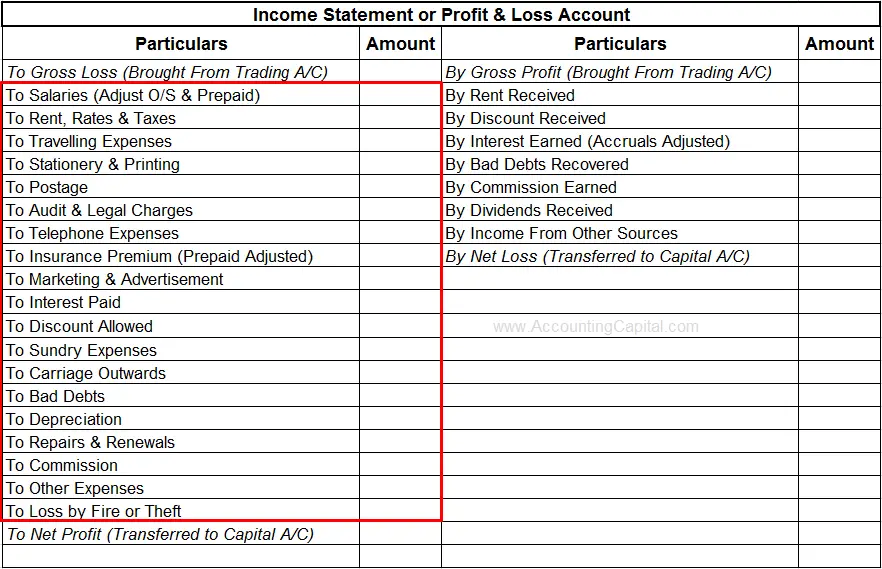

This type of expenditure is shown in the income statement on the debit side.

Examples of Operating Expenditure (Opex)

Telephone, Electricity, Maintenance and Repairs, Carriage are few examples of Opex (Operating Expenses)

Short Quiz for Self-Evaluation

>Related Long Quiz for Practice Quiz 16 – Capital Expense

>Related Long Quiz for Practice Quiz 28 – Operating Expense

>Read Direct and Indirect Expenses