Fixed Assets – Definition and Meaning

In accounting, fixed assets are assets which cannot be converted into cash immediately. They are primarily tangible assets used in production having a useful life of more than one accounting period. Unlike current assets or liquid assets, fixed assets are for the purpose of deriving long-term benefits.

Generally, it refers to tangible assets that an organization owns and uses to generate revenue. To account for natural wear and tear on these assets, companies are able to depreciate their value.

Intangible assets and investments are considered non-current assets in conjunction with fixed assets. Unlike other assets, fixed assets are written off differently as they provide long-term income. They are also called “long-lived assets” or “Property Plant & Equipment”.

Example and List of Fixed Assets

- Land

- Land improvement (e.g. irrigation)

- Building

- Building (work in progress)

- Machinery

- Vehicles

- Furniture

- Computer hardware

- Computer software

- Office equipment

- Leasehold improvements (e.g. air conditioning)

- Intangible assets like trademarks, patents, goodwill etc. (non-current assets)

Fixed assets are “fixed” not because of their geographical fixity. They are “fixed” because they are not entirely consumed during production activities in a single accounting period.

Related Topic – Can Assets have a Credit Balance?

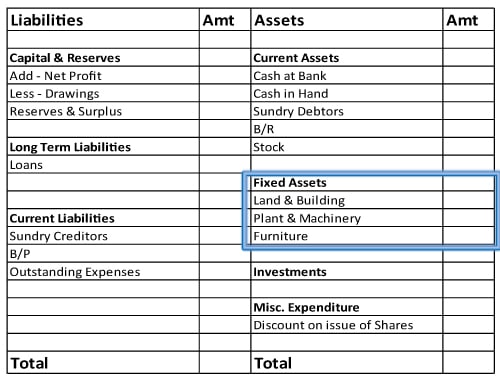

Fixed Assets Shown in the Balance Sheet

Fixed assets are shown on the “Assets” side i.e. right-hand side of the vertical balance sheet. They are shown in financial statements at their net book value, the calculation for net book value has been demonstrated in the next section.

Related Topic – Why is depreciation not charged on land?

Net Book Value

In the balance sheet, fixed assets are recorded under the “Property, Plant and Equipment” section. Although these assets are available in the production process for several accounting years, with time and usage, they depreciate, i.e. they lose value.

Furthermore, fixed assets are recorded at their net book value, which is the difference between the “historical cost of the asset” and “accumulated depreciation.

Net book value = Historical cost of the asset – Accumulated depreciation

Let us assume Unreal Pvt Ltd. purchases a computer for their company at a price of 30,000. The computer has a constant depreciation of 2,000 per year. So, after 3 years, the net book value of the computer will be recorded as

30,000 – (3 x 2,000) = 24,000.

Difference Between Fixed Assets and Current Assets

| Basis | Fixed Assets | Current Assets |

| Definition | An entity’s fixed assets are long-term assets acquired for continuous use. | A company’s current assets are resources that are held for a short term and mainly used for trading. |

| Time | Assets of this type are held for more than a year. | A year or less is the typical holding period for these assets. |

| Intent | A company invests funds in fixed assets for the long term to generate income. | Current assets are mainly used by a business for day-to-day business transactions. |

| Valuation | A fixed asset is valued by subtracting its depreciation from its cost. | A current asset is valued at its cost or market value, whichever is lower. |

| Funding Source | Long-term funds are used to acquire fixed assets. | Current assets are acquired from short-term funds. |

| Sale | A capital gain or loss occurs at the time of sale. | A revenue gain or loss occurs at the time of sale. |

| Funding Source | Long-term funds are used to acquire fixed assets. | Current assets are acquired from short-term funds. |

| Collateral | Assets such as these can be used as collateral for loans. | Current assets can not be used as collateral for loans. |

Short Quiz for Self-Evaluation

Revision & Highlights Short Video

Highly Recommended!!

Do not miss our 1-minute revision video. This will help you quickly revise and memorize the topic forever. Try it :)

>Related Long Quiz for Practice Quiz 34 – Outstanding Expenses

>Read Types of Depreciation