Revenue Expenditure

During the normal course of business, any expenditure incurred of which benefit is received during the same accounting period is called revenue expenditure. These expenses help a business sustain its operations and may not result in an increase in revenue.

Examples of such expenses are wages, rent, power, bad debts, depreciation, telephone, printing, cost of goods (to be sold), freight, maintenance of fixed assets, etc.

Unlike capital expenditure, these expenses are relatively small & recurring in nature. Sometimes referred to as revex these are used for meeting daily requirements of a business, therefore, they are short-term i.e. the benefit received is consumed by the business within the same accounting year.

Related Topic – What is a Control Account?

Revenue Expenditure in Financial Statements

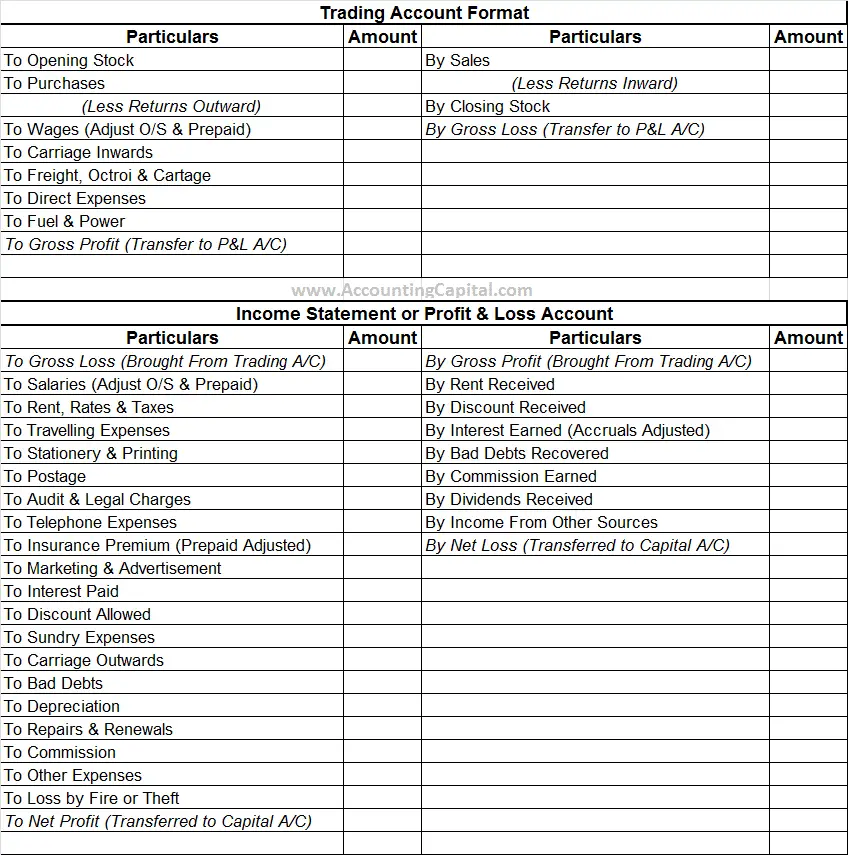

It is shown on the debit side of the trading account & Income statement, the accounting treatment for both revex and capex is done differently.

All expenses are shown on the debit side of the below Trading and Profit & Loss account are revenue in nature.

The amount transferred to trading and P&L account should only be to an extent to which goods or services have been consumed. For example, cost of goods (to be sold) is a revenue expenditure, however, only the cost of goods actually sold in the current accounting period should be transferred to the trading account.

Short Quiz for Self-Evaluation

>Read Difference Between Capital Receipts and Revenue Receipts