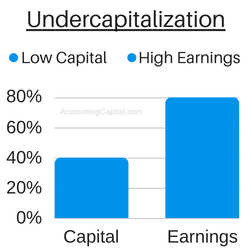

Undercapitalization

It is a financial situation where a company doesn’t have enough capital or reserves as compared to the size of its operations. Undercapitalization is often seen with new companies, it is a result of inadequate planning of funds for future growth. Even larger corporations with struggling operations and huge debts may be undercapitalized.

An example – A startup growing quickly enough may be undercapitalized as it may not be able to convert profits into cash as quickly as needed, consequently, it may lack sufficient capital to pay off its creditors due to lack of cash flow.

Undercapitalization may occur when the return on investment earned by a company is exceptionally higher with respect to other similar companies in the same industry. In such a scenario the firm is said to have neither the cash flow nor the ability to raise fresh capital.

Causes and Effects of Undercapitalization

Causes

1. An extraordinary increase in earnings of a company due to some reason.

2. Underestimation of initial equity required to run smooth operations of a business.

3. Ultra high efficiency in operations and increased sales with the help of new technology and techniques.

4. Fuelling the company mainly with short-term capital instead of cheaper long-term options.

5. Inability to mitigate probable future risks for e.g. no insurance against a likely event.

4. Purchase of assets at a very low price.

Effects

Undercapitalization can lead to serious effects on growth and future of a company as the firm might not be able to meet its short-term debt, operate smoothly & eventually collapse.

In case of an expansion opportunity, the business will not be able to avail the benefit of expansion and grow even further as it would not have sufficient capital.

Possible Solutions of Undercapitalization

1. Fresh share capital can be raised via the primary capital market to curb undercapitalization.

2. A company may decide to go for a stock split which would eventually display a reduction in dividend per share and earnings per share.

3. A company may issue bonus shares which would have the same effect as in the previous point.

4. Startups and small businesses should prepare monthly cash flow projections & equity forecasts to avoid being undercapitalized.

Short Quiz for Self-Evaluation

>Read Overcapitalization