Meaning of Capital

Capital refers to the financial resources of a business that are used to pay for its operations. The financial assets invested in the business by the owners form a part of the capital. It includes cash or cash equivalents, plant, machinery, etc.

Generally, there are four types of capital:

- Debt Capital: The capital that is acquired by borrowing from banks or other financial institutions is called debt capital. It is to be repaid along with interest at a certain percentage of the loan.

- Equity Capital: It is the capital collected from the owners in exchange for a common or preferred stock (shares). It is to be paid only when the company goes under liquidation.

- Working Capital: The capital that is used to fund day-to-day operations is called working capital. It is calculated as the current assets minus the current liabilities.

- Trading Capital: The capital available to the business to buy and sell securities in the financial markets is called trading capital. This type applies exclusively to the financial industry.

The different types of capital help the firm in different ways to improve its business.

In accounting terms, capital is a liability for the business, i.e. it is to be repaid in the future.

Journal Entry for Capital

As per the Modern Rules of Accounting

| Account | Increase | Decrease |

|---|---|---|

| Capital | Credit (Cr.) | Debit (Dr.) |

Capital is Credited (Cr.) when increased and Debited (Dr.) when decreased.

As capital is brought into the firm, the business is obliged to pay it back to its shareholders and lenders. Therefore when more capital is brought into the firm it is credited.

Suppose cash is brought into the business as capital, it leads to an increase in assets. As per the modern rules of accounts, increases in assets are debited.

| Cash A/c | Debit |

| To Capital Account A/c | Credit |

(The additional capital is credited to the capital account.)

As per the Golden Rules of Accounting

| Account | Rule for Debit | Rule for Credit |

|---|---|---|

| Personal | Debit the receiver | Credit the giver |

Capital is credited as per the Golden Rules.

An account is said to be personal when it is related to firms, companies, individuals, etc. Capital is a liability for the firm/company/business because it is obliged to repay its owner, hence, it is a personal account. A personal account is recorded on the balance sheet of the organization.

As per the golden rules of accounting (for personal accounts), capital is credited since the company needs to pay it back.

Example

Sam has started a new business and brought in capital in the form of cash of 30,000.

| Particulars | Debit | Credit |

| Cash A/c | 30,000 | |

| To Capital A/c | 30,000 |

The cash account is debited since Sam brings in cash leading to an increase in assets. The capital account is credited since this leads to increase in capital and capital is a personal account.

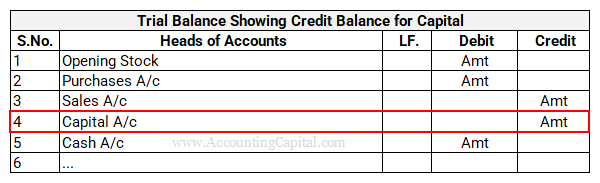

Capital Inside Trial Balance

Capital is shown on the credit side of the trial balance. Below is an example of capital recorded inside the trial balance.

Conclusion

- The capital is credited since it’s a contribution given by the shareholders, corporate banks, etc. It needs to be returned back. It is treated similarly to a liability.

- As more capital is bought in it is credited since it increases. The cash account has been debited since there is an increase in assets as the money is coming into the firm.