Meaning and Example

The term “reconstitution of partnership” refers to an alteration in the financial relationship between the existing partners of a partnership firm. As a result, the existing agreement ends and a new one is formed.

A reconstitution occurs whenever the terms of a partnership agreement are modified and the profit-sharing ratio is changed. Such an alteration may occur due to admission of a new partner, death of a partner, retirement of a partner, insolvency of a partner, etc.

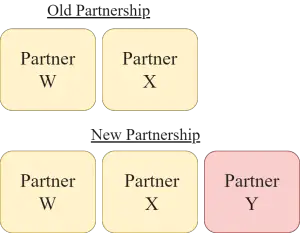

Example: Two partners W & X operate a partnership firm and they decide to admit a third partner Y. In this case, Y will also have a share in the profits of the firm and this will lead to a change in the profit-sharing ratio leading to a new partnership agreement.

Related Topic – Revaluation Account

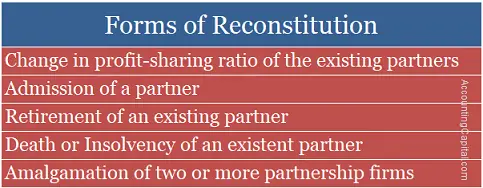

Partnership Firms: Forms of Reconstitution

Following are the various forms of reconstitution of partnership firms that lead to an alteration in the terms of the existing agreement & result in a new partnership;

1. Mutual Change in Profit Sharing Ratio of the Existing Partners

Sometimes, the partners of a firm decide to change their profit-sharing ratio and adjust the increase and decrease of share among themselves.

As a result, some partners gain whereas others sacrifice, however, the total amount of gain will always be equal to the total amount of sacrifice.

Points to remember for its treatment

- Computation of sacrificing Ratio & gaining ratio.

- Accounting treatment of (existing) goodwill, reserves, accumulated profits & losses.

- Revaluation of firm’s assets & liabilities.

- Adjustment of partners’ capital accounts.

2. Admission of a Partner

The entry of new partner(s) can be done either as per the partnership deed or by the mutual consent of all the current partners, in case of absence of deed.

Also, the new partner has a right over the profits & assets of the firm. The share of the newly admitted partner(s) will be equal to the aggregate of the sacrifice made by the existing partners or the share given by the existing partner(s).

As a result, a change in the profit-sharing ratio amongst the partners will lead to the reconstitution of the partnership.

Points to remember for its treatment

- Calculation of the new profit-sharing ratio & sacrificing ratio.

- Valuation of goodwill under different scenarios & its adjustment.

- Revaluation of firm’s assets & liabilities.

- Adjustment of deferred revenue expenditure, reserves, accumulated profits & losses.

- Adjustment of the partners’ capital accounts as per the agreement between the partners.

3) Retirement of an Existing Partner

When a partner ceases to continue as a partner of a firm, either as per the agreement or by mutual consent of all the partners, it is termed as “retirement of an existent partner”.

Also, a partner can retire by giving a written notice stating his retirement to all the remaining partners, provided the partnership is at will.

A retiring partner is liable for the firm’s acts only up to the date of his/her retirement. However, such a partner will also be liable to others for the firm’s acts until public notice of retirement is delivered, irrespective of the actual date of retirement.

Lastly, the remaining partners (minimum 2) will continue to run the firm with the new-profit sharing ratio, which will result in the reconstitution of the firm.

Points to remember for its treatment

- Calculation of the new profit-sharing ratio & gaining ratio.

- Valuation & adjustment of firm’s goodwill.

- Reassessment of firm’s assets & liabilities.

- Settlement of reserves & undistributed profits or losses.

- Estimation of retiring partner(s) interest & aggregate payment to be made to such a partner.

- Adjustment of the partners’ capital accounts, if so agreed.

4) Death or Insolvency of an Existing Partner

Death or Insolvency of a partner leads to an end of the old partnership & the beginning of a new agreement provided the remaining partners (2 or more) continue to run the firm. Consequently, this will result in the reconstitution of partnership.

Further, as a bankrupt partner is incompetent to carry out the business, all the dues will be settled with such a partner. However, in the case of a deceased partner, all money is paid to the legal heir.

The treatment in case of the death of a partner is similar to the treatment done in the event of the retirement of a partner, except for the dues of the deceased partner, which are settled with the official executor of the deceased partner, as per the agreement between remaining partners and the executor.

5) Amalgamation of Two or More Partnership Firms

The term amalgamation refers to the merger of two or more business firms operating on similar lines of business to expand the market, benefit from the economies of scale, etc.

Thus, the amalgamation of two or more partnership firms will lead to the termination of the older separate business entities and the creation of a new firm, further leading to the alteration of the terms of the agreement of partnership. As a result, it will lead to the reconstitution of partnership.

Points to remember for its treatment

- Calculation of the new profit-sharing ratio & gaining ratio.

- Adjustment of goodwill for all the amalgamating firms.

- Calculation of purchase considerations.

- Settlement of reserves & undistributed profits or losses.

- Adjustment of the partners’ capital accounts and calculation of new capital of the partners in the new firm.

Related Topic – Realisation Account

Why is it Necessary?

Any change or modification in the terms of an existing agreement of partnership should be accounted for and documented. Following are the points highlighting the need for reconstitution of a partnership firm,

- Reconstitution of two or more partnership firms by amalgamation can help in reducing the cost of business as well as in strengthening the capital position of such firms.

- Further, reconstitution resulting from the change in the profit-sharing ratios of the partners largely assists in incentivising the partners in accordance with their workload & capital contribution.

- Similarly, the admission of a new partner not only helps in raising more capital but also adds to the creditworthiness of the partnership firm.

However, such a change in the terms of the agreement might also be discouraging for the partners who are supposed to sacrifice or give their share of profits to the other partner(s).

Related Topic – Accounting Quiz with Answers

Difference Between Reconstitution and Dilution

The term “Reconstitution” refers to the restructuring of a business firm or organization as a result of alteration in the terms of its agreement. Whereas, the term “Dilution” directs towards the fall in the ownership of the existing stakeholders of a company because of the issue of additional shares.

Unlike, joint-stock companies a partnership firm can not be diluted because it can not issue shares. But, the reconstitution of a partnership firm can be simply done by altering the terms of its agreement.

Related Topic – Difference Between Revaluation and Realisation Account

Solved Question

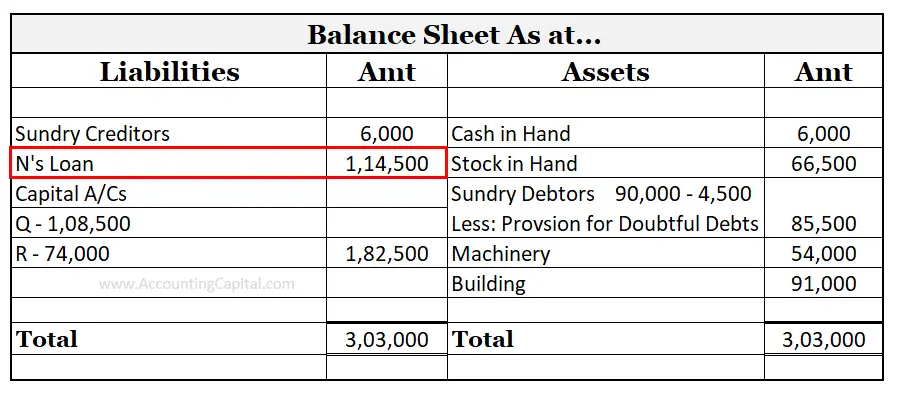

Suppose Q, R & N are partners in a firm, having a profit-sharing ratio of 3: 2: 1. Assume that following is the balance sheet of the firm at the end of the accounting year.

| Balance Sheet as on – (End of financial year) | |||

| Liabilities | Amt | Assets | Amt |

| Sundry Creditors | 6,000 | Cash in Hand | 6,000 |

| General Reserve | 60,000 | Sundry Debtors | 90,000 |

| Capital A/Cs | Stock in Hand | 70,000 | |

| Q – 80,000 | Machinery | 60,000 | |

| R – 80,000 | Building | 80,000 | |

| N – 80,000 | 2,40,000 | ||

| Total | 3,06,000 | Total | 3,06,000 |

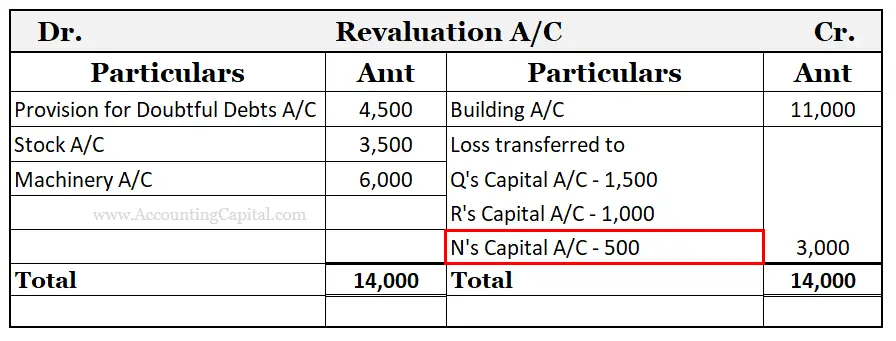

Partner N retires on the balance sheet date and they decide to adjust the value of assets as follows;

- Create provision for doubtful debts @5% on sundry debtors.

- Reduce stock by 5% & machinery by 10%.

- Building to be revalued at 91,000.

- The firm’s goodwill is valued at 1,50,000.

Partner Q & R decide to continue the business & share profits equally.

Solution:

Working Notes

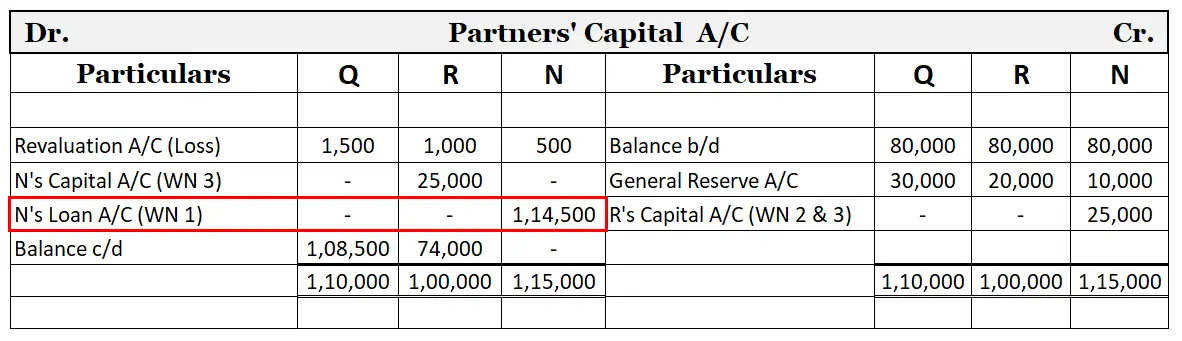

1) The balance of N’s capital is to be transferred to his loan A/C assuming it is payable on a future date.

2) Gaining Ratio = New Ratio – Old Ratio

- Q’s Gain = 1/2 – 3/6

- 1/2 – 1/2 = 0

- R’s Gain = 1/2 – 2/6

- 1/2 – 1/3 = 1/6

Thus, R is the sole gaining partner who will compensate the retiring partner N.

3) N’s share in Goodwill = 1,50,000 x 1/6 = 25,000, which is contributed by the gaining partner R.

Revaluation account, prepared at the time of reconstitution so that the revaluation gain or loss can be distributed among the existing partners as per their old profit sharing ratio.

Partners’ capital account, prepared to determine the closing balances of all the partners after all profits and reserves are distributed, plus goodwill is adjusted.

Final balance sheet, on the date of partner N’s retirement.

>Read Overcapitalization and Undercapitalization