Meaning, Example & Purpose

Revaluation means “reassessing the value of something”. In the event of a change to the original partnership of a business, such a reassessment is done. Only assets & liabilities of a firm are revalued and a “Revaluation Account” is opened to determine profit/loss resulting from the exercise.

Note: Revaluation is only done for assets & liabilities whereas income and expenses generated from the core business operations are excluded.

It is a nominal account that is prepared in the event of admission, retirement, or death of a partner and changes in profit sharing ratio. Alternatively, it can be said that it is prepared at the time of reconstitution of a partnership.

Example

Suppose R, M & S are partners in a firm, sharing profits & losses in the ratio of 5:3:2 However, after a mutual decision, they changed their profit-sharing ratio to 2:5:3

- Workmen’s Compensation Reserve is 12,000 but, the workers claim 20,000.

- Creditors worth 9,000 are unclaimed.

- Investments of 38,000 is revalued at 40,000.

- Unrecorded furniture worth 34,000 is there.

- Stock worth 40,000 is to be reduced by 10%.

Revaluation Account

| Particulars (Dr.) | Amt | Particulars (Cr.) | Amt |

| Stock A/C | 4,000 | Creditors A/C | 9,000 |

| Workmen’s Compensation Claim A/C | 8,000 | Furniture (unrecorded) A/C | 34,000 |

| Profit on Revaluation transferred to:- | Investments A/C | 2,000 | |

| R’s Capital A/C – 16,500 | |||

| M’s Capital A/C – 9,900 | |||

| S’s Capital A/C – 6,600 | 33,000 | ||

| Total | 45,000 | Total | 45,000 |

Note – Profit on revaluation of the firm’s assets & liabilities above is to be distributed amongst the partners in their old profit sharing ratio i.e. 5: 3: 2.

Computing the Gaining & Sacrificing Ratios

Gaining Ratio = New Ratio – Old Ratio

M’s Gaining Ratio = 5/10 – 3/10 = 2/10

S’s Gaining Ratio = 3/10 – 2/10 = 1/10

Sacrificing Ratio = Old Ratio – New Ratio

R’s Sacrificing Ratio = 5/10 – 2/10 = 3/10

Related Topic – Can assets have a credit balance?

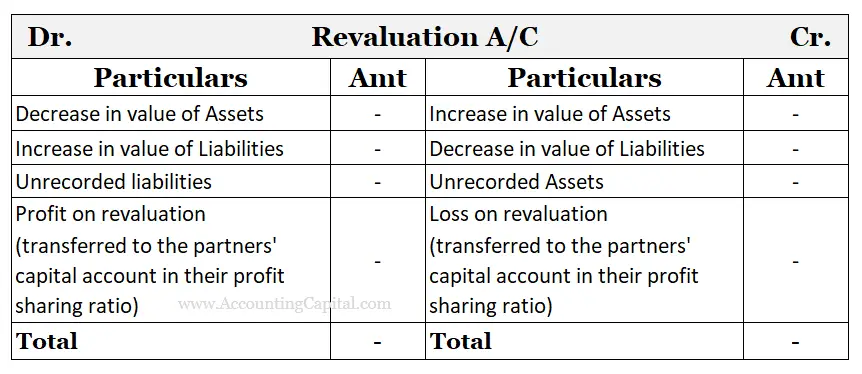

Type of Account and Format of Revaluation Account

Information regarding the type of account helps in recording the various transactions in the right way using the right accounting rules.

As per the golden rules of accounting

| Type of Account | Nominal Account |

| Rule Applied | Debit all expenses & losses. Credit all incomes & gains. |

Template of Revaluation Account

Note – Either profit or loss will be there, on account of revaluation of the firm’s assets & liabilities. However, sometimes it might even balance i.e. neither profit nor loss.

Note – Either profit or loss will be there, on account of revaluation of the firm’s assets & liabilities. However, sometimes it might even balance i.e. neither profit nor loss.

Further, when a revaluation account is prepared then assets & liabilities are shown at their revised value in the balance sheet.

Related Topic – Is debit balance positive and credit balance negative?

Steps to Prepare

Following are the various steps involved in the preparation of the Revaluation Account

- Debit the Revaluation Account with the decrease in the value of the firm’s assets & the increase in the value of its liabilities.

- Similarly, Credit the Revaluation Account with the decrease in the value of the firm’s liabilities & the increase in its assets.

- Same way, debit the unrecorded liabilities & expenses but, credit the unrecorded assets.

- If the total credit side of the revaluation account is greater than the total of its debit side then, there will be a profit on revaluation, which is to be credited to Partners’ Capital Accounts in their old profit sharing ratio.

- However, the Partners Capital Accounts are to be debited if there is a Loss on Revaluation in their old profit sharing ratio.

Related Topic – Where is Amortization Shown in Financial Statements?

Important Points to Remember

- It helps in settling the profit or loss on revaluation of the assets & liabilities till the date of change in the terms of agreement of partnership amongst the existing partners in their old profit sharing ratio.

- Free Reserves, Amount claimed out of Workmen’s Compensation Reserve, Credit balance of Profit & Loss Account, etc. should not be transferred to the Revaluation Account instead, should be Credited directly to the partners’ capital account.

- A debit balance is regarded as “Loss on Revaluation”.

- A credit balance is categorised as “Profit on Revaluation”.

- Sometimes, the Revaluation Account can be also balanced which is when neither profit nor any loss is there on the reassessment of the firm’s assets & liabilities.

- A revaluation account is different from a memorandum revaluation account. Memorandum Revaluation Account is prepared in the case when partners do not want to alter or revise the value of assets and liabilities, at the time of reconstitution of the partnership firm.

Related Topic – Is investment an asset?

Difference between Revaluation Account and Realisation Account

| Basis | Revaluation Account | Realisation Account |

| 1) Meaning | Revaluation account records the effect of revaluation of the firm’s assets & liabilities. | Realisation account records the effect of reassessment of a firm’s assets & settlement of liabilities. |

| 2) Objectives | By calculating the gain or loss on revaluation, it assists in making appropriate modifications to the value of assets and liabilities. | By computing the gain or loss on realisation of assets & payment of the outsider liabilities, it helps in settling the various balances. |

| 3) Time | This account is prepared when a partner retires, dies, or when the profit-sharing ratio changes, etc. | This account is prepared when the partnership firm dissolves. |

| 4) List of Contents | Contains only the amount of change in the value of the firm’s Assets and Liabilities. | Contains all the Assets (except fictitious assets, cash/bank & loan to partners) & outsiders’ liabilities of the firm. |

| 5) Effect on firm’s assets & liabilities | It only results in the reassessment of the assets & liabilities account and not their closure. | It results in the closure of all the assets & liabilities accounts of the firm. |

| 6) Recurrence of preparation | It can be prepared more than once during the lifetime of a business. | It is prepared only once, during the dissolution of the firm. |

Short Quiz for Self-Evaluation

>Read Difference Between Debt and Liability