Journal Entry for Manager’s Commission

In addition to salaries, companies may offer a fixed percentage of their net profit to managers as commission. This is done to motivate and encourage them to generate more revenue for the company. Accounting and journal entry for manager’s commission involves the below 3 steps,

Step 1 – Manager’s commission is shown as a payable since it is calculated at the very end of an accounting period.

| Manager’s Commission A/C | Debit |

| To Oustanding Commission A/C | Credit |

Step 2 – Accounting for manager’s commission includes the actual payment made to pay off the liability created in Step 1.

| Outstanding Commission A/C | Debit |

| To Bank A/C | Credit |

Step 3 – Journal entry for manager’s commission includes transferring commission paid to the income statement/profit and loss account.

| Profit and Loss A/C | Debit |

| To Manager’s Commission A/C | Credit |

Features of Manager’s Commission

- The outstanding commission is a current liability like any other outstanding expense, hence it is shown on the liability side in the balance sheet.

- Manager’s commission is an operating expense just as any other expense like salary, rent etc.

- Manager’s commission paid is shown on the debit side of the profit and loss account as it is an expense for the company.

- There are 2 ways to calculate the amount payable as the manager’s commission.

Calculation of Manager’ Commission – Case I

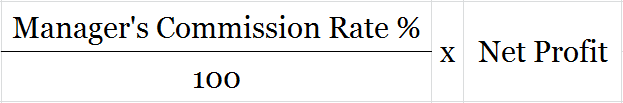

In this case, the commission rate is calculated on the “net profit of the company” and the calculated amount is finally paid as a manager’s commission.

Manager’s commission is calculated on net profits (before charging manager’s commission)

Example for Case I – Commission rate – 10%, Net Profit – 1,50,000

Manager’s Commission Amount = (10/100)*1,50,000

= 15,000

Calculation of Manager’ Commission – Case II

In this case, the commission rate is calculated on “net profit of the company minus manager’s commission”.

In this case, manager’s commission is calculated on net profits (after charging manager’s commission)

Example for Case I – Commission rate – 10%, Net Profit – 1,50,000

Manager’s Commission Amount = (10/100+10)*1,50,000

= 13,636.36

Short Quiz for Self-Evaluation

>Read What is Honorarium?