Journal Entry for Advance Received from a Customer

In certain types of business transactions, it is a requirement for the customer to pay a part of the total amount or the entire sum in advance, for example – security deposit to rent a property, customized items, bulk orders, insurance premium, etc. As a result, journal entry for advance received from a customer is entered in the books.

Not to be confused with accrued income advance received from a customer is an ideal example of unearned income or deferred revenue. Funds collected as advance received from a customer are treated as a liability because the related revenue has not been earned by the business yet.

Journal Entry for Advance Received from a Customer

Bookkeeping rules applied – Three golden rules

| Cash A/C | Debit what comes in – Real A/C |

| Customer Advance Account A/C | Credit the giver – Personal A/C |

Bookkeeping rules applied – Modern rules

| Cash A/C | Debit the increase – Assets |

| Customer Advance Account A/C | Credit the increase – Liability |

If the related goods or services are to be delivered within 1 year then it is treated as a current liability otherwise a long-term liability.

Related Topic – Journal Entry for Manager’s Commission

Accounting Treatment for Customer Advance

Following are the steps and the associated timeline to book the journal entry for advance received from a customer.

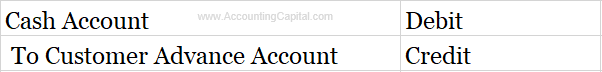

Step 1 – When customer advance is received.

| Cash Account | Debit | Debit the increase in asset |

| To Customer Advance Account | Credit | Credit the increase in liability |

Customer advance account is shown on the liability side of the balance sheet as the related revenue is still unearned.

Step 2 – When an invoice is sent to the customer.

| Accounts Receivable Account | Debit | Debit the increase in asset |

| To Revenue Account | Credit | Credit the increase in revenue |

As per accrual based accounting the revenue is earned at this step i.e. when the final product is ready for delivery. An invoice is sent to the customer, consequently, the customer advance shown as a liability on the balance sheet is removed.

Step 3 – Journal entry to clear the customer advance account.

| Customer Advance Account | Debit |

| To Accounts Receivable Account | Credit |

Finally, the journal entry to clear the customer advance account.

Example – Journal Entry for Customer Advances

Unreal Corporation received 10,000 as advance from ABC on 1st January for a custom paint job for ABC’s car. The work completed, and the customer was invoiced on 1st February of the same year. Show journal entry for advance received from the customer in the books of Unreal Corp.

January 1 – When 10,000 is received from ABC as advance

| Cash Account | 10,000 |

| To ABC Advance Account | 10,000 |

February 1 – When ABC is billed or invoiced for 10,000

| Accounts Receivable Account | 10,000 |

| To Revenue Account | 10,000 |

February 1 – Journal entry to clear ABC’s customer advance

| ABC Advance Account | 10,000 |

| To Accounts Receivable Account | 10,000 |

Short Quiz for Self-Evaluation

>Read What is a Service Center?