Table of Contents

Introduction

At the beginning of an accounting period, opening stock refers to the value of inventory available for sale. Raw materials, finished goods, and work in progress are all included. Inventory is another word for stock, which is a current asset.

In other words, it is the stock that was not sold in the previous accounting period and carried forward to the current accounting year.

Stock can be of various types;

- Raw Material: It is a substance or component used in manufacturing. They are unprocessed and undergo a transformation during production.

- Work-in-progress: Part of the stock that is partially finished is called “WIP or Work-in-progress”. These items have incurred some production costs but are not yet finished and ready for sale.

- Finished goods: It is stock that has completed the manufacturing process and is ready for sale to customers.

Raw Material + Work in Progress + Finished goods = Opening Stock

In a trading business, opening stock is usually just finished goods. Whereas, in the case of a manufacturing firm, opening stock can be finished goods, work-in-progress, and/or raw materials.

Recommended – Quiz on Inventory in Accounting

Journal Entry

The journal entry of opening stock is;

| Trading A/c | Debit |

| To Opening Stock A/c | Credit |

(Being opening stock brought into books)

In a trading account, opening stock appears on the debit side and is considered an expense because opening stock forms part of the cost of sales for the current accounting period.

Related Topic – Journal Entry to Purchase Machinery

Example of the Accounting Entry

The above journal entry can be explained with an example given below:

Unreal Co. had an opening stock of 50,000 at the beginning of the financial year. Pass the journal entry for opening stock to record this.

| Trading A/c | 50,000 |

| To Opening Stock A/c | 50,000 |

(Being opening stock brought into books)

It is important to accurately determine the value of the stock being recorded in the journal entry. This may include the cost of the stock, as well as any additional expenses such as taxes or shipping costs.

Related Topic – Top Journal Entries in Accounting (examples)

Impact on Financial Statements

Balance Sheet: Opening stock isn’t shown directly on the balance sheet. Instead, it shows up in the cost of goods sold (COGS). The cost of goods sold represents the cost of inventory sold during the period. It is calculated based on opening stock from the previous accounting period.

Even though opening stock isn’t explicitly listed on the balance sheet, its impact is reflected indirectly.

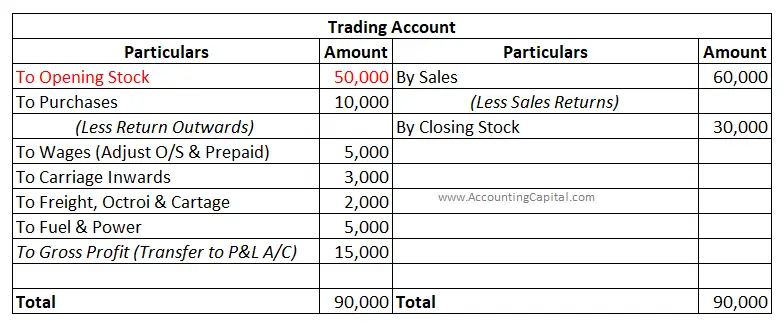

Trading Account: The opening stock is shown on the debit side as it represents the value of closing stock (inventory) brought forward from the previous accounting period.

Related Topic – Journal Entry for Started Business with Cash

Conclusion

- By comparing the opening stock with the closing stock at the end of the accounting period, the gross profit or gross loss is calculated.

- The journal entry for opening stock involves debiting the Trading Account and crediting the Opening Stock Account.

- At the beginning of an accounting period, the value of inventory on hand is recorded as opening stock and is crucial for accurate reporting of financial data.

- The journal entry for opening stock ensures the inclusion of the opening stock’s number into the trading account, which is a part of the income statement. As a result, it is used to calculate the cost of goods sold (COGS).

- The opening stock is shown as the first item on the debit side of the trading account as it is carried over from the previous accounting period. For this reason, there is no opening balance in the first year of a firm.

- For businesses, keeping track of opening stock is important to assess profitability, manage efficient inventory levels, and pricing.

>Read Journal Entry for Closing Stock