Meaning and Basics

It is a financial statement prepared by all types of businesses (sole proprietors, partners, enterprise, etc.) at a given date. The balance sheet represents the financial position of a business at any given point in time. It shows the company’s assets along with how they are financed, which may be by debt, equity, or a combination of both.

Financial Statements can be presented in two ways; Vertical Representation or Horizontal Representation.

Few other names of a balance sheet are Statement of Financial Position, Statement of Financial Condition or Statement of Net Worth.

It is based on a fundamental accounting equation which is;

Assets = Liabilities + Equity

The above equation means that at any point in time, a business’s assets should be equal to its liabilities and equity. Usually, the balance sheet is prepared from a trial balance.

The three aspects of a balance sheet are:

- Assets: These are the resources owned by an entity, whether tangible or intangible.

- Liabilities: These are the financial obligations of an entity and includes everything which the entity owes to outsiders.

- Equity: This is the amount invested by the owners plus the retained earnings. In other words, it is the part of the assets left for the owners, after the payment of outsiders liability.

The Balance sheet presents an account of where a company has obtained its funds and where it has invested them. A business has primarily two sources of funds which are shareholders and lenders. These funds are then invested in assets which helps the business in generating revenue.

Related Topic – Can Assets have a Credit Balance?

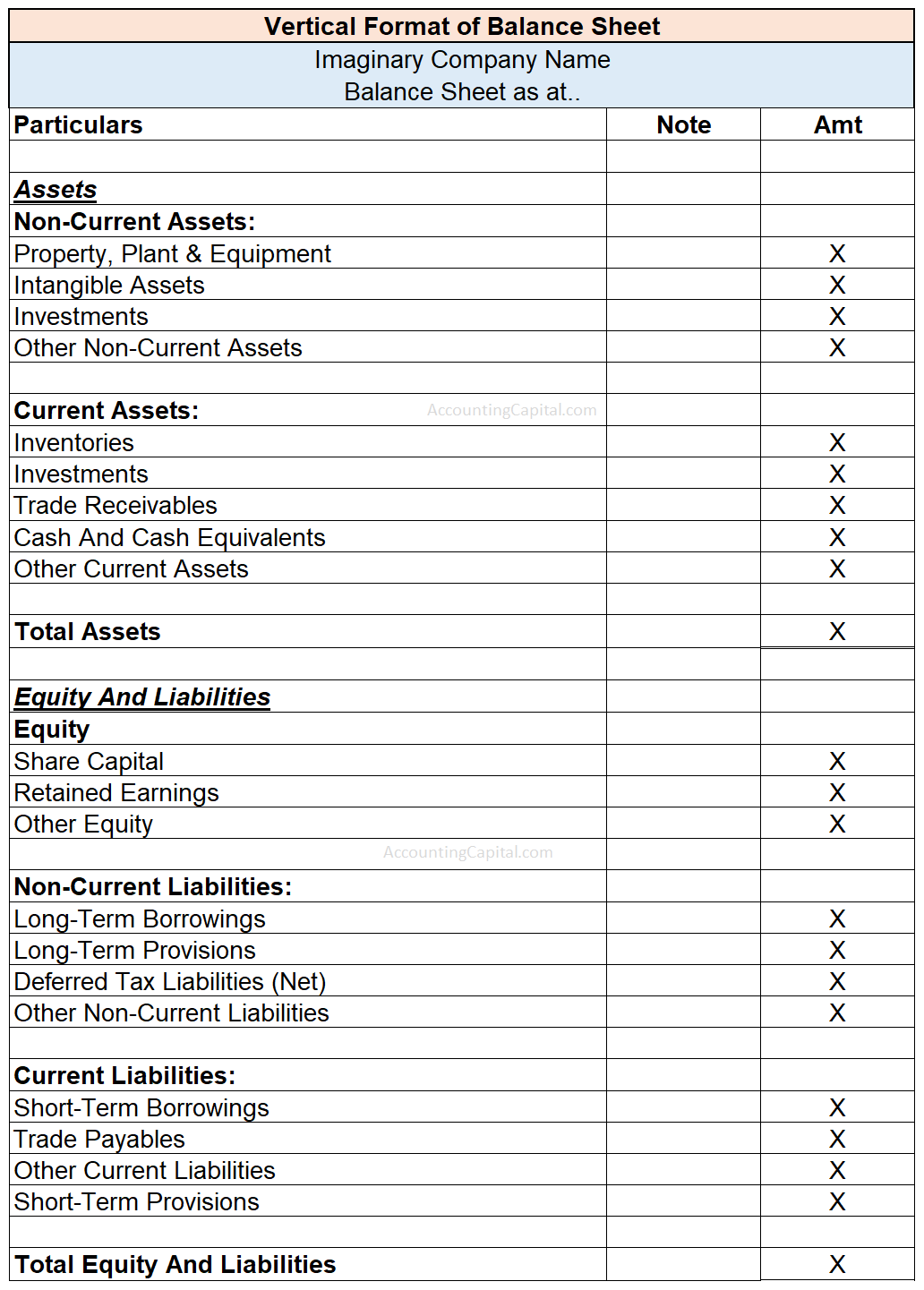

Vertical Format of Balance Sheet

The vertical format is also known as the report format. This presentation starts with assets and after that, equity & liabilities are listed. The format is categorized into sections that are in descending order of liquidity, which means prioritizing items that are less liquid in nature. The data is presented from top to bottom in two columns i.e. assets and liabilities in one column and amounts in another.

The five major sections under the vertical format of the Balance sheet are;

- Non-Current Assets – These are long-term assets and are held for a longer period of time (usually more than 1 year).

- Current Assets – These are short-term assets that can be liquidated or converted into cash within a period of twelve months.

- Equity – This section represents share capital, share premium, any retained earnings, and revaluation surplus of an entity.

- Non-Current Liabilities – These are long-term debts and other long term obligations of an entity that are to be settled after a period of 12 months.

- Current Liabilities – These are the short-term debts and obligations, payable within a period of 12 months.

There are various advantages of a Vertical format balance sheet.

- It helps in easier intra-firm comparison (comparison of a company’s balance sheet with that of previous years) and inter-firm comparison (comparison of a company’s balance sheet with that of other companies)

- It makes it easier to understand the correlation between different line items on a balance sheet.

Related Topic – Can Depreciation be Charged in the Year of Sale?

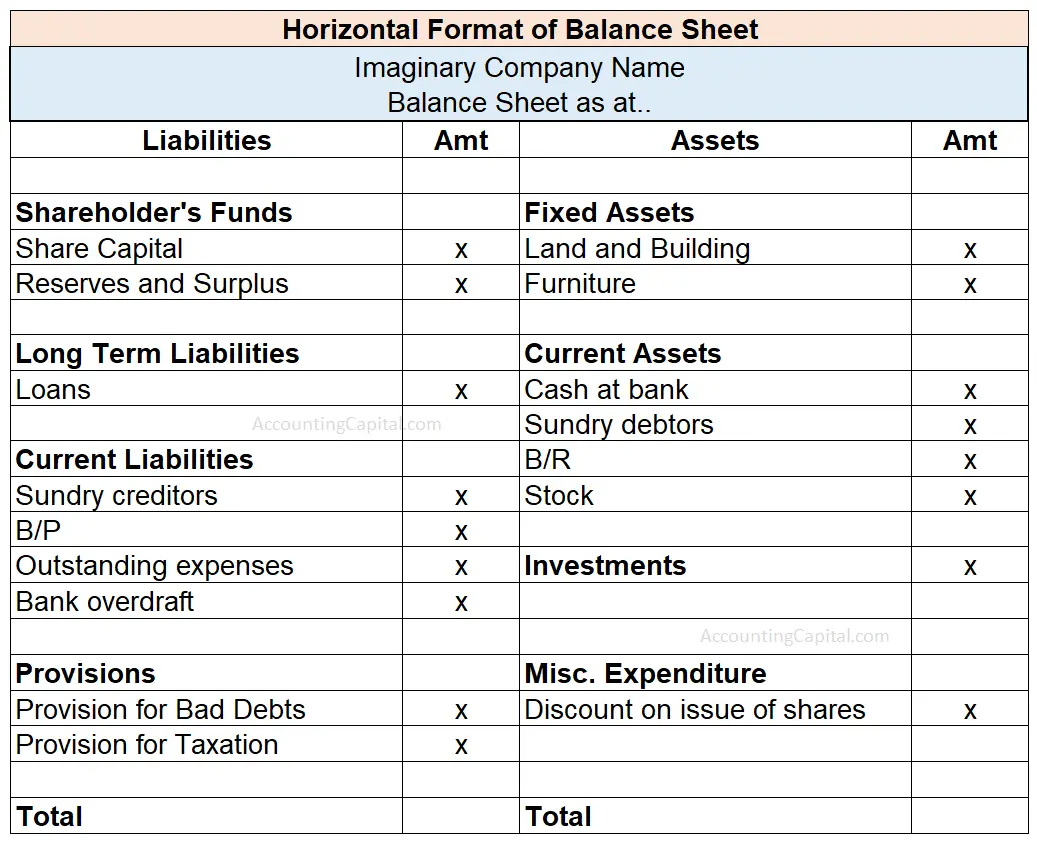

Horizontal Format of Balance Sheet

Horizontal format lists all liabilities on the left-hand side and all assets on the right-hand side of the balance sheet. It is also called a T-shaped Balance sheet.

In a horizontal format, assets and liabilities are presented descriptively. The liabilities and assets are listed in the 1st and 3rd column of the balance sheet respectively whereas, the amounts associated with them are listed in the 2nd and 4th columns respectively.

This format is not ideal for both inter-firm and intra-firm comparisons because the information presented only relates to the current year. It is easier to compare the information in a vertical format balance sheet.

Related Topic – Is Prepaid Expense a Fictitious Asset?

Importance of this Financial Statement

The balance sheet is the most important source of information about a company’s financial health. By analyzing the components of the balance sheet you can;

- Understand the company’s financial health and measure its growth,

- Understand how well a company generates returns by using ratios such as Return of Assets (ROA), Return on Capital Employed (ROCE),

- Understand the company’s liquidity position by comparing its current assets to its current liabilities,

- Understand how much financial risk the company is taking by looking at how a company is financed and how much leverage or debt it has,

- Understand how efficiently a company uses its assets by using the income statement in connection with the balance sheet.

Related Topic – Grouping and Marshalling of Assets and Liabilities

Grouping and Marshalling

Grouping refers to putting similar items with similar qualities together and showing them under a common head inside financial statements. For example, all the debtors of an organisation are grouped together under just 1 head of sundry debtors in the balance sheet. Similarly, Inventory shows the net total of Raw Material, Work In Progress and Finished Stock.

Marshalling refers to the arrangement of assets and liabilities on the balance sheet in a particular order. The assets and liabilities are shown in a logical order for helping the stakeholders in understanding the financial statements easily.

There can be 3 ways of marshalling;

- In Order of Liquidity

Under this method, the assets & liabilities are shown in the order of their liquidity or urgency of payment i.e. assets & liabilities which are highly liquid, like Cash equivalents, Bank overdraft, etc. are shown first & permanent assets & liabilities like Land & Building, Capital, etc. are shown afterwards.

The following is a format of a balance sheet based on this order.

| Balance Sheet – In order of Liquidity | |||

| Liabilities | Amt | Assets | Amt |

| Creditors | x | Cash | x |

| Loans | x | Bank | x |

| Reserves & Surplus | x | Debtors | x |

| Capital | x | Furniture | x |

| Plant & Machinery | x | ||

| Building | x | ||

2. In Order of Permanence

Under this method, the assets & liabilities are shown in the order of their permanency or duration i.e. permanent assets & liabilities like Land & Building, Capital, etc. are shown first & the current assets & liabilities like Cash, Debtors, Creditors, etc. are shown afterwards.

The following is a format of a balance sheet based on this order.

| Balance Sheet – In order of Permanence | |||

| Liabilities | Amt | Assets | Amt |

| Capital | x | Building | x |

| Reserves & Surplus | x | Plant & Machinery | x |

| Loans | x | Furniture | x |

| Creditors | x | Debtors | x |

| Bank | x | ||

| Cash | x | ||

3. Mixed Order

Under this method, the assets are arranged in the order of liquidity & the liabilities are arranged in the order of permanency.

The following is a format of a balance sheet based on this order.

| Balance Sheet – Mixed order | |||

| Liabilities | Amt | Assets | Amt |

| Capital | x | Cash | x |

| Reserves & Surplus | x | Bank | x |

| Loans | x | Debtors | x |

| Creditors | x | Furniture | x |

| Plant & Machinery | x | ||

| Building | x | ||

Types of Balance Sheet Presentation PDF Download

Download 1 (PDF) – Horizontal Format of Balance Sheet

Download 2 (PDF) – Vertical Form of Balance Sheet

Short Quiz for Self-Evaluation

>Read Meaning of Set off in Accounting