Stock Turnover Ratio

The inventory turnover ratio or stock turnover ratio indicates the relationship between “cost of goods sold” and “average inventory”. It indicates how efficiently the firm’s investment in inventories is converted to sales and thus depicts the inventory management skills of the organization.

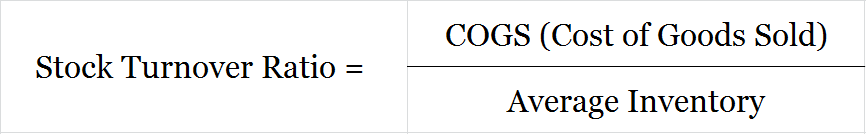

It is both an activity and efficiency ratio. This ratio helps to determine stock-related issues such as overstocking and overvaluation. The stock turnover ratio is calculated as;

In some cases, the numerator may be “Cost of Revenue from Operations” which is calculated as “Revenue from operations – Gross profit”.

COGS – It can be calculated with either one of these formulas;

- Opening Stock + Purchases + Direct Expenses (*if provided) – Closing Stock

- Net Sales – Gross Profit

Average Inventory – Average of stock levels maintained by a business in an accounting period, it can be calculated as;

- (Opening Stock + Closing Stock)/2

- Stock to include = Raw material + Work in Progress + Finished Goods

Example

Calculate the stock or inventory turnover ratio from the below information.

Cost of Goods Sold – 6,00,000

Stock at beginning of period – 2,00,000, Stock at end of period – 4,00,000

Average Inventory = (2,00,000 + 4,00,000)/2 = 3,00,000

Stock Turnover Ratio = (COGS/Average Inventory)

= (6,00,000/3,00,000)

=2/1 or 2:1

High Ratio – If the stock turnover ratio is high it shows more sales are being made with each unit of investment in inventories. Though high is favourable, a very high ratio may indicate a shortage of working capital and a lack of sufficient inventories.

Low Ratio – A low inventory turnover ratio may indicate unnecessary accumulation of stock, inefficient use of investment, over-investment in inventories, etc. This is a concern for the company as inventory could become obsolete and may result in future losses.

Short Quiz for Self-Evaluation

>Read Proprietary Ratio