Table of Contents

Fixed Capital vs Working Capital

Fixed Capital is the money invested by a business or its owners in long-term assets. Such assets are essential for business operations therefore they aren’t meant for immediate resale and are expected to last a long time. This includes various types of tangible assets, such as land, furniture, buildings, plant & machinery, vehicles, laptops, etc.

It may also be referred to as long-term capital, real capital, or physical capital.

In contrast to fixed capital, working capital is invested in the current assets of a business. Current assets include cash, stock (inventory), bank balance, trade receivables, etc.

Working capital is the portion of the capital that is used to meet the day-to-day business requirements such as purchasing raw materials for production, payment of wages, etc.

Table Format

| Fixed Capital | Working Capital |

|---|---|

| It is invested in the long-term tangible fixed assets of the entity. | It is invested in the current or working assets of the entity. |

| It is used to generate long-term revenue for the firm. | It is used to meet the day-to-day business requirements of the business. |

| It cannot be easily converted into cash. | It can be easily converted into cash. |

| Recorded as fixed assets and depreciation is charged. | Recorded as current assets and depreciation is not charged. |

| Typically funded via long-term debt such as loans and equity. | Typically funded via a mix such as long-term funds & current liabilities. |

| Fixed capital does not need frequent monitoring as the changes are slow. | Working capital needs frequent monitoring as the changes are almost daily. |

| Examples – Building, furniture, real estate, etc. | Examples – Cash, inventory, receivables, etc. |

Related Topic – Meaning of Capitalized in Accounting

Fixed Capital

Fixed Capital is called “Fixed” or “blocked” capital because it is used to purchase those assets that are not intended to be sold or converted into cash. Although in some scenarios fixed assets can be sold as per the requirement of the entity, generally they remain in the business for a long period of time.

Fixed capital is required at the initial stages of a business or in case of an expansion. The majority of a firm’s total capital constitutes fixed capital.

Example of Fixed Capital

Imagine a textile factory that produces clothing. In this case:

Machinery: The factory may have large weaving machines, sewing machines, and fabric-cutting equipment. Machines like these aren’t meant for quick resale. They have a long useful life and are considered fixed capital.

Building: Fixed capital also includes the factory building. It provides the space and infrastructure necessary for the manufacturing operations.

Related Topic – Capital is to be debited or credited?

Purpose of Fixed Capital

- Facilitating Production: Businesses use fixed capital, like machinery, equipment, and buildings, to produce goods and provide services more efficiently.

- Long-Term Investments: It supports a company’s core operations, often with a lifespan of several years or decades.

- Scalability: Firms can scale up their operations without relying solely on manual labour to meet increased demand.

- Depreciation: A business can get tax deductions related to the depreciation of fixed assets, reducing their overall tax burden.

Related Topic – Is Capital an Asset or Liability?

Fixed Capital Ratio

An important ratio linked to fixed capital is the fixed capital ratio. The accounting representation of fixed capital ratio is :

Fixed capital ratio = Total fixed assets (net) / Long-term debt

It indicates the ability of the entity to discharge its long-term debts. A fixed asset ratio that is greater than 1 is an indicator of the sound long-term financial position of the entity.

Working Capital

It is the portion of the total capital that is used to meet the operational obligations of the entity such as purchasing goods, payment of short-term liabilities, payment of wages, etc. In accounting equation terms, working capital is calculated as (Current Assets – Current Liabilities).

Example of Working Capital

Imagine the same textile factory that we used above and it produces clothing. In this case:

Cash: The cash in hand or in the company’s bank accounts that is used to pay for immediate expenses like utilities, wages, etc.

Accounts Receivable: Customer payments owed to the company for clothes sold on credit. Funds which are to be received soon.

Inventory: The textile company’s stock of raw materials, work-in-progress items, and finished goods are also part of the working capital.

Related Topic – What is Zero Working Capital?

Purpose of Working Capital

- Liquidity Management: A company’s working capital is used as a buffer for short-term obligations and unexpected expenses. This helps maintain financial stability.

- Inventory Management: It helps manage inventory and make sure you don’t overstock, which ties up money.

- AP & AR Management: By having working capital, you can pay suppliers on time and extend credit to customers while collecting outstanding payments on time.

Related Topic – Formula for Working Capital

Working Capital Ratio

Work capital ratio, also known as the current ratio, is an important ratio linked to working capital. It reflects the relationship between an entity’s current assets and its current liabilities.

The accounting representation of the current ratio is :

Current ratio = Current Assets / Current Liabilities

A slightly higher working capital ratio indicates a sound short-term financial position of the entity.

Related Topic – Profit Sharing Ratio

Conclusion

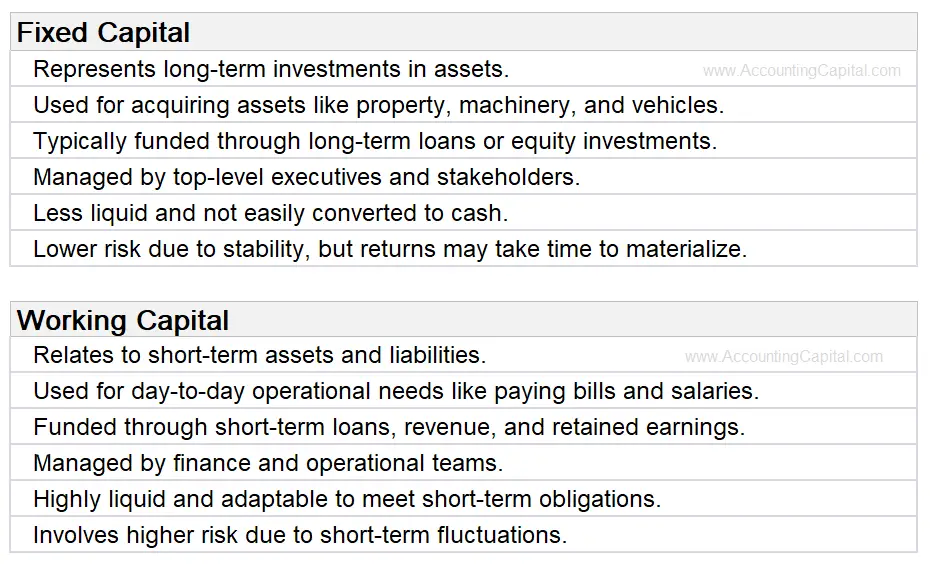

We have created a table to conclude everything about the difference between fixed capital and working capital.

Both fixed and working capital are of equal importance for the existence and smooth functioning of the entity. Identifying the right source and amount of both fixed and working capital is a strategic task for an entity.

Both fixed and working capital are of equal importance for the existence and smooth functioning of the entity. Identifying the right source and amount of both fixed and working capital is a strategic task for an entity.

>Read Negative Working Capital