Journal Entry for Salary Paid

Salary is an indirect expense incurred by every organization with employees. It is paid as a consideration for the efforts undertaken by the employees for the business. Salary expense is recorded in the books of accounts with a journal entry for salary paid.

Salary is among the most recurring transactions and paid on a periodical basis. The amount of salary payable by the employer to the employee is specified in the employment contract.

Journal entry for salary paid (in cash/cheque)

Accounting rules applied – Modern Rules

| Salary Account | Debit | Debit the increase in expense |

| Cash/Bank Account | Credit | Credit the decrease in asset |

Accounting rules applied – Three Golden Rules

| Salary Account | Debit | Debit all expenses – Nominal A/C |

| Cash/Bank Account | Credit | Credit what goes out – Real A/C |

Accounting Treatment for Salary Payment

The life cycle to account for payment of salary expense (in cash/cheque) goes through a couple of steps as shown below;

Step 1 – Journal entry for salary paid (in cash/cheque)

| Salary A/C | Debit |

| To Cash/Bank A/C | Credit |

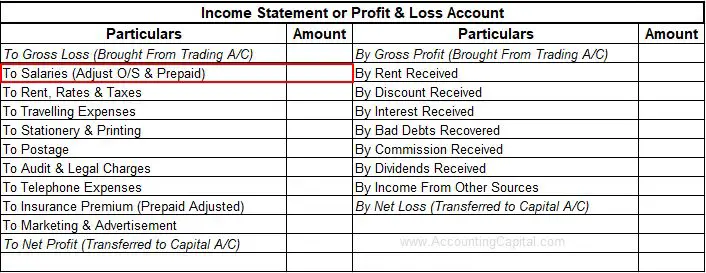

Step 2 – Transferring salary expense into income statement (profit and loss account).

| Income Statement | Debit |

| To Salary A/C | Credit |

Presentation in the Financial Statements

It is shown on the debit side of an income statement (profit and loss account)

Example

On the last day of every month, Unreal Corporation pays salaries to its employees amounting to 250,000. The payment relates to the salary due for the same month. Show related journal entries for salary paid in the books of Unreal Corporation.

End of every month – Journal entry at the time of payment of salary

| Salary A/c | 250,000 |

| To Cash/Bank A/c | 250,000 |

End of every month/year – When the business posts closing entries

| Income Statement | 250,000 |

| To Salary A/c | 250,000 |

Journal Entry for Salary Paid in Advance

Salary paid in advance is also known as prepaid salary (it is a prepaid expense). It is the amount of salary paid by an entity in advance but the corresponding work-effort equivalent to the advance salary paid is yet to be received from the employee. The money paid relates to a future accounting period.

It is presented as a current asset in the balance sheet, as it is an advance payment made by the firm.

Journal Entry

| Prepaid Salary A/C | Debit | Debit the increase in asset |

| To Salary A/C | Credit | Credit the decrease in expense |

(Being salary paid in advance/ prepaid salary adjusted at the end of the period)

Example – On 31st March ABC Co. paid salary amounting to 45,000 (15,000 x 3) for the month of March, April & May to one of its employees. Show journal entries to be posted in the books of ABC Co.

March 31 – Journal entry at the time of payment of salary.

| Salary A/c | 45,000 |

| To Cash/Bank A/c | 45,000 |

March 31 – Journal entry for adjustment of prepaid salary (for April & May) at the end of March.

| Prepaid Salary A/c | 30,000 |

| To Salary A/c | 30,000 |

April 1 & May 1 – Journal entry for salary obligation charged against the salary paid in advance.

| Salary A/c | 15,000 |

| To Prepaid Salary A/c | 15,000 |

Related Topic – Inflation Accounting

Journal Entry for Salary to Partners

Salary is paid to the partners of the partnership firm only if it is specified in the partnership deed.

Journal Entry

The following are the steps to record the journal entry for salary to partners.

Step 1 – Journal entry for salary due.

| Partner’s Salary A/C | Debit |

| To Partner’s Capital/Current A/C | Credit |

Partner’s Capital A/c to be credited if capitals are fluctuating.

Partner’s Current A/c to be credited if capitals are fixed in nature.

Step 2 – Transferring partners salary to Profit & Loss Appropriation A/c

| Profit & Loss Appropriation A/C | Debit |

| To Partner’s Salary A/C | Credit |

Salary to partners is an appropriation of profits, therefore Profit & Loss Appropriation A/c is debited.

Step 3 – Journal entry at the time of payment of salary to partners

| Partner’s Capital/Current A/C | Debit |

| To Cash/Bank A/C | Credit |

Example – A & B are partners of AB Ltd. As per the terms of the partnership deed, they are allowed a monthly salary of 25,000 each. Assume partner’s capitals are fluctuating. Show related journal entries to be posted in the books of AB Ltd.

End of each month – Journal entry for salary due by crediting the partner’s salary to the partner’s capital account

| Partner’s Salary A/c | 50,000 |

| To A’s Capital A/c | 25,000 |

| To B’s Capital A/c | 25,000 |

End of each month/year – Journal entry for transferring partners salary to Profit & Loss Appropriation A/c

| Profit & Loss Appropriation A/c | 50,000 |

| To Partner’s Salary A/c | 50,000 |

On the date of payment – Journal entry for payment of salary to partners

| A’s Capital A/c | 25,000 |

| B’s Capital A/c | 25,000 |

| To Cash/Bank A/c | 50,000 |

Short Quiz for Self-Evaluation

>Read Accounting and Journal Entry for Rent Paid