- Meaning and Overview

- Examples

- Prepaid Expenses Journal Entry

- Are Prepaid Expenses Assets?

- Where do Prepaid Expenses Appear?

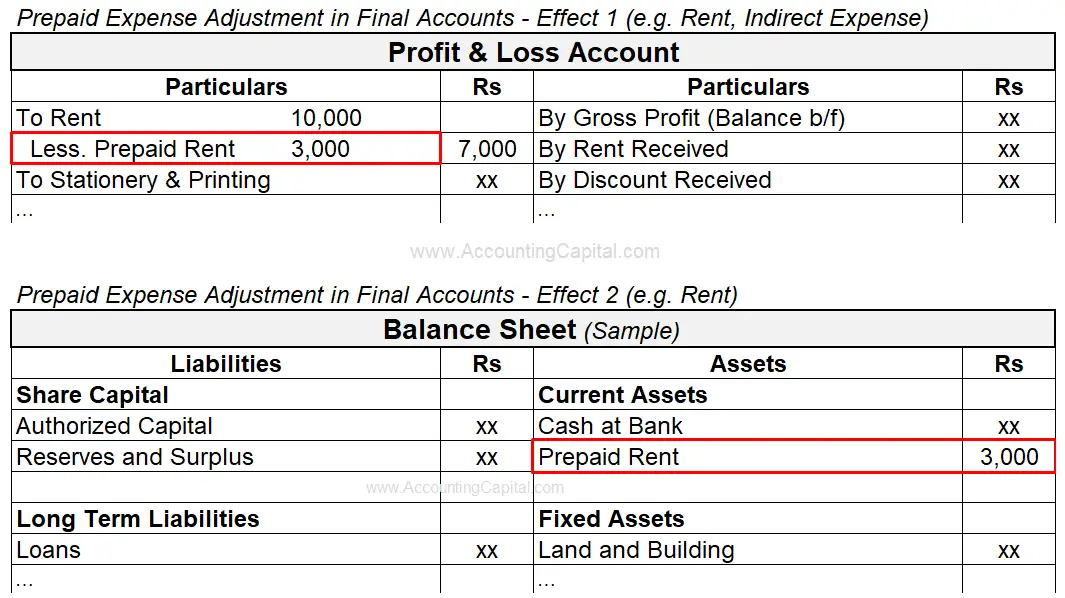

- Prepaid Expenses in Profit & Loss Account

- Prepaid Expense is Which Type of Account?

- Treatment in Final Accounts

- Revision Video

- Conclusion

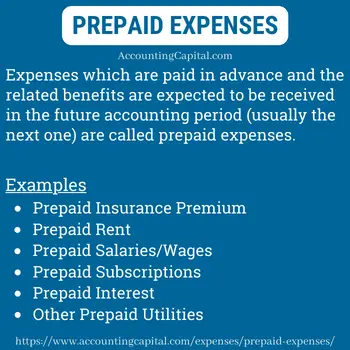

Meaning and Overview

Prepaid expenses are those expenses which have been paid in advance and the related benefits are not received within the same accounting period. The benefits of expenses incurred are carried forward to the next accounting period. Prepaid expenses are treated as an asset by the business.

Examples – Prepaid salary, prepaid rent, prepaid subscription, etc. They are recorded in books of finance at the end of an accounting period to show the true numbers of a business. They are also known as unexpired expenses or expenses paid in advance.

Examples

Company-A has a rent obligation of 80,000/year that is due every time on the 10th of Jan, this year the company decides to pay double that is full rent in advance for next year.

The amount paid in advance for next year is 80,000 which is prepaid and termed as a “prepaid expense” for Company A.

At the end of the period, this “amount paid in advance” impacts the financials of the business. Such a transaction is supposed to be journalized.

According to the accrual concept of accounting, transactions are recorded in the books of accounts at the time of their occurrence and not when the actual cash or a cash equivalent is received or paid.

Based on the above principle, payments are not necessarily made immediately they may be late or in advance. Outstanding expenses and unexpired expenses are both a result of this.

Related Topic – Is Prepaid Expense a Fictitious Asset?

Prepaid Expenses Journal Entry

Advance payment made for an expense has two steps for being recorded and recognised. Firstly, when the prepayment is done and secondly when the related expense becomes due.

a) At the time of advance payment of the expense.

| Prepaid Expense A/c | Debit | Debit the increase in asset |

| To Bank A/c | Credit | Credit the decrease in asset |

(Being expense paid in advance for the period)

b) At the time when the expense becomes due to be paid.

| Expense A/c | Debit | Debit the increase in expense |

| To Prepaid Expense A/c | Credit | Credit the decrease in asset |

(Adjustment entry made to recognize the expense on the due date)

Alternate Scenario

In some cases, expenses are prepaid along with the actual payment made on the due date. In such a case, when the date is the same then a compound journal entry can also be recorded.

| Expense A/c | Debit | Debit the increase in expense |

| Prepaid Expense A/c | Debit | Debit the increase in asset |

| To Bank A/c | Credit | Credit the decrease in asset |

(Being expense paid along with prepaid expense paid in advance for a future period)

Prepaid Expenses in Trial Balance

- If prepaid expense already appears inside the trial balance then it implies that the adjusting entry has already been posted.

- In this case, it is only shown on the balance sheet as a “current asset” and no adjustment is required in the income statement.

- In the event that such an expense does not appear in the trial balance, they should be added to the respective accounts. This should be reflected on the debit side of the Profit and Loss Account.

Related Topic – Treatment of Prepaid Expenses in Financial Statements

Prepaid Insurance Journal Entry

An insurance premium is an amount paid to cover the cost of coverage associated with an insurance agreement. It is often paid monthly, quarterly, half-yearly, or yearly.

When an insurance premium has been paid to the insurance company but the related coverage hasn’t yet begun, this is known as insurance premium prepaid.

Prepaid insurance journal entry should be recorded as follows:

a) At the time insurance premium is prepaid.

| Prepaid Insurance Premium A/c | Debit |

| To Bank A/c | Credit |

(Being insurance premium paid in advance)

b) On the date the prepaid insurance premium becomes due.

| Insurance Expense A/c | Debit |

| To Prepaid Insurance Premium A/c | Credit |

(Insurance expense being recognized and the related prepaid asset being reduced)

When the insurance premium is due, the amount due is deducted from the prepaid account and is shown as an operating expense in the Profit and Loss A/c prepared for the current period.

Related Topic – Is Prepaid Insurance debit or credit?

Prepaid Rent Journal Entry

The term “rent” refers to a periodic payment that covers the expenses associated with occupying and using a property (such as land, buildings, etc.) The payments are made to the owner of the property. Usually, it is paid on a monthly or annual basis.

The term “outstanding rent” refers to rent due for a period that has already passed.

Prepaid rent journal entry should be recorded as follows:

a) At the time rent is paid in advance.

| Prepaid Rent A/c | Debit |

| To Bank A/c | Credit |

(Being rent paid in advance)

b) On the date the prepaid rent becomes due.

| Rent Expense A/c | Debit |

| To Prepaid Rent A/c | Credit |

(Rent expense being recognised and the related prepaid asset being reduced)

On the date when rent expense is actually due, the amount is deducted from the prepaid rent account and is shown as an operating expense in the Profit and Loss A/c prepared for the current period.

Related Topic – Is Prepaid Rent a Current Asset?

Prepaid Salary Journal Entry

In exchange for the work that an employee performs, an employer pays them a salary. It is often paid monthly and accompanied by some benefits.

When a salary is paid in advance to an employee but the employee is yet to work for that period it is called salary paid in advance.

Prepaid salary journal entry should be recorded as follows:

a) At the time salary is prepaid.

| Prepaid Salaries A/c | Debit |

| To Bank A/c | Credit |

(Being salary paid in advance)

b) On the date the salary becomes due.

| Salaries A/c | Debit |

| To Prepaid Salaries A/c | Credit |

(Salary expense being recognized and the related asset being reduced)

When the actual salary is due, the amount is deducted from the prepaid salaries account and is shown as an operating expense in the current period’s Income Statement.

Related Topic – Journal Entry for Paid Salary by Cheque

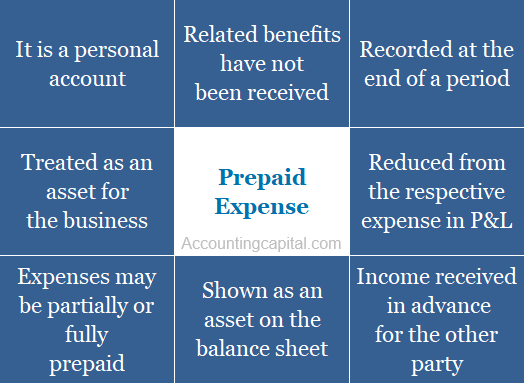

Are Prepaid Expenses Assets?

Assets are resources that belong to a person or entity. They may be tangible or intangible items used to generate economic value for business operations. An expense that is paid before it is due is considered prepaid and it is treated as an asset (current) for the business.

Reason – The logic of why advance payment made for an expense is treated as an asset by the business is because the benefit in exchange for the payment is postponed to a future date. It stays an asset till the time the actual expense is due and recognized accordingly.

Such an expense has an unexpired value which means the benefit in exchange for the payment is still to be received. As a result, it is also called unexpired expense or unexpired cost.

Consider it a slow-burning asset that gradually becomes an expense and exhausts when the actual due date comes around.

Why is it considered a current asset?

Assets that are generally expected to be used, sold, or depleted within the current accounting year (usually 12 months) are called current assets.

The expectation around a prepaid expense is to convert it from being an asset to realising it as an income within a year.

Commonly a business expects to use, sell, or exhaust the current asset within the current accounting period therefore it is regarded as a current asset. In this way, they contribute to the calculation of the current ratio but they are excluded from the list of liquid assets.

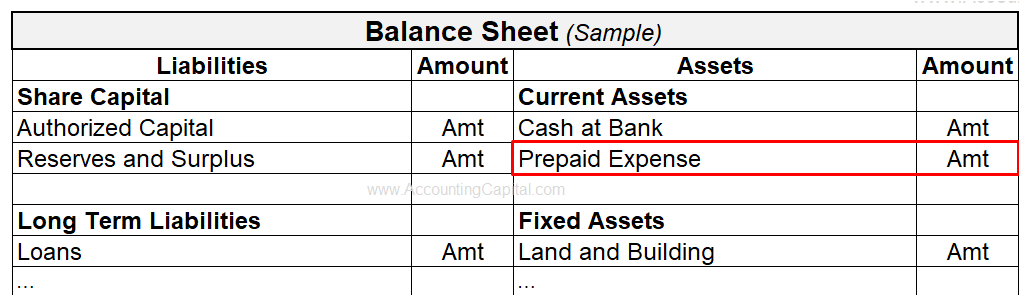

Where do Prepaid Expenses Appear?

The portion of the expense that is prepaid is shown on the “Assets” side of a balance sheet under the subhead “Current Assets”. This is done to comply with accounting laws, but it also helps the internal users of the accounting information with management accounting.

It is shown as a current asset till the time it is completely consumed during the year.

- Expense that is paid in advance shows up on the balance sheet.

- It is shown as a current asset because the assumption is that all the related benefits of the prepayment will be acquired within the current year.

- In a normal business scenario, it is moved into the profit & loss account with the help of a periodic adjustment entry.

Related Topic – Adjustments in Final Accounts

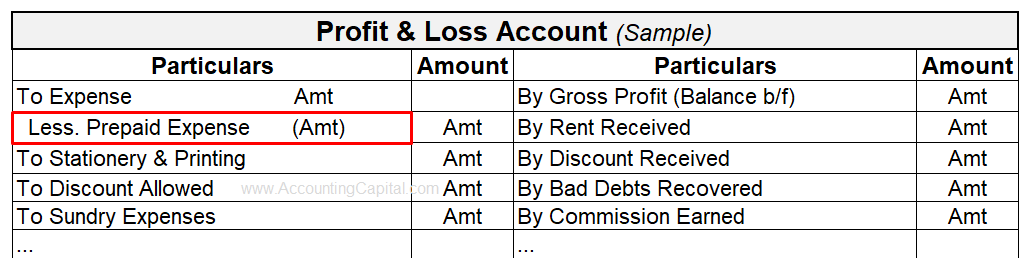

Prepaid Expenses in Profit & Loss Account

In continuation of the previous heading, it is important to know that the prepaid expense is also shown as a reduction from the related direct or indirect expense in the Trading and P&L A/c.

Prepaid Expense is Which Type of Account?

As per the traditional classification of accounts, a prepaid expense is a type of personal account (representative personal). These types of accounts represent a person or a group.

It makes sense to call it a representative personal account since it’s indirectly linked to a person or group. As per the rules of debit and credit, it follows the rule of Dr. the receiver and Cr. the giver.

However, as per modern accounting rules, it is an asset and follows the rule of Dr. the increase and Cr. the decrease.

Treatment in Final Accounts

Treatment of Prepaid Expenses in Financial Statements/Final Accounts

- Trading & Profit and Loss A/c Show on the Dr. side (subtract from the respective direct or indirect expense)

- Balance Sheet: Show on the “Assets” side (under the head “Current Assets”)

Example

In the year, a company paid Rs 10,000 in rent and estimated the prepaid rent to be Rs 3,000. Adjust prepaid expenses in final accounts at the end of the period.

Revision and Highlights

Highly Recommended!!

Do not miss our 1-minute revision video and the quiz below. This will help you quickly revise and memorize the topic forever. Try them :)

Short Quiz for Self-Evaluation

Conclusion

Prepaid expenses are also referred to as deferrals, prepayments, deferred expenses, unexpired costs, prepaids, or prepaid liabilities. Some more common examples not shared above are interest expenses, estimated taxes, some utility bills,

This is an important concept from an accounting perspective as it is included in the list of frequently asked accounting terms.

Important points to remember

-

It’s only when you use the prepaid expenses they become expenses until then they remain an asset for the business.

-

As you use the asset, its value decreases. At the same time, expenses increase.

- The value of the asset is then removed from the balance sheet and adjusted with an actual expense recorded on the income statement.

>Related Long Quiz for Practice Quiz 36 – Prepaid Expenses

>Read Accounting Principles