Reserves Vs Provisions

Reserves and provisions are somewhat alike but are created for different reasons and under distinct circumstances. Both are important for a business and one can’t reduce the importance of the other. This article covers major points of difference between reserves and provisions.

Reserves are what a business would put away from its profits for future contingencies and strengthening of the business, whereas, provisions are aimed to satisfy an anticipated known expenditure.

| Reserves | Provisions |

| 1. Reserves are made to strengthen the financial position of a business and meet unknown liabilities & losses. | 1. Provisions are made to meet specific liability or contingency, e.g. a provision for doubtful debts. |

| 2. Reserves are only made when the business is profitable. | 2. Provisions are made irrespective of profits earned or losses incurred by a business. |

| 3. They can be used to distribute dividends to shareholders. | 3. They cannot be used to distribute dividends as they are made for a specific liability. |

| 4. They are made by debiting P&L Appropriation Account. | 4. They are made by debiting the P&L Account. |

| 5. It is not mandatory to create reserves for the business, it is mainly done for prudence. | 5. It is mandatory to create provisions as per various laws. |

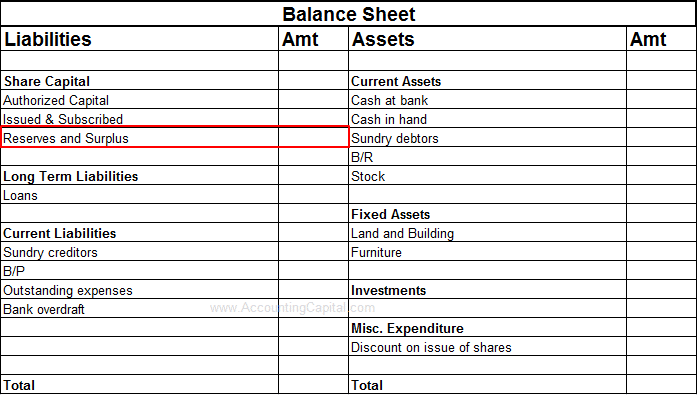

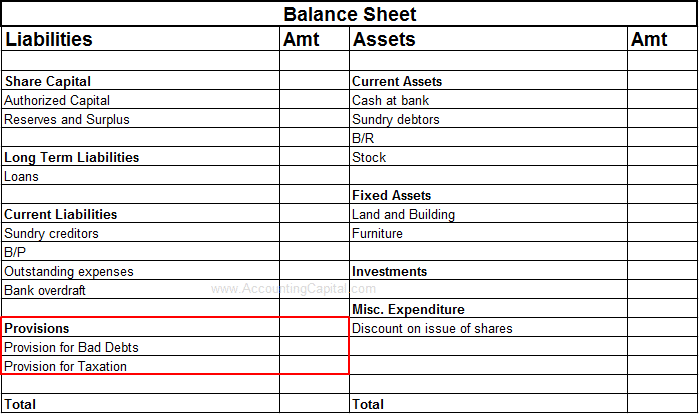

| 6. Reserves are shown on the liability side of a balance sheet. | 6. Provisions are either shown on the liability side of a balance sheet or as a deduction from the concerned asset. |

| 7. It may be used for investment outside the business. | 7. It can not be used for investment purposes. |

Reserves

They are the portion of profits set aside to strengthen the financial position of a business. Generally, reserves are created to meet unknown future obligations which may arise due to miscellaneous business reasons.

For example – General reserve, reserve for expansion, dividend equalisation reserve, debenture redemption reserve, capital redemption reserve, increased replacement cost reserve, etc.

Specific reserves, as the name suggests are made for specific reasons and may only be used for that specific purpose. One major difference between reserves and provisions is that a provision is always specific, however, reserves may be generic.

They are shown in the balance sheet along with share capital.

Provisions

They are the portion of profits set aside to meet known losses/expenses in the future. The main purpose to create provisions is to meet recognized future obligations which may arise due to a specific business reason.

For example – Provision for doubtful debts, provision for discount on debtors, provision for depreciation, provision for repairs and renewals, provision for audit fees, provision for taxation, etc.

They are shown in the income statement along with expenses.

Types of Reserves

Reserve means the amount set aside out of profits or other surpluses that are not meant to cover any liability, contingency, commitment, or legal requirement. Thus, the reserve covers the case of an amount that is neither a liability nor a provision. The following are the important types of reserves:

- Capital Reserve- It is an accounting mechanism for conserving profits. It imparts an element of stability to the overall finances of a business enterprise. Capital reserve arises either as a gain on the sale of long-term assets or a settlement of liabilities. It does not include any free balance that might be used for the distribution of profits. Examples of the capital reserve are:

-

- Profits emerging from the revaluation of fixed assets

- Profits accruing on the sale of fixed assets

- Profits from the re-issue of shares

- Profits prior to incorporation of a company

- Revenue Reserves – Revenue reserves are created out of revenue profit that is usually distributable profits. All distributable profits are not always available for paying dividends since a certain amount may be required to be kept aside either by law (minimum) or as a managerial decision (higher amount) for business needs. It is only after this that the profits will be available for distribution. A few examples are:

- General Reserve

- Dividend Equalization Reserve

- Debenture Redemption Reserve

- General Reserve – General reserve is a retention of a portion of revenue profits for the improvement of the overall financial status of an enterprise and to improve its health in general. It is a salient feature of corporate finance. The creation and maintenance of a general reserve helps in-

- Conserving resources

- Saving for unforeseen losses

- Scope of business expansion

- Specific Reserves – A business undertaking in contemporary times is involved in a range of business activities in pursuance of its goal of creating value in the organization. Some of the contingency situations can be looked after and financially managed by the creation of provisions for known events. Management may like to provide a second line of defence against some of these. A specific reserve is created for such a given purpose. A few examples are:

- Contingency reserve

- Capital Redemption reserve

- Workmen Compensation reserve

Types of Provisions

The provision means an amount that is written off or retained, kept aside by way of providing for depreciation; or retained by way of providing for any unknown future liability of which the amount can not be ascertained with reasonable accuracy. Important types of Provision are-

Provision for Doubtful Debts – When it is certain that a debt will not be recovered, the amount is written off as bad debt. But, it is also likely that some of the remaining debts may not be recovered in full. This will be a loss to the business.

Hence, it is a common practice to make a suitable provision for doubtful debt at the time of ascertaining profit and loss. Such a provision is made by debiting the number of doubtful debts to the profit and loss account and crediting the account of provision for doubtful debts.

Provision for Discount on Debtors – In practice, business enterprises allow cash discounts to their customers. The tenure of that discount may spill over into the following accounting year for the sales made during the current year.

This requires a provision to be made on debtors and is treated as a loss for the current year. Provision for discount on debtors is created by debiting the profit and loss account and crediting the amount for provisions for a discount on debtors.

Provision for Taxation – A provision for taxation is created and maintained to meet the income tax payable which is a liability for the business, in the current year. Such provision is created by debiting the Income-tax amount of the profit and loss account for that year and crediting the amount for provision for taxation.

Provision for Depreciation – Provision for depreciation is the specific portion of depreciation for that accounting year. Depreciation is by principle charged at the end of the accounting year, and this leads to a lowering of the book value of the asset. However, this reduction isn’t accounted for by crediting the asset account in question, because the assets are going to be continued to be shown on the balance sheet at their original price.

Instead, these depreciation amounts are attributable to a specific account named ‘Accumulated Depreciation‘ which records the collective provisions for depreciation. Such provision is created by debiting the depreciation account and crediting the amount of provision for depreciation.

Reserves Vs Surplus

Following are the differentiating factors between Reserves and Surplus:

- Meaning – Reserve is the amount set aside out of undivided profits and other surpluses in order to strengthen the financial position of the business, but not designed to meet any liability or contingency known to exist on the date of the Balance Sheet. The surplus is the credit balance of the profit and loss account after providing for dividends, bonuses, provision for taxation and general reserves, and all other external payments.

- Creation – Reserves are an appropriation out of profits and are created only if profit has been earned. It is a matter of financial prudence. What remains after reserves have been created, of the profit earned in that year, is termed as surplus for that accounting period.

- Purpose – General Reserves can be used by the company to meet any obligation unknown at that point in time. This includes issuing bonus shares, and dividend equalization, among others. The surplus is the “extra” funds available to the business and shows the operational stability of the company. It is usually transferred to the next year as retained earnings.

Short Quiz for Self-Evaluation

> Read Three Main Financial Statements