-This question was submitted by a user and answered by a volunteer of our choice.

To understand the Presentation of Accumulated Depreciation in the Trial Balance, it is crucial first to understand the concept and meaning of Depreciation.

What is Depreciation?

Depreciation is the fall in the value of an asset due to use, wear and tear, or obsolescence. It is a non-cash expense for the business.

There are various methods that are used to calculate depreciation including the Written Down Value method, Straight Line Method, Sum of the digits method and various others.

The business maintains a provision for depreciation account to prepare for this expense. An amount is set aside every financial year in the form of this provision.

What is Accumulated Depreciation?

Accumulated depreciation is the aggregate or the total amount of fall in the value of the asset since the asset was put to use. In other words, it is the total depreciation that an entity has expensed in its profit and loss statement till that date.

It is a Contra asset account as it reduces the balance in the asset account. If the accumulated depreciation is subtracted from the original value of the asset, the present value of the asset can be found.

Accumulated Depreciation in the Trial Balance

A Trial Balance of the business shows the closing balances of all the general ledgers.

The accumulated depreciation is shown as a “credit item” in the trial balance. Accumulated depreciation is nothing but the sum total of depreciation charged until a specified date.

Since in every reporting period, a part of a fixed asset is written off i.e. depreciated, such accumulated depreciation has a credit balance.

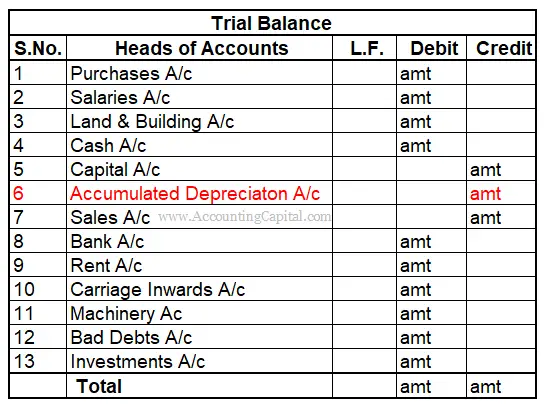

The image given below shows how Accumulated Depreciation is shown in the Trial Balance:

Illustrative Example

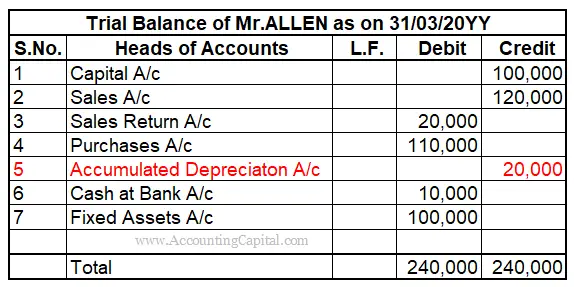

Prepare a trial balance of Mr Allen on the basis of given heads of accounts;

|

Particulars |

Amount |

| Capital | 1,00,000 |

| Sales | 1,20,000 |

| Purchases | 1,10,000 |

| Sales Return | 20,000 |

| Fixed Assets | 1,00,000 |

| Cash at bank | 10,000 |

| Accumulated Depreciation | 20,000 |

Solution :

The Trial Balance of Mr. Allen is given below:

Accumulated Depreciation always has a credit balance.

Conclusion

The above discussion is summarised below:

- Depreciation is the fall in the value of an asset due to use, wear and tear, or obsolescence.

- It is a non-cash expense for the business.

- Accumulated Depreciation is the total depreciation that an entity has expensed in its profit and loss statement till that date.

- Accumulated Depreciation is the total amount of Depreciation charged during the life of an asset.

- It is a Contra asset account as it reduces the balance in the asset account.

- The accumulated depreciation is shown as a “credit item” in the trial balance.

- When the accumulated depreciation is subtracted from the original cost of the asset, the remaining value is the present valueof such asset.