Meaning of Contra Assets

The word contra means “opposite”. So, contra assets have a credit balance, whereas assets normally have a debit balance. A contra-asset account stores a reserve which reduces the balance of the paired account. The reason to show this information separately in a contra-asset account is to see the extent to which the corresponding asset should be reduced.

A contra asset is used to offset or reduce the balance of the corresponding asset account in the balance sheet. Reducing or offsetting the gross value of the asset with the corresponding contra asset will give us the net value of the asset. A contra asset can also be referred to as a negative asset account.

Examples of Contra Assets

1. Accumulated Depreciation

2. Accumulated Amortization

3. Obsolete Inventory Reserve

4. Reserve/Provision for Doubtful Debts

Importance of Preparing the Contra Assets

- This helps in the accurate valuation of assets on the balance sheet. It helps in showing the present value of the assets after using them.

- It enhances financial transparency. The accuracy of financial documents is important for investors, creditors, and other stakeholders in making informed decisions.

- Contra assets help in eliminating risks relating to assets. For example, accumulated depreciation is a common contra asset that is used to indicate the depreciating nature of fixed assets, which may require maintenance or replacement and reduce the value.

- Contra assets help in making management decisions related to asset management and its maintenance.

Presentation in the Balance Sheet

Contra assets are to be stated in separate line items on the balance sheet of the company. The following contra assets can be presented on the balance sheet as given below:

| Contra Asset | Presentation on the Balance Sheet |

| Accumulated Amortization | Reduced from the respective Intangible Assets under the head “Non-Current assets” |

| Reserve/Provision for Doubtful Debts | Reduced from Accounts Receivable/Debtors under the head “Current assets” |

| Accumulated Depreciation | Reduced from the respective Tangible Assets under the head “Non-Current assets” |

| Obsolete Inventory Reserve | Reduced from Inventory under the head “Current assets” |

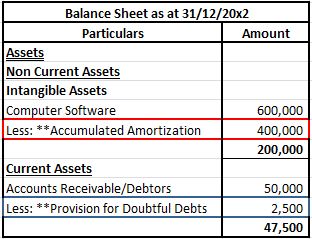

Given below are the examples of Accumulated Depreciation & Reserve/Provision for Doubtful Debts. The calculation and posting in the extract of the balance sheet are also provided.

Example 1.

Suppose ABC Ltd. acquires new computer software for 600,000 in the month of January 20×1. The expected useful life of the software is 3 years with no scrap value.

As per the straight-line method, 200,000 will be written off or reduced from the amount of computer software each year for 3 consecutive years.

| Year-end | Depreciation | Accumulated Depreciation | Net Value of Computer Software |

| 20×1 | 200,000 | 200,000 | 400,000 (600,000 – 200,000) |

| 20×2 | 200,000 | 400,000 | 200,000 (600,000 – 400,000) |

| 20×3 | 200,000 | 600,000 | Nil (600,000 – 600,000) |

Example 2.

The outstanding balance of debtors was 50,000 as of 31/12/20×2. Entity ABC Ltd anticipates doubtful recovery from some debtors based on the previous year’s experiences. Therefore, it decides to provide a reserve for doubtful debts at 5% on its debtors.

So, 2,500 (50,000*5%) will be reduced from the number of debtors as a reserve or provision for doubtful debts as of 31/12/20×2. Hence, the net amount of debtors will be 47,500 at the end of the year.

Presentation of Accumulated Depreciation & Reserve/Provision for Doubtful Debts in the extract of the balance sheet as of 31/12/20×2

Conclusion

Adjusting asset values will help reflect their true worth and accounting like depreciation, and contra assets contribute to the reliability and integrity of financial reporting. These are asset quality indicators, that help assess financial health, and influence strategic decisions regarding asset management.