Journal in Accounting

Journal is the primary book of accounting where daily records of business transactions are first recorded in chronological order, i.e. in the increasing order of dates.

In case of a large business where the number of transactions is substantially more, it is divided into various subsidiary books; such as cashbook, sales book, purchase book, B/R book, B/P book, etc.

It is also called the book of original or first entry. It is a preliminary record where business transactions are first entered into the accounting system. This stage is also known as the original record stage & marks the beginning of a double-entry accounting system.

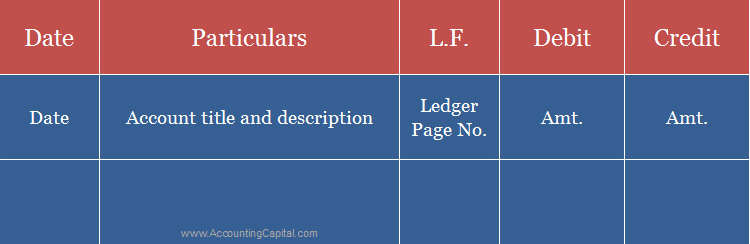

Sample Format & Template

Recording a transaction in a journal using an accounting entry is called Journalizing. It records both the debit and credit side of a business transaction.

The entry of a business transaction recorded in the journal is called a Journal Entry. It shows details of a transaction in a summarized form.

The act of transferring an accounting entry from a journal or a subsidiary book into a ledger account is called Posting.

Nowadays, for businesses and big corporations the entries carry over several pages, hence the totals are mentioned at the end of each page in front of the debit and credit columns.

Totals are carried forward carried down appropriately with the help of abbreviations such as Balance C/F and Balance B/F and Balance B/D and Balance C/D.

Short Quiz for Self-Evaluation

>Read What is a Voucher?