Profit and Loss Suspense Account

An entity prepares a profit and loss suspense account when either the partner is retired or in case of the death of a partner at any time before the end of the reporting period. It is a temporary account created to record the estimated profit for the current financial year during the ‘Reconstitution of the Partnership firm’.

It is used to record some fictitious profits during the year. The profit of the current year is calculated either on the basis of the last year’s profit or the average profit. The proportionate profit thus found is recorded in the Profit and Loss Suspense A/c.

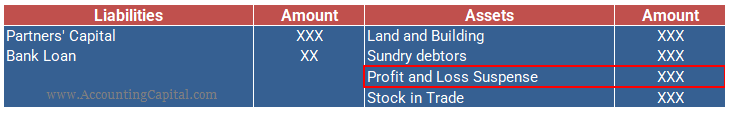

The balance of the Profit and Loss Suspense account is transferred to the balance sheet of the new firm i.e. after the reconstitution of the partnership.

Why do we Prepare the Profit and Loss Suspense Account?

Generally, an organization prepares its financial statements at the end of its reporting period. The financial statements of a partnership firm typically include the following –

- Trading and Profit and Loss Account or

- Income and Expenditure account

- Balance Sheet

As stated above these financial statements are prepared at the end of an accounting period. The partner may die or decide to retire on any given date. In the case of the retirement or death of a partner in the middle of the year or on any given date, it shall be a tedious task for an entity to distribute the profits.

Hence to eliminate the hardships, the “Profit and Loss Suspense Account” is created and the share of profit of such deceased or retired partner is calculated through the Profit and Loss Suspense Account.

Calculation of Profit and Loss Suspense A/c

Proportionate profit for the part of the year is calculated from the date of the opening Balance Sheet to the date of retirement or death. Share of Retiring/Deceased partner is calculated on the basis of proportionate profit.

Proportionate profit can be calculated on the basis of the previous year’s profit or average profits in the past years. The estimated profit for the entire year is proportioned till the date of retirement/death of the partner and their share of the profit is settled in cash, loan, or their current account.

Let us understand this better with the help of an example:

Mr. Alex, Ms. Anna, and Mr. John are in partnership sharing profits and losses in the ratio of 2:2:1. Mr. Alex died on 15th April, YYYY. The firm closes its books of account on 31st December every year. So the executor of Mr. Alex is entitled to 3 and 1/2 months’ profit. Ms. Anna and Mr. John decided to pay the profit immediately to the executor of Mr. Alex. The profit of the previous accounting period was 1,20,000.

Here, The proportionate profit for 3 and 1/2 months

= 1,20,000 x 3.5months/12months

= 35,000

Mr. Alex’s share of the profit

= 35,000 x 2/5 (his share in the partnership)

= 14,000 (for 3 and 1/2 months)

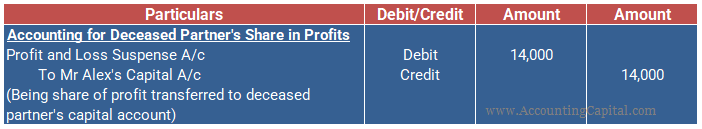

For the transfer of such Profit or Loss the following journal entries are drafted in the books of the firm:

Extract of Balance Sheet as of 15th April YYYY is given below:

Profit and Loss Appropriation Account vs Profit and Loss Suspense Account

A Profit and Loss Appropriation Account is prepared to show the distribution of profits or losses of a partnership firm. It is an extension of the Profit and Loss Account. It shows the share of each partner in the profits and losses of a partnership firm during the financial year.

On the other hand, the Profit and Loss Suspense account is prepared to ascertain the profits or losses when either the partner retires or in case of the death of a partner at any time before the end of the financial year.

Conclusion

The following points may be concluded from the above discussion:

- A Profit and loss suspense account is prepared in order to distribute the profits and losses for a period shorter than the reporting period in a case where a partner is leaving the firm.

- It is a temporary account prepared during the ‘Reconstruction of the firm.’

- The Current year’s profit is calculated either based on the last year’s profit or the average profit.

- Share of Retiring/Deceased partner is calculated on the basis of the proportionate profit.