-This question was submitted by a user and answered by a volunteer of our choice.

A question often asked is, “Is bad debt an asset or liability?”. Let us try to understand this concept in detail.

What are Bad Debts?

In layman’s language, a Bad Debt is a non-cash expense incurred by a business when the debtor does not repay the amount owed by him in due course of time for reasons such as fraud, insolvency of the debtor, etc.

We can also refer to them as Uncollectible Accounts Expenses and Irrecoverable Debt.

What is a Liability?

Liabilities refer to the financial obligations of a business. In simple words, it is a sum of money owed by a debtor to a creditor under an agreement and is repayable on a specified period. For example, Bank Loans, Accounts Payable, Bank Overdrafts, etc.

Are Bad Debts an Expense or a Liability?

Bad Debts are an expense to the business and not a liability as the amount that was expected to be received from the debtor is irrecoverable and has a negative effect on the books of accounts by way of reduction from the accounts receivable.

It is recorded on the asset side of the balance sheet. However, it is entered in the balance sheet as a contra asset account, i.e. as a reduction from the accounts receivable. It is also recorded under operating expenses in the Income Statement as well as in the profit and loss a/c on the debit side.

Therefore, we can easily conclude now that bad debts are an expense and not a liability.

This concept is further explained with an example stated below.

Example

XYZ Ltd sells machinery to ABC Ltd. for 5,000 at 60 days credit. However, ABC Ltd has been declared bankrupt and can no longer pay the specified amount. This amount of 5,000 is a non-cash expense for XYZ Ltd and leads to a fall in the accounts receivables. Hence, it is a bad debt. It is not a liability for the company but an expense.

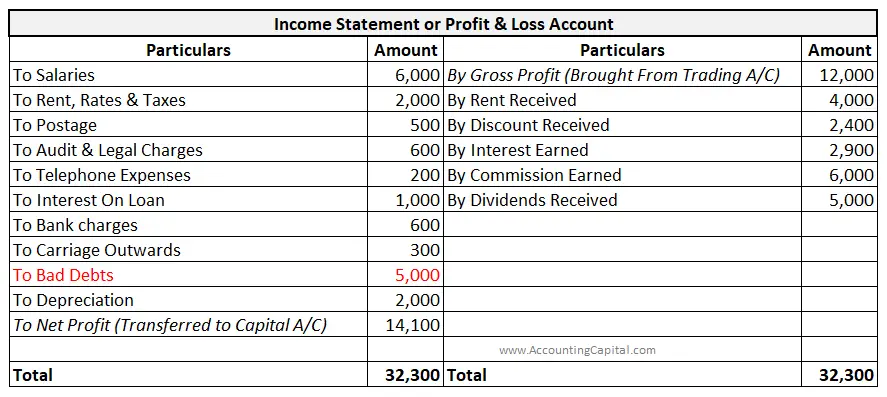

Bad Debts Shown in the Income Statement

An extract of an Income Statement showing Bad debts is given below:

What is Provision for Bad Debts?

When a business anticipates that a debtor may not repay the money owed by him, it prepares a Provision for Bad debts. This helps the business in preparing for any loss that may occur in the future.

Conclusion

The key takeaways from the above discussion are as follows:

- A Bad Debt is a debtor who fails to repay the amount he owes to the business.

- Liabilities refer to the financial obligations of a business.

- Bad Debts are an expense to the business and not a liability.

- It is entered in the balance sheet as a contra asset account, i.e. as a reduction from the accounts receivable.

>Read