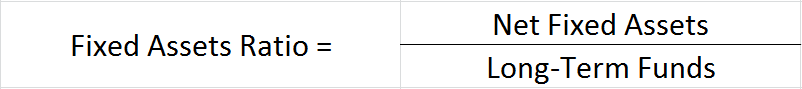

Fixed Assets Ratio

The fixed Assets ratio is a type of solvency ratio (long-term solvency) which is found by dividing the total fixed assets (net) of a company by its long-term funds. It shows the amount of fixed assets being financed by each unit of long-term funds.

It helps to determine the capacity of a company to discharge its obligations towards long-term lenders indicating its financial strength and ensuring its long-term survival.

Formula to Calculate Fixed Assets Ratio

Net fixed assets: (Total of fixed assets – Total depreciation till date) + Trade Investments including shares in subsidiaries.

Long-term funds: Share capital + Reserves + Long-term loans.

Explanation with an Example

From the balance sheet of Unreal corporation calculate its fixed assets ratio;

| Liabilities | Amt | Assets | Amt |

| Share Capital | 2,00,000 | Plant & Machinery | 1,90,000 |

| Reserves & Surplus | 40,000 | Furniture | 10,000 |

| Short-Term Loans | 25,000 | Inventories | 60,000 |

| Trade Payable | 25,000 | Trade Receivable | 30,000 |

| Expense Payable | 10,000 | Short-Term Investment | 10,000 |

| Total | 3,00,000 | Total | 3,00,000 |

From the above balance sheet (considering nil depreciation)

Net Fixed Assets = Plant & Machinery + Furniture

= 1,90,000 + 10,000

= 2,00,000

Long-Term funds = Share Capital + Reserves + Long-Term Loans

= 2,00,000 + 40,000

= 2,40,000

Fixed Assets Ratio = 2,00,000/2,40,000

= 0.83

This shows that for 1 currency unit of the long-term fund, the company has 0.83 corresponding units of fixed assets; furthermore, the ideal ratio is said to be around 0.67.

High and Low Fixed Assets Ratio

Ideally, fixed assets should be sourced from long-term funds & current assets should be from short-term funds/current liabilities.

High – A ratio of more than 1 indicates net fixed assets of the company are more than its long-term funds which demonstrate that the company has bought some of its fixed assets with the help of short-term funds. This depicts operational inefficiency.

Low – A ratio of less than 1 indicates long-term funds of the company are more than its net fixed assets It is desirable to some extent as it means that a company has sufficient long-term funds to cover its fixed assets.

Short Quiz for Self-Evaluation

>Related Long Quiz for Practice Quiz 35 – Fixed Assets

>Read What is Interest Coverage Ratio?