Meaning and Example

Goodwill refers to an intangible asset that facilitates a company in making higher profits & is a result of a business’s consistent efforts over the past years. In other words, it is the advantageous outcome of the firm’s good name, reputation, prestige, connections, quality services or products, etc.

It is an attractive force that helps old reputed businesses in earning higher revenues as compared to the normal expected rate of return on capital as a result of its already-established reputation among potential buyers or consumers.

Also, Goodwill is a long-term intangible asset that does have a separate existence from that of the business which means that it cannot be sold separately in the market like other assets. Hence, its realizable value is considered only at the time of sale of the business venture. The value of goodwill is subjective because it depends upon the valuation criteria of the valuer.

Various factors affecting the value of goodwill are as follows;

- Efficiency & competency of the management,

- Nature of the business,

- Benefits of intellectual property rights – patents/trademarks/copyrights,

- Risks associated with the business & market situations,

- Past performance and so on.

Related Topic – Profit and Loss suspense account

Example of Goodwill

McDonald’s Corporation, the fast-food giant is now able to generate higher revenues than its local competitors because of its goodwill. Further, this goodwill is a result of the company’s past performance, efficient management, advantageous locations of its franchises, benefits of its patents, etc.

Hence, if this company decides to sell its franchise or the entire business to any third party then the realizable value of its goodwill will also be considered while calculating the total purchase consideration. The other party should also compensate for the goodwill because it will get benefitted from the same.

Type of Account & Formula

To understand the accounting of a transaction, it is first crucial to know the type of accounts involved in it.

| Name of Account | Golden Rules | Modern Rules |

| Goodwill |

|

|

Formula to calculate the value of goodwill;

| (Purchased) Goodwill = Purchase price of the targeted/acquired company – (Fair market value of the total assets of the acquired company – Fair market value of the total liabilities of the acquired company) |

Related Topic – Meaning of set-off in accounting

Journal Entries

a) Inherent, existing, or self-built goodwill

Inherent or internally generated goodwill is the value of the business in excess of the fair value of the net assets of the business. It arises over a period of time due to the good reputation of the business.

Internally generated goodwill is never recognized in books of accounts, so no journal entry is passed.

b) Acquired or purchased goodwill

In the case of the acquisition of one business by another, any amount that is paid over and above the net assets simply refers to the amount of (Purchased) Goodwill.

| Asset A/C Dr. | Amt | |

| Goodwill A/C Dr. | Amt | |

| To Liabilities A/C | Amt | |

| To Transferor A/C | Amt |

(Purchase of goodwill)

Logic – Debit the increase in assets (including goodwill which is an intangible asset) & credit the increase in liabilities (including the amount payable to the transferor).

c) Entry to write off existing goodwill

| All partner’s capital or current A/C Dr. | Amt | |

| To Goodwill A/c | Amt |

(goodwill written off in old profit sharing ratio)

Logic – Debit the Partners’ capital or current accounts to reflect the decrease in the capital whereas, credit the Goodwill account to reflect the decrease in the asset.

Note – Additionally, the impairment loss of goodwill shall also be written off from the books of accounts if goodwill is impaired/devalued. Thus, Debit the impairment loss to the profit & loss account as well as deduct the same from the amount of goodwill (credit it to the goodwill account).

Related Topic – Can an asset have a credit balance?

Types of Goodwill

i) Inherent Goodwill – Inherent Goodwill refers to the goodwill that is generated by a company internally, over the years which is also termed non-purchased & self-generated goodwill. It is the value of the business over and above the value of its net assets.

Also, the valuation of self-generated goodwill is subjective & is not to be recorded in the books of accounts as it is an unidentifiable resource.

Example

Suppose Ben & Kevin are partners in a firm having fluctuating capitals of 50,000 & 40,000 respectively. Further, the partnership firm makes a profit of 10,000 on an average basis every year & the normal rate of return is 10%.

Then the valuation of the firm’s goodwill for the given year by capitalization method will be as follows; (Capitalization of Average Normal Profit)

Capital Employed = 50,000 + 40,000 = 90,000

Normal Rate of Return = 10%

Average Normal Profit (given)= 10,000

Total Capitalized Value of the Business = Average Normal Profit x 1/Normal Rate of Return(in %)

= 10,000 x 100/ 10 = 100,000

Therefore, Goodwill = Total Capitalized Value of the Business – Actual Capital Employed = 100,000 – 90,000 = 10,000

Note – Provided it is the self-generated goodwill of the business, hence it will not be recorded in the books of accounts.

ii) Acquired Goodwill – Acquired Goodwill refers to the goodwill which is bought against the payment of a consideration in cash or kind. Hence, it is recorded in the books of accounts & amortized.

It is also called purchased goodwill as it arises from the purchase of a business. Further, the amount of acquired goodwill is equal to the amount paid over & above the net assets of the company being acquired.

Example

Suppose Deloitte acquires the business of ABC & Co. for a purchase consideration of 1,000,000. The assets acquired & liabilities taken over are as follows;

| Assets | Amt | Liabilities | Amt |

| Bills Receivables | 300,000 | Creditors | 550,000 |

| Inventory | 850,000 | Salaries Payable | 250,000 |

| Debtors | 250,000 | Outstanding Expenses | 100,000 |

Therefore, for Deloitte

Value of Goodwill = Purchase price of the targeted/acquired company – (Fair market value of the total assets of the acquired company – Fair market value of the total liabilities of the acquired company)

= Purchase price of the acquired company -[(Bills Receivables + Inventory + Debtors) – (Creditors +Salaries Payable + Outstanding Expenses)]

= 1,000,000 – [(300,000 + 850,000 + 250,000) – (550,000 + 250,000 + 100,000)]

= 1,000,000 – [1,400,000 – 900,000] = 1,000,000 – 500,000 = 500,000

Being a long-term intangible asset, the purchased goodwill will be shown on the asset side of Deloitte’s balance sheet.

Related Topic – List of fixed assets and current assets

Calculation of Goodwill & Sale of Goodwill

Goodwill simply refers to the value attached to the brand of an entity that puts the business in an advantageous position by attracting more & more potential consumers without putting any extra effort into the same.

Thus, valuation & computation of the existing goodwill is to be done at the time of the sale of the business, or during reconstitution of the partnership in the case of a firm. The following are the various methods for the valuation of goodwill;

1) Average Profit Method – In this method, the simple average profit or weighted average profit of the previous several years is multiplied by a certain number of years, referred to as years of purchase. The goodwill here represents the potential benefit of producing income in the coming years.

| Goodwill = Simple Average Profit or Weighted Average Profit x Numbers of Years’ Purchase

where, Weighted average profits = Sum of profits multiplied by weights / Sum of weights |

2) Super Profit Method – Super profits are the profits earned by the business over and above the normal profits of the business i.e. the profit margin of the business is more than its competitors in the same industry. Here, we calculate the super-profits earned by the company at an agreed no of years of purchase.

| Goodwill = Super profit * No of years of Purchase, where

Super profit = Actual or Average profit – Normal profit Normal profit = Capital Employed * (Normal rate of return/100) |

3) Capitalization Method – Under this method, goodwill is calculated by computing the average or super profit and using the real capital invested in the business.

| Goodwill = Total Capitalized Value of the Business – Net Assets

or Goodwill = (Super Profit x 100) / Normal Rate of Return |

where, Total Capitalized Value of the Business = Average Profit x 100 / Normal Rate of Return, and

Net Assets = Total Assets (except goodwill, non-trade investments & fictitious assets) – Outside Liabilities

4) Annuity Method – In this method, future profits of the company are calculated and then they are discounted at an established rate of interest to calculate the goodwill of the business. This method considers the time value of money.

| Goodwill = Super profits * Discounting factor |

Apart from mergers and acquisitions of the companies, the need for its computation can also arise in the case of partnership firms in the following events;

- Admission of partner,

- Retirement of a partner,

- Death of a partner,

- Change in profit sharing ratio amongst the existing partners,

- Dissolution of the firm,

- Conversion of a partnership firm into a company,

- & Amalgamation of two or more partnership firms.

Related Topic – Different branches of accounting

Sale of Goodwill

The premium received over and above the fair value of net assets at the time of sale of a business is the value of goodwill. However, as discussed above it cannot be sold independently but only along with other assets at the time of sale of the business.

Moreover, the sale not only leads to the transfer of brand value along with the business but also gives some rights to the buyer as well as the seller.

Rights of the buyer

- Can use the firm’s brand name & value,

- Can represent himself as a part of the ongoing firm,

- Appeal to the previous established customers of the business, and

- Can even deny the seller of the goodwill from being in touch with old customers.

Rights of the seller

The seller has the right to start his own competing firm (without using the old brand name/goodwill). However, if the parties agree to a restriction of trade during the transaction, he has no such rights.

Related Topic – Is goodwill a fictitious asset?

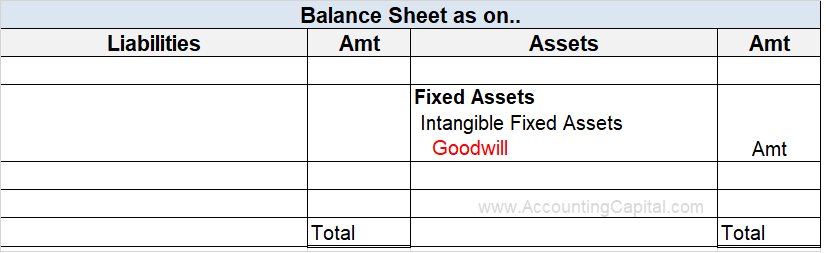

Goodwill in Balance Sheet

It is an intangible asset for a company as it cannot be touched or seen. It adds value by attracting more customers to buy the products or avail of the services offered by the entity.

Therefore, it helps in raising the overall revenue of the enterprise without any additional efforts & is recorded on the asset side of its balance sheet.

However, as discussed earlier, only purchased goodwill can be recognized in books.

It is usually shown under the head “intangible fixed assets”.

>Read Different types of financial statements