Revaluation Account Vs Realisation Account

Revaluation Account

It is a nominal account used to distribute profit or loss originating from re-assessment of the book value of a firm’s assets & liabilities. The balance of a Revaluation A/C is either profit or loss (on revaluation) which is then transferred to “Partners’ Capital A/C” in their old profit sharing ratio.

Major reasons why a partnership goes through reconstitution are;

- Admission of a new partner

- Retirement of an existing partner

- Change in profit sharing ratio of the existing partners

- Death of a partner

At the time of reconstitution due to any of the above events, the assets and liabilities of the firm are revalued so that any gain or loss up to the point of revaluation is shared among the old partners in the old profit sharing ratio. The newly reconstituted firm remain unaffected due to the past activities of the firm.

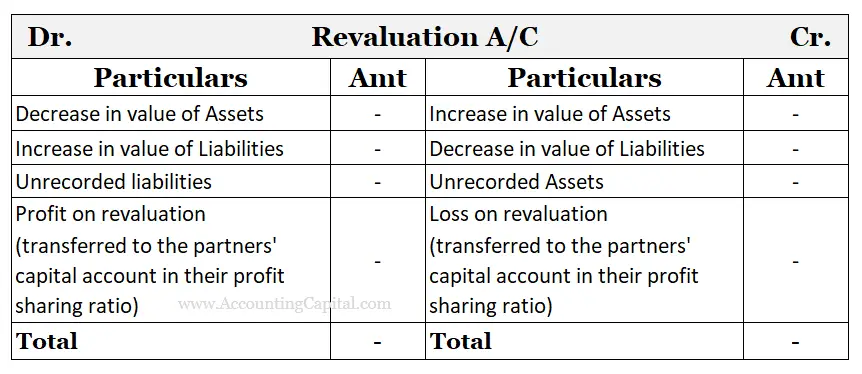

Format of Revaluation Account

Realisation Account

Realisation Account is used to determine the profit or loss on realisation of the firm’s assets & the settlement of its liabilities. It is a nominal account that is created in the event of the dissolution of a partnership firm.

After a partnership is dissolved, its closing balance of assets and liabilities is transferred to the realisation account. Such profit or loss on realisation is calculated after recording the amount received or paid on sale/liquidation of assets and discharge of liabilities.

Consequently, this profit or loss on realisation is transferred to the Partners’ Capital A/C or Partners’ Current A/C in case of fluctuating & fixed capital, respectively.

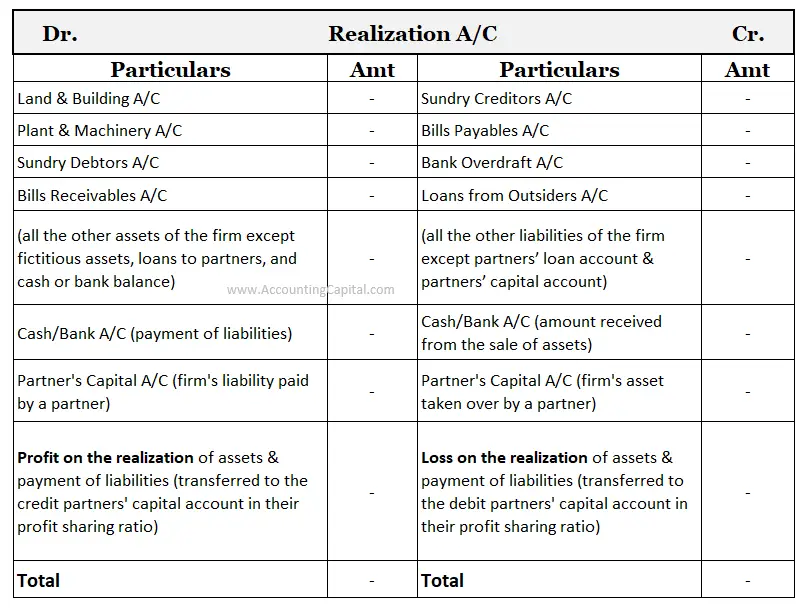

Format of Realisation Account

Note – Transactions that involve the settlement of a firm’s assets against its liabilities are not recorded in the Realisation Account, because the final effect of such a transaction is nil on the Realisation Account.

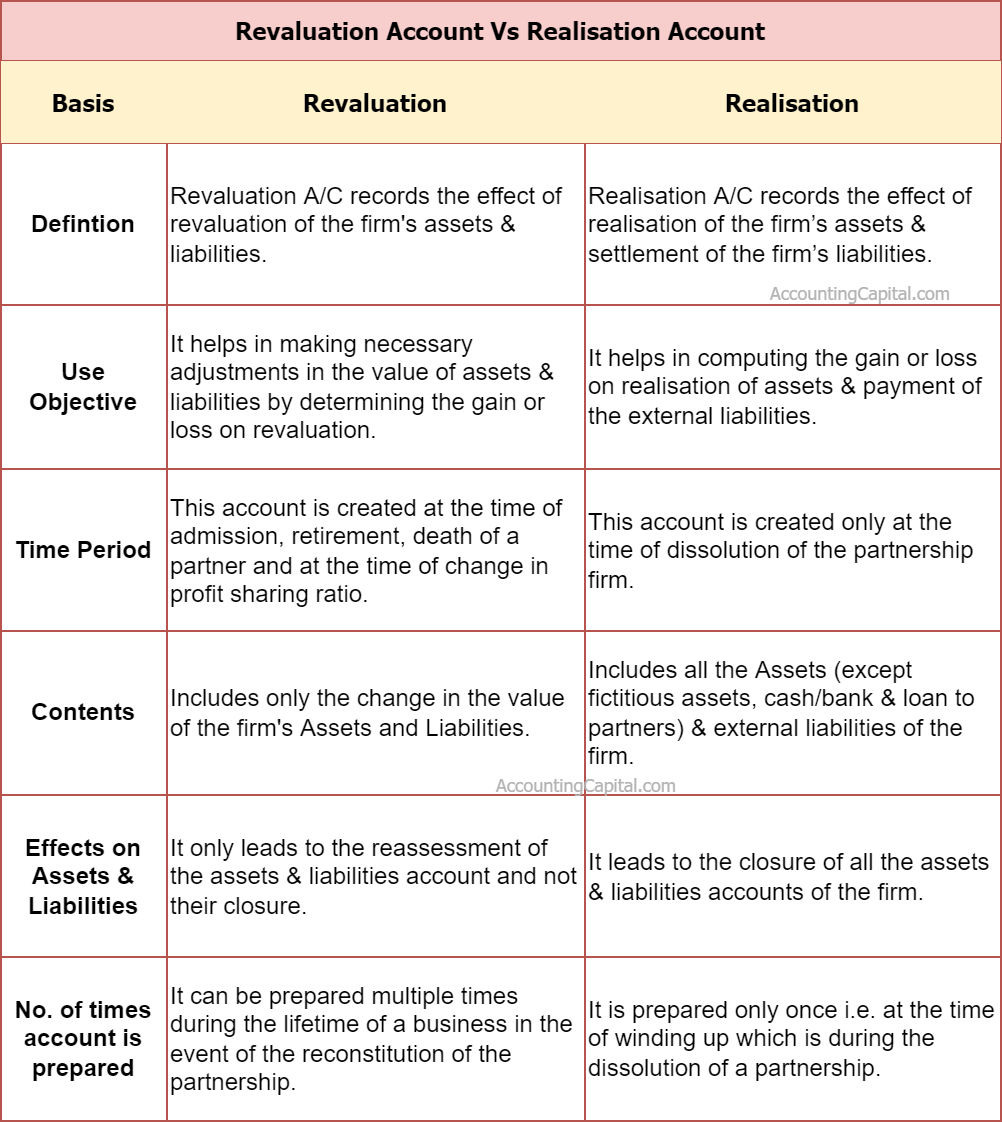

Difference Between Realisation and Revaluation Account – Table

| Basis | Revaluation Account | Realisation Account |

| 1) Definition | Revaluation A/C records the effect of revaluation of the firm’s assets & liabilities. | Realisation A/C records the effect of realisation of the firm’s assets & settlement of the firm’s liabilities. |

| 2) Use / Objective | It helps in making necessary adjustments in the value of assets & liabilities by determining the gain or loss on revaluation. | It helps in computing the gain or loss on realisation of assets & payment of the external liabilities. |

| 3) Time Period | This account is created at the time of admission, retirement, death of a partner and, at the time of change in profit sharing ratio. | This account is created only at the time of the dissolution of a partnership firm. |

| 4) Contents | Includes only the change in the value of the firm’s Assets and Liabilities. | Includes all the Assets (except fictitious assets, cash/bank & loan to partners) & external liabilities of the firm. |

| 5) Effect on assets & liabilities | It only leads to the reassessment of the assets & liabilities account and not their closure. | It leads to the closure of all the assets & liabilities accounts of the firm. |

| 6) Number of times the account is prepared | It can be prepared multiple times during the lifetime of a business in the event of the reconstitution of the partnership. | It is prepared only once i.e. at the time of winding up which is during the dissolution of a partnership. |

Difference Table as an Image

We’ve provided an image of the above table to download. Simply right-click and save.

>Read Interest on Capital Adjustment in Final Accounts