Table of Contents

Introduction

In accounting “capital” refers to the assets or money that a business owner invests into his or her business for it to start or grow. Whenever the owner introduces new assets into the business the event is recorded with the journal entry for introduction of capital as assets.

Capital could be introduced in the form of fixed assets and current assets. It could be brought in various forms such as cash, furniture, land, buildings, machinery, etc. In particular, assets can be introduced to start a business, expand the business, or use it during production.

As a result of the journal entry, the assets on the balance sheet grow, reflecting new incoming capital. In this entry, the ledger reflects the conversion of partner contributions into tangible resources for the business.

Recommended Quiz – Trial Balance

Journal Entry

The Journal entry for the introduction of capital as assets;

| Asset A/c | Debit |

| To Capital A/c | Credit |

(Being capital introduced in the form of assets)

Accounting Rules applied – Respective “Asset A/c” is debited as Dr. the increase in assets. “Capital A/c” is credited as Cr. the increase in capital/equity.

3 Golden Rules applied – “Assets” are classified as real accounts, therefore, Dr. What comes in & “Capital A/c” is a personal account therefore Cr. the giver.

Related Topic – Journal Entry for Interest Paid on Loan

Example of the Accounting Entry for Introduction of Capital as Assets

Here is an example to help you understand the above accounting entry;

Partner A in the ABC partnership company brought 20,000 as capital into the business. Pass the journal entry for the introduction of assets as capital.

| Furniture A/c | 20,000 |

| To A’s Capital A/c | 20,000 |

(Being furniture introduced in the form of assets)

- In the first part of the journal entry, the furniture is debited since there is an increase in fixed assets (furniture) as the asset is being brought into the firm.

- In the second part of the journal entry, A’s capital is credited since there is an increase in the partner’s capital as the owner brings furniture into the business.

Related Topic – Fixed Capital vs Working Capital

Impact on Financial Statements

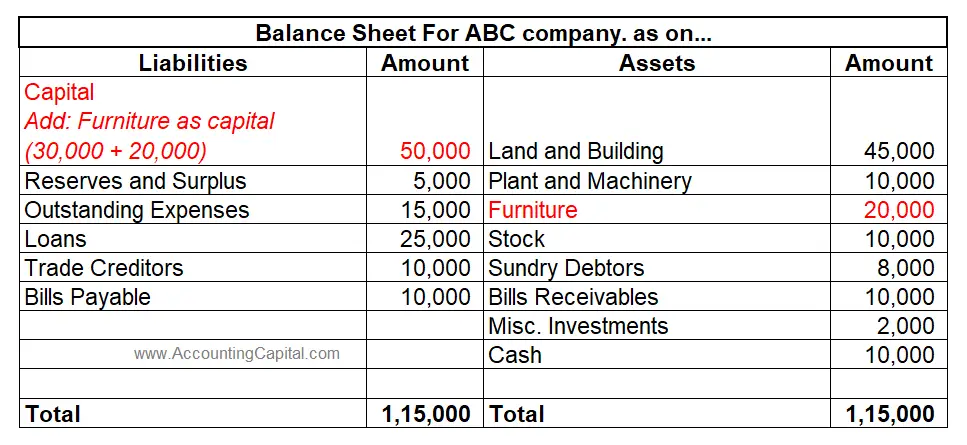

Balance Sheet: It affects the assets side of the balance sheet. There will be an increase in the total assets. The capital section in the balance sheet will increase as well. This increase will show an increase in equity.

From the example used in this article, the balance sheet changes should look something like this; Cash Flow Statement: It is recorded as a financing activity indicating an increase in the partner’s investment.

Cash Flow Statement: It is recorded as a financing activity indicating an increase in the partner’s investment.

Income Statement: There will be no direct impact on the income statement since this entry has no revenue or expense component.

Related Topic – Fixed Assets vs Intangible Assets

Conclusion

- By bringing in assets as capital, partners can infuse resources into the firm without actually injecting any cash.

- The newly introduced assets are debited as they come into the business which is shown in the balance sheet as an increase.

- Newly acquired assets increase capital, which is also shown on the balance sheet as an increase in equity.

- To determine the cost of assets contributed by partners, the business considers fair market value or the actual purchase price. It also depends on the condition & prior usage of the asset.

- Assets are often brought into the business to facilitate strategic expansions, acquisitions, or fuel capital-intensive projects.

- Some of the most common examples of assets introduced in a business are; machinery & equipment, furniture & fixtures, inventory, intellectual property, real estate, vehicles, and investments.

- When partners contribute assets to the business, it affects their ownership stake in the company, which in turn can impact the profit-sharing ratio.

>Read Journal Entry for Bank Overdraft