- Mobile as a Capital Asset

- Mobile Depreciation Rate as per the Income Tax Act

- Mobile Depreciation Rate as per the Companies Act

- Example

- Why Should a Mobile be Depreciated at all?

Most businesses today rely on company mobile phones for after the work communication. These mobiles are considered an asset since they usually last for more than a year.

At the time this article was written they are considered “office equipment” therefore mobile phone depreciation rate is the same as that of Plant and Machinery. Like any other long-term asset, mobiles are also depreciated according to the Income Tax Act of 1961 & the Companies Act of 2013.

Mobile as a Capital Asset

Any property that generates value over time is considered a capital asset for a business. The organization benefits from having a mobile phone.

Two main reasons why it qualifies as a capital asset are:

- The control of this asset lies with the organization. It is purchased in the name of the company and the usage is for business purposes so there is a direct value addition for the business.

- It is a communication device, just like a landline telephone, so the economic benefit accrued from mobile phones will continue till the mobile lasts.

Treatment of mobiles purchased by the company:

- Irrespective of the value, the mobiles should be capitalized under the Companies Act, 2013 if purchased on or after 1st April 2014.

- If the mobile is purchased on or before 31st March 2014 and the value is < INR 5,000 (greater than) then the mobile should be capitalized.

Related Topic – Accounting Interview Questions with PDF

Mobile Depreciation Rate as per the Income Tax Act 1961

We are almost in 2023 and for AY 2022-2023, the rules and standards are as follows:

The depreciation rate according to the Income Tax Act of 1961 is 15% WDV (Written Down Value). Businesses other than companies charge this rate for mobile phone depreciation.

It is important to note that mobiles are viewed as “Plant & Machinery” therefore, the same depreciation rate applies. Here is how to find current depreciation rates as per the Income Tax Act of India, including mobile phone depreciation rates.

- Follow this Link – Income Tax India – Charts & Tables

- In the search bar type “depreciation rates” and hit “Search”.

- You can also search other tables and charts available on IT India’s government website with this method.

Related Topic – Difference Between Depreciation and Provision for Depreciation

Mobile Depreciation Rate as per the Companies Act 2013

For AY 2022-2023, nearly 2023 at the time of writing this article, the following rules and standards apply:

Companies also use the same rate of depreciation as that of “Plant and Machinery” to depreciate mobiles.

The rates according to the Companies Act of 2013 are:

- 4.75% SLM (Straight Line Method)

- 13.91% WDV (Written Down Value)

There is an argument about whether to charge the same rate of depreciation as computers. The Madras High Court held that in the case of Federal Bank Ltd. Vs. ACIT, mobiles are not in fact computers and, therefore, the depreciation will be allowed at the general rate of depreciation on plant and machinery.

Here is a PDF as per the MCA website (Ministry of Corporate Affairs).

Related Topic – Which Contra Account is used to Record Depreciation?

Example of a Smartphone being Depreciated

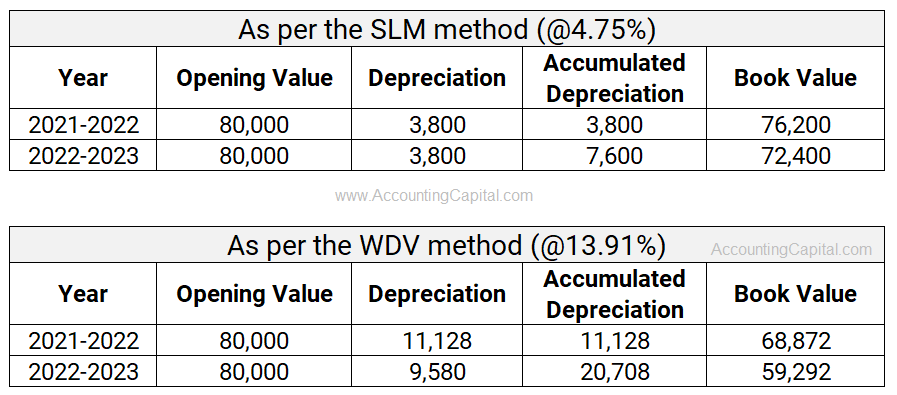

Unreal Pvt. Ltd. provides mobile phones to its staff for office use. The company purchased two of them at a total of INR 80,000 during FY 2021-22.

Following is the calculation of depreciation under the Companies Act of 2013 for the next two years:

While depreciating as per the written-down value method the charges and calculations shall happen on the diminished value.

Related Topic – How to Show Amortization in Financial Statements?

Why should a Mobile be Depreciated?

Compared to other assets, smartphones undergo frequent innovation and become obsolete in a shorter period of time.

Like office equipment, smartphones contribute to the success of an organization. Mobile phones should be depreciated annually in the books of accounts since their value decreases over time.

Although it takes more time to write off the entire value of a mobile phone even when the rate is 15% compared to its actual useful life, smartphones purchased for business purposes should be depreciated.

>Read Accumulated Depreciation in Trial Balance